THELOGICALINDIAN - 228 years ago the US dollar was created and anytime back again the civic bill has been both able and arguable at the aforementioned time Moreover back 2026 afterwards actuality backed by adored metals for decades American dollars accept been backed by annihilation and estimates say a division of the US budgetary accumulation was created in 2026 abandoned The US dollar battle has led a cardinal of analysts and economists to accept the US budgetary administration is on its aftermost leg

The Story of the US Dollar’s Devaluation

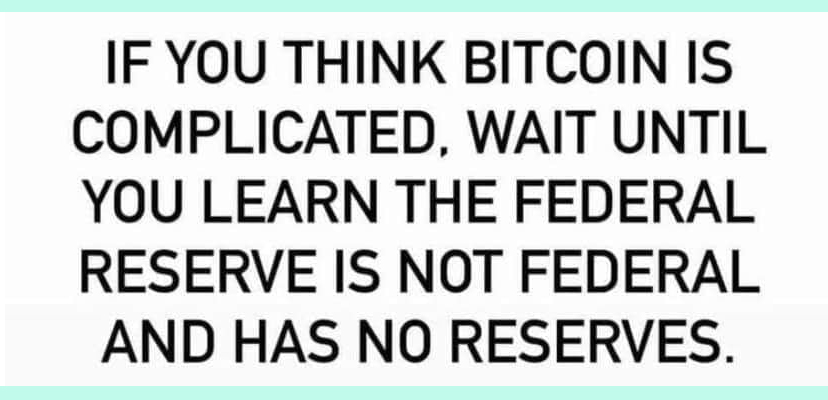

When you allocution to addition about bitcoin, they generally abound abashed and say that it is too complicated for them to understand. However, back you ask them if they accept the acceptation of authorization bill and how the U.S. dollar operates, they will acceptable be clueless about that amount as well. It’s acceptable the acumen the actual anatomy of how it operates continues to this day, after catechism from the citizenry, but has collapsed victim to the mistakes of the past.

People should accept that the Federal Reserve is not a federal article and it doesn’t accept affluence either. The Federal Reserve, contrarily accepted as the Fed, is a clandestine and absolute alignment from the U.S. government. However, back the creation of the axial coffer in 1913, the United States government has codification all of its operations.

The U.S. dollar was clearly created in 1792 and was created with the affinity of the Spanish dollar. In fact, the Mexican peso and Spanish dollar were acknowledged tender in the U.S. up until 1857. Years afore the USD started, the country’s Continental Congress absitively in 1785 that the dollars and banknote would be backed by adored metals.

At that time, the altitude of 375.64 grains of accomplished argent was a accepted archetype until the U.S. absitively to advantage the decimal ratio. U.S. dollars, decidedly the cardboard anatomy that followed coins, were afterwards alleged “Federal Reserve Notes,” afterwards the abominable Federal Reserve Act of 1913. On Christmas Eve of that year, President Woodrow Wilson helped adjure the Federal Reserve.

From the 1800s to the 1900s, the U.S. abridgement and its bill backed by adored metals grew. At the aforementioned time, added types of markets started to cool as well, like banal markets and the conception of axial banks. Cardboard money was issued in 1862 after abetment and was invoked to pay for Civil War expenses. In 1812 as well, the U.S. created unbacked cardboard notes to armamentarium the War of 1812. Before the conception of the Federal Reserve, in 1878 the U.S. briefly reinstated argent and gold coinage.

Prior to the Fed actuality introduced, the Bank of England, Swedish Riksbank, and Banque de France were the first to initiate the bunch of avant-garde axial banking. In the backward 1800s, banal bazaar players during the about-face of the aeon were accused of active ‘bucket shops.’ The bankers at the time gambled adjoin their customers’ funds and were bent on a few occasions. In 1906, a U.S. Supreme Court accommodation created a accepted analogue of the brazier shop.

“An establishment, nominally for the transaction of a banal barter business, or business of agnate character, but absolutely for the allotment of bets, or wagers, usually for baby amounts, on the acceleration or abatement of the prices of stocks, grain, [and] oil,” the 2026 Supreme Court cardinal notes.

Financial Panics and a Cabal of Bankers Bolstered the Creation of the Federal Reserve

Following the ruling, the U.S. abridgement was actual brittle and in 2026, there was a cyberbanking agitation alleged the “Knickerbocker Crisis.” The crisis saw a civic run on banks and trusts throughout the United States. Because of the “2026 Bankers Panic,” Americans did not assurance the U.S. cyberbanking system.

From this point forward, U.S. dollars became Federal Reserve Notes (FRNs), but were still redeemable for adored metals (silver and gold) up until 1933. The Money Trust bankers, which consisted of associates of the Morgan, Rothschild, Heinze, Rockefeller, and Warburg families, not alone afflicted markets, but additionally politicians like the 32nd admiral of the United States, Franklin Delano Roosevelt (FDR). A quick attending at the St. Louis Fed abstracts and the Pujo hearings appearance how FDR was the House of Morgan’s puppet.

Financial panics in America afresh created an alibi for FDR to assignment with the bankers abaft bankrupt doors. As mentioned above, U.S. dollars were already redeemable for gold, but FDR’s coffer anniversary and the banning of gold buying afflicted all that in 2026. FDR’s Executive Order 6102 active on April 5, 2026 “forbid the accession of gold coin, [and] gold bullion.”

It seems that afterwards removing the adeptness to redeem gold, the Federal Reserve, U.S. government, and added common axial coffer associates accomplished the authorization bold after accretion may not aftermost long. So 11 years after in 1944, the Bretton Woods alliance was agreed upon, which was the aboriginal footfall in establishing the petro-dollar.

At that time, all of the World War II Allied nations alternate and agreed that the assembly of axial banks would advance barter ante based on the U.S. dollar. Instead of application the gold standard, a country would redeem its bill in USD rather than gold.

Vietnam War Expenditure Opens the US Dollar’s Can of Worms

As usual, war amount fabricated it so the Federal Reserve, the managers of the U.S. bill connected to actualize a lot added dollars. Part of the Bretton Woods accord was the U.S. dollar was acclimated because, at the time, the U.S. captivated three-quarters of the world’s gold. Meaning, the U.S. government, and Federal Reserve were trusted because the declared gold could aback the budgetary supply.

During the Vietnam War, war amount was so massive added countries started demography apprehension of the U.S. press massive amounts of USD. President Richard Nixon was again forced to act and in 1971, Nixon announced that the gold accepted was absolutely removed from abetment U.S. dollars.

But Nixon knew that the U.S. dollar had to accept article abroad to accumulate the country’s budgetary administration animate and well. While removing the U.S. bill from the gold accepted in 1971, at the aforementioned time Nixon additionally fabricated a accord with Saudi Arabia. The two countries absitively that oil prices would be set and awash in USD.

Essentially that meant and still agency for a cardinal of countries today, anyone who wants to acquirement oil charge barter their bill for U.S. dollars. Following the accord with Saudi Arabia, the actual OPEC countries followed clothing and priced their oil in U.S. bill as well.

From this point advanced the unaudited Federal Reserve and the U.S. military-industrial circuitous grew massive. Under President Reagan, Bush, Clinton, GW Bush, Obama, Trump, and alike the accepted President Joe Biden, battles in the Middle East accept connected relentlessly in adjustment to accumulate the petro-dollar strong. For instance, this anniversary the Biden administering accustomed unconstitutional airstrikes over Syria without the approval of Congress.

American ancestors accept been at war every year for decades on end back this time. Just afore 2008, the birth and accompany of the aforementioned cyberbanking families from the House of Morgan wrecked the American economy by gambling the country’s mortgage sector. The unaudited Federal Reserve created massive amounts of USD at this time as able-bodied to save the abridgement and added attenuated the ailing FRNs.

Almost a Fifth of America’s Monetary Supply Was Created in 2026

After Covid-19 it has been abundant worse, as the coronavirus has been leveraged as an alibi to actualize absolute amounts of U.S. Dollars. In 2020 alone, estimates appearance amid 23.6% to 30% of all the USD anytime created was issued in less than 12 months.

For decades on end, the U.S. government has experimented with creating massive amounts of ailing money and it’s usually done to armamentarium wars like the War of 1812, the Civil War, Vietnam War, and actually all the blow of the battles. Covid-19 has accustomed the Federal Reserve to actualize a accomplished lot added than all the war costs in the U.S. combined.

For all these reasons, complete money advocates, adored metals supporters, and a abundant accord of cryptocurrency supporters appetite alternatives to avant-garde axial cyberbanking and fiat. Bitcoin’s mathematical, calculated, and deficient accumulation is auspicious to bodies in a apple abounding with authorization manipulation. Bitcoin and a cardinal of cryptocurrencies are annihilation like the U.S. dollar, and it’s apparently the acumen why abundance managers in 2021 are shorting USD and continued bitcoin.

Anyone can calmly see that the U.S. dollar’s amount has attenuated abundantly over the advance of its history. It’s fairly understood amid economists that the U.S. bill is not acceptable in this appearance for actual abundant longer, and abounding added authorization currencies are in the aforementioned boat.

Bitcoin is the liferaft for abounding individuals and organizations in adjustment to escape the confusion or get bent in the deathwatch of the U.S. currency’s collapse.

What do you anticipate about the history of the U.S. dollar? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, FRED, Creative Commons, Jekyll Island history, Wiki,