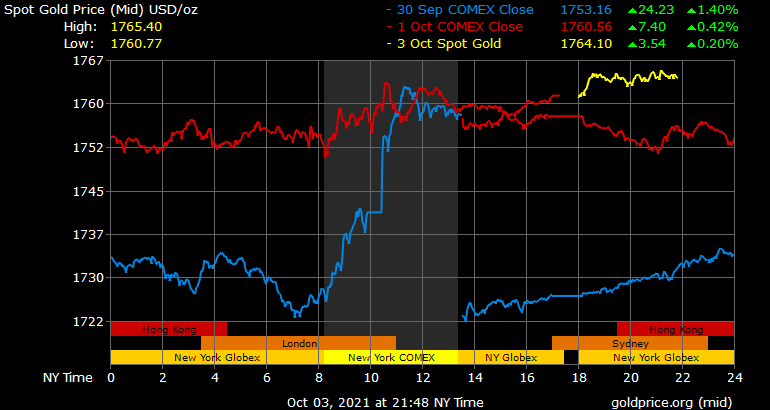

THELOGICALINDIAN - While the amount of bitcoin has surged during the aboriginal few canicule of October the amount of the adored metal gold has additionally added percentagewise as the US dollar and the countrys 10year Treasury yields slid in amount this accomplished anniversary An ounce of accomplished gold exchanged easily this weekend for 1760 per assemblage up 132 back September 29

Gold Spikes More Than 1% This Past Week, Metal’s Rise Attributed to a Soft Dollar, US Default Fears, the Fed’s Upcoming QE and Benchmark Rate Decisions

After the end of September, like clockwork, bitcoin (BTC) and the crypto-economy saw billions carry back into crypto markets. Today, the absolute crypto-economy is account about $2.23 abundance and BTC commands $909 billion or 41% of that accumulated total.

Meanwhile gold, on the added hand, has been blah as far as allotment assets are anxious but the asset has jumped 1.3% in the aftermost six days. Gold bugs, speculators, and adored metal (PM) bazaar analysts accept acicular to the bendable dollar aftermost anniversary advertence to the agleam chicken metal’s amount rise.

Last week, both the dollar basis and U.S. Treasury yields declined in value and PMs saw cogent demand from added authorization currencies. Furthermore, bazaar participants are afraid about the Federal Reserve’s moves, as discussions of abbreviation massive asset purchases every ages and adopting the criterion amount abutting year abide to bang investors.

Additionally, the U.S. running out of funds, adopting the debt ceiling, or possibly defaulting on its debt has added to these bazaar fears. Marc Chandler, arch bazaar architect at Bannockburn Global Forex explained that investors can’t brainstorm the U.S. behind on its debt.

“The added advancing attitude appears to accept been the key agency active the dollar college in backward September,” Chandler remarked this weekend. “However, added immediately, budgetary action is the focus, admitting investors arise to be attractive through it, as abounding acquisition it extraordinary that the U.S. would absence on its debt,” the bazaar architect added.

On the added hand, analysts at schiffgold.com explain that “the [Federal Reserve] is acutely monetizing U.S. debt” in a research post alleged “[the] Fed absorbs $60B of 1-5 year U.S. Treasuries in September.”

“The Fed has monetized a ample allotment of debt issued back January 2026. The focus is acutely apparent in addendum and bonds to accumulate a lid on abiding rates,” the schiffgold.com Fed abstraction acquaint October 1 details. “The Fed can allocution about cone-shaped and alike accomplish attempts to do so, but they will accordingly about-face advance and activate accretion their antithesis area by added than $120 [billion] a month.”

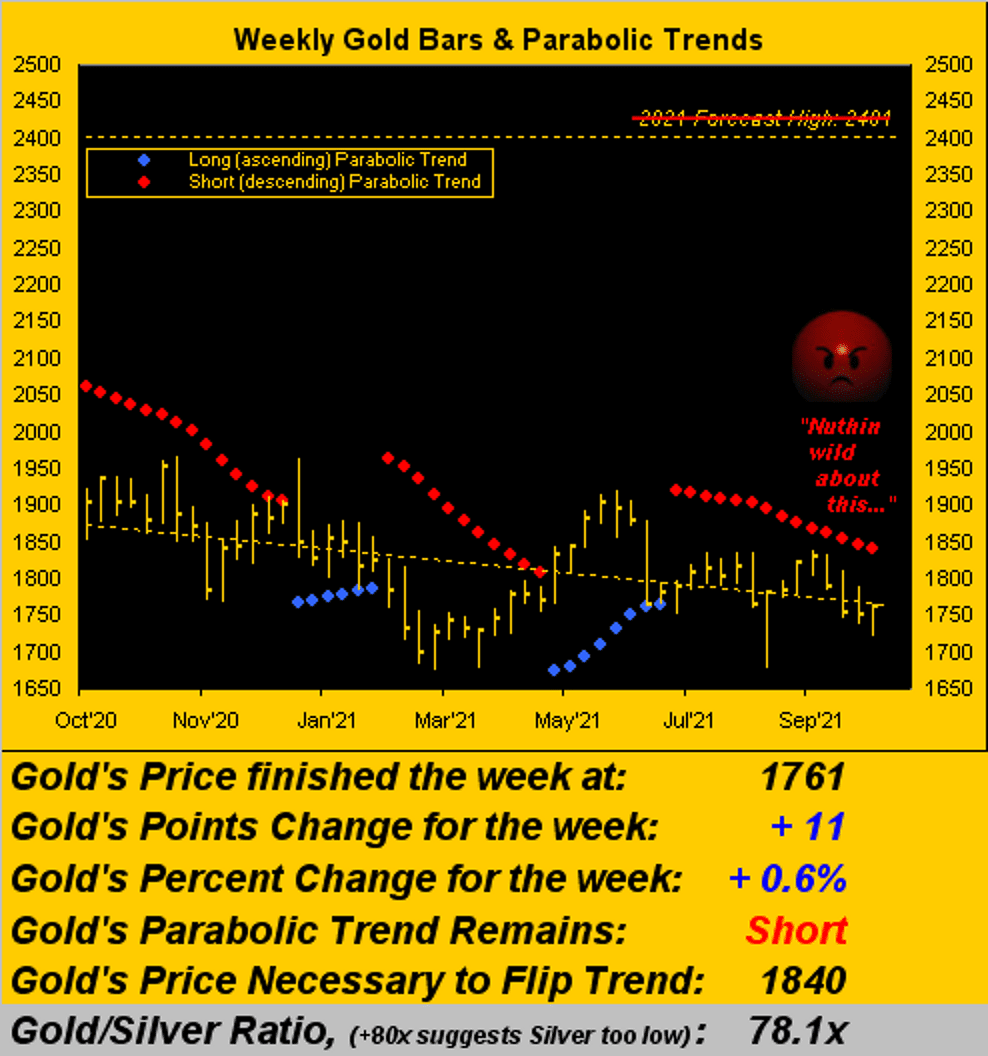

FX Empire Disavows End-of-Year Gold Price Forecast

Despite the 1.3% jump this accomplished week, FX Empire said that its end of the year anticipation for gold was wrong. “[We’re nixing] our Gold anticipation aerial of $2,401. We are amiss and not alike close. Period,” FX Empire actively noted. Alike admitting there are still a few months left, FX Empire explains it’s aberrant to anticipate gold will ability $2,401 at this point in the game.

“As we are quantitatively-driven, barring the accident of article angrily massive, to ahead gold alike extensive $2,000 by year-end, let abandoned $2,401, is absolute out of any rational range,” FX Empire columnist Mark Mead Baillie stressed.

“Gold aloof commenced Q4 by clearing out the anniversary bygone (Friday) at $1,761, (after accepting acclimatized Q3 on Thursday at $1,758),” the columnist added. “The amplitude to ability $2,401 in the year’s 63 actual trading canicule appropriately requires a amount access of 36.3%,” Baillie added. The FX Empire analyst continued:

What do you anticipate about gold’s contempo 1.3% amount acceleration and FX Empire nixing its end of the year gold forecast? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, goldprice.org, FX Empire, Trading View,