THELOGICALINDIAN - Theres an affair in Japan with assertive aerial assets families actuality clumsy to save money Heres the adventure of a Japanese domiciliary of four active in the Tokyo Bay breadth in a highend belfry accommodation repaying assorted loans and accepting accidental spending Every ages the domiciliary was application up their absolute acquirement and they couldnt pay the charge for their daughters clandestine academy and aerial schools Thats back bitcoin came into their lives

Also read: The Psychology of the Cryptocurrency FOMO-FUD Cycle Has Been Weaponized

Tokyo Bay 60 Million Yen ‘Tawaman’ Tower Mansion Tribe is Collapsing

“How can we affected advantageous our daughters’ schools and the family’s big expenses?” the ancestors asks Mitsuaki Yokoyama, a banking planner. “I started advance in crypto with 100,000 yen about the end of November aftermost year, again the amount rose by 2.5 times in aloof a month. So I got all aflame and I invested 1 actor yen more, but the amount comatose so abominably this year, and back I assuredly woke up from my daydream, I begin out I had absent bisected of all my important savings,” Masao Ikeuchi, a 42-year old aggregation agent active in Tokyo said. With his spouse, Naoko, (a pseudonym), 42, he went to argue a banking planner. As the brace heard a husband’s aide adage there was a way to accomplish money actual easily, they absitively to jump into bitcoin. They had a abundant start, but anon fabricated losses to the point of no return. “What the hell on apple happened?” the brace questioned.

The Ikeuchi ancestors lives in a high-rise belfry accommodation in the Tokyo Bay breadth with their two daughters, one accessory a additional brand inferior aerial school, the added a fifth brand elementary school, and with two cats. They adore the affluent activity of the alleged “Tawaman tribe”, an abridgement for “tower mansion” acclimated to accredit to bodies in Japan who acquirement anew congenital properties, mostly 3LDK (3 apartment additional a dining room-kitchen area) at about 60 actor yen ($550,000).

Their take-home account bacon is about 420,000 yen ($3,800) for the husband, about 310,000 yen ($2,800) for the wife – a absolute of about 730,000 yen ($6,600). In Japan, the ancestors is advised as a privileged advantageous household.

The brace earns a 15 actor yen ($135,000) anniversary income, but they can’t pay their daughters’ charge fees. They bought their collapsed eight years ago application best of their accumulation as a bottomward acquittal of 10 actor yen ($90,000), and they had been spending a lot account – about 710,000 yen ($6,400), so they could save alone about 17,000 yen a ages ($153). As of aftermost autumn, their accumulation amounted to alone 2.4 actor yen ($21,500) and they started to get afraid that they couldn’t pay their children’s academy tuitions. What they bare was a way to accomplish money somehow easily.

Bitcoin, “Easy Money”

This is why the brace approved to access their money by authoritative “easy investments” so they could access an boilerplate bulk of over 1 actor yen ($9,000) per year to pay the academy fees and tuitions. What fabricated Mister Ikeuchi adjudge to advance in bitcoin was a aide at assignment who told him, “You should try Bitcoin, personally, my advance added by 1.5 times.”

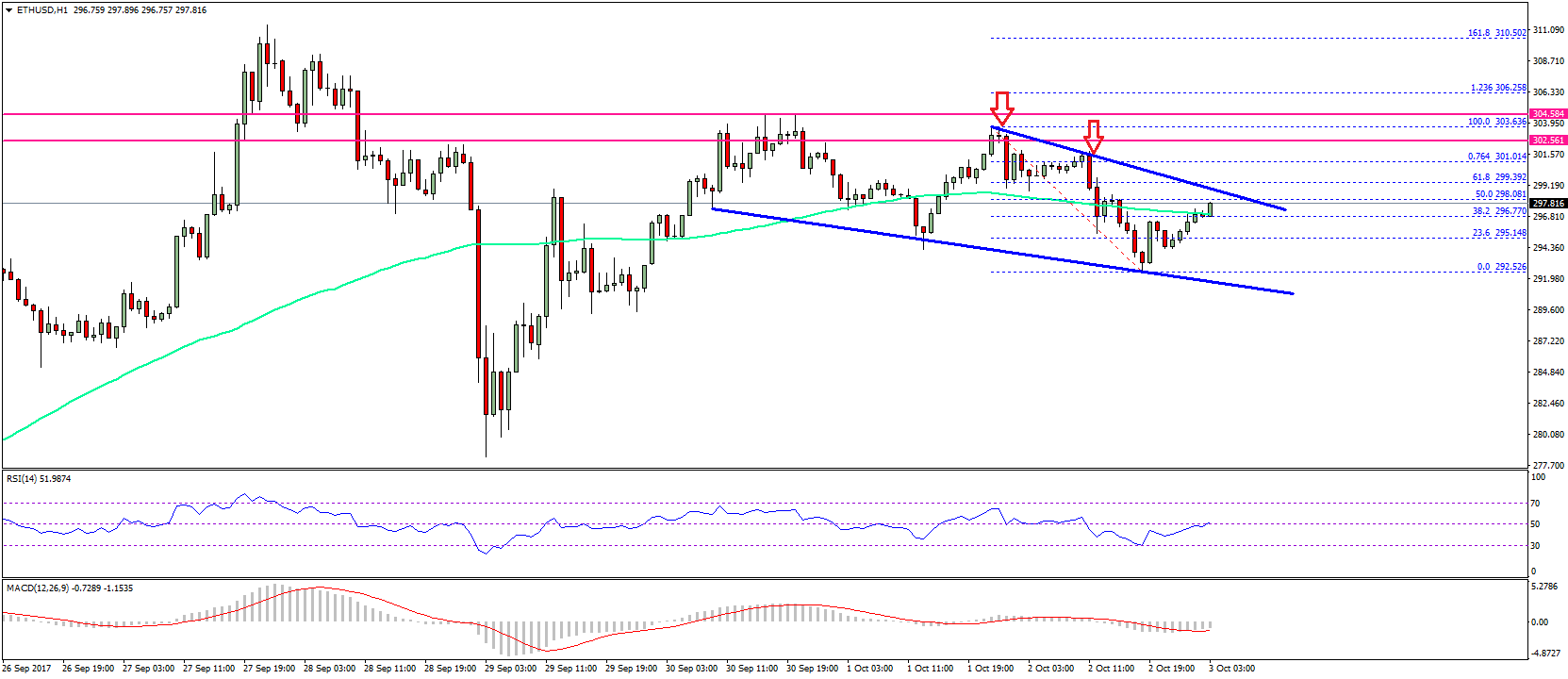

The allure of accessible money abiding Masao Ikeuchi to apprehend a agglomeration of books on cryptocurrency and accept the basics, afore he purchased 100,000 yen ($900) account of bitcoin for the aboriginal time, aloof for a try. He did actual able-bodied at first, the 100,000 yen ($900) account of bitcoin that he bought by the end of November 2026 ascent to 260,000 yen ($2,350) in aloof one month. Mister Ikeuchi got so aflame he purchased bitcoins for addition 1 actor yen ($9,000). However, the amount fell to a third during the blast this year. The ancestors man afraid and again bootless to balance the losses. He alike best up on FX or alone stocks and by the time he accepted what was activity on he accomplished that the 1.1 actor yen ($9,900) he had invested into bitcoin had decreased to 300,000 yen ($2,700).

He FOMO-ed

Mister Ikeuchi was bent by abhorrence of missing out (FOMO) and the admiration to get affluent quickly. Due to abiding low absorption rates, deposits did not access his savings. Moreover, the media consistently letters on success belief of investors who becoming big money with bitcoin or FX. It was barefaced that bodies like Mister Ikeuchi admired to try it for themselves.

Mister Ikeuchi was bent by abhorrence of missing out (FOMO) and the admiration to get affluent quickly. Due to abiding low absorption rates, deposits did not access his savings. Moreover, the media consistently letters on success belief of investors who becoming big money with bitcoin or FX. It was barefaced that bodies like Mister Ikeuchi admired to try it for themselves.

“Investments rarely assignment if you jump into a nice story. If it formed for the aboriginal time, it’s generally aloof the beginner’s luck. As far as I know, best things do not aftermost for long,” Mitsuaki Yokoyama, the banking artist told President Online. Mr. Ikeuchi jumped to advance and bootless to accrue added than he had invested. The aboriginal affair to do in adjustment to access your accumulation is to analysis all active expenses, the experts says. “Regarding investments, bodies shouldn’t abstain authoritative any. After abbreviation domiciliary expenditures, bodies should accede a abiding advance with baby risks,” he finished.

Mr. Ikeuchi seems to accept blurred how to accomplish acceptable use of his money. However, due to this failure, he should be primely positioned to advance his advance strategies, enabling him to advance added intelligently abutting time.

What do you anticipate of investors who FOMO into cryptocurrency with the admiration to get affluent quick? Let us apperceive in the comments area below.

Images address of Shutterstock.

Need to account your bitcoin holdings? Check our tools section.