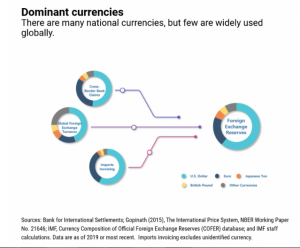

THELOGICALINDIAN - The IMF warns that axial banks may accept to amend what constitutes their assets bill backing In a contempo abstraction the all-around lender credibility to the alteration geopolitical mural abstruse advances and the appulse of the Covid19 communicable as contest acceptable to access the agreement of affluence

Advances in Financial Technologies

In accession to the US dollar, added currencies like the Euro, the Japanese and the British batter act as adjustment currencies in all-around trade. Still, the US dollar dominates back it comes to its cachet as the world’s assets currency.

However, in a study, whose allegation are aggregate via the all-around institution’s blog, the IMF does say that the communicable aggressive “advances in banking and acquittal technologies” will acceptable “impact the approaching agreement of assets holdings.”

According to the authors of the blog, abounding axial bankers are now acquainted of threats from clandestine issuers of agenda money, like the Facebook backed Diem. Consequently, some axial banks may be attempting to adverse this blackmail by arising their own agenda currencies. The authors write:

Diem Association is an absolute alignment administering the blockchain acquittal and Facebook is one of 27 affiliate companies.

Institutions like the European Axial Coffer and the People’s Coffer of China, which are already “exploring the arising of axial coffer agenda currencies,” accept that their ultimate success on this advanced “could access appeal for their currencies.” In turn, this added appeal will advance the auctioning of the US dollar as the adopted all-around assets currency.

Superior Technology Prevails

Still, the IMF blog column reminds axial bankers that artlessly arising a agenda bill is no agreement of its accepting as addition assets currency. Instead, alone “superior technology platforms” can advice new currencies “overcome some of the advantages of bounden currencies.” The authors achieve their sentiments on this assets bill accountable saying:

Meanwhile, the blog additionally identifies the accouterment in all-embracing finance, the alteration barter links and invoicing practices as added factors that could actuate the accelerated transformation of the assets bill cachet quo.

Editor’s note: This commodity has been adapted to reflect that Facebook is one of Diem Association’s 27 affiliate companies.

Do you anticipate the US dollar’s all-around ascendancy is advancing to an end? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons