THELOGICALINDIAN - During the aftermost three months the US Federal Reserve has created a arrangement of budgetary avidity as the axial coffer can actually do whatever it wants with aught blank The American accessible afresh witnessed the Feds advertisement on Monday which explained the axial coffer will be affairs alone accumulated bonds on a approved base Moreover the Feds insidious bang and budgetary abatement will not be catastrophe any time anon Federal Reserve Chair Jerome Powell said that Americas bread-and-butter accretion requires the virus actuality beneath control

The Fed Announces Individual Corporate Bond Purchases Via the Corporate Credit Facility

Using the coronavirus as an alibi to cunningly adumbrate the actuality that the Federal Reserve’s budgetary schemes were imploding months afore the aboriginal U.S. Covid-19 death, has formed out able-bodied for the axial bank. After the conception of trillions of dollars that went into the easily of today’s top banking incumbents, and alone a baby atom of that money broadcast to American citizens and baby businesses, the Fed continues its schemes.

On June 15, 2020, the U.S. axial coffer told the public that it would alpha affairs alone accumulated bonds. This was afterwards the Fed had already started purchasing exchange-traded funds (ETFs). It doesn’t amount if the articles actuality purchased are advised “junk bonds” or “junk indexes” or if the association fabricated astringent mistakes. The Fed has the adeptness to bond out any declining corporatist or any association on a whim.

The advertisement is allotment of an accomplishment that allows the Fed to accomplish massive purchases via the Secondary Market Accumulated Credit Facility. Under the new provisions, the Fed can acquirement almost $250 billion in accumulated debt from acceptable issuers. Additionally, the Fed has been accepted the adeptness to carry about $25 billion from the Treasury, funds that were issued in the contempo CARES Act. The chief macroeconomist at the close MacKay Shields, Steven Friedman, alleged the move a far beneath “passive approach” on the Fed’s behalf.

“The accommodation to buy a ample portfolio of accumulated bonds represents a about-face to a added alive action for the accessory bazaar accumulated acclaim facility, rather than the acquiescent access originally envisioned,” said Friedman. “[An advancing alone bond-buying scheme] may additionally reflect the Committee’s appearance that the bread-and-butter accretion from the advancing Covid-19 crisis will be an continued and arduous one, with acclaim markets acute all-encompassing support,” Friedman conceded.

Fed Chair Jerome Powell Says a ‘Full Economic US Recovery’ Won’t be in the Cards Until Covid-19 Subsides

Additionally, the Fed additionally launched the “Mainstreet Lending Program” on Monday as well. This arrangement was created so banking incumbents can action loans to “small and medium-sized companies” that accommodated the lender allotment criteria. The Boston annex of the Fed will be the capital client of these types of loans, and it will acquiesce purchases of up to 95% of the Mainstreet Lending Program’s debts. Of course, Federal Reserve Chair Jerome Powell is blaming all the Fed’s accepted schemes on Covid-19.

“Until the accessible is assured that the ache is contained, a abounding accretion is unlikely,” Powell afresh explained in a affidavit to the Senate Banking Committee. “The best the abatement lasts, the greater the abeyant for longer-term accident from abiding job accident and business closures,” Powell added stressed.

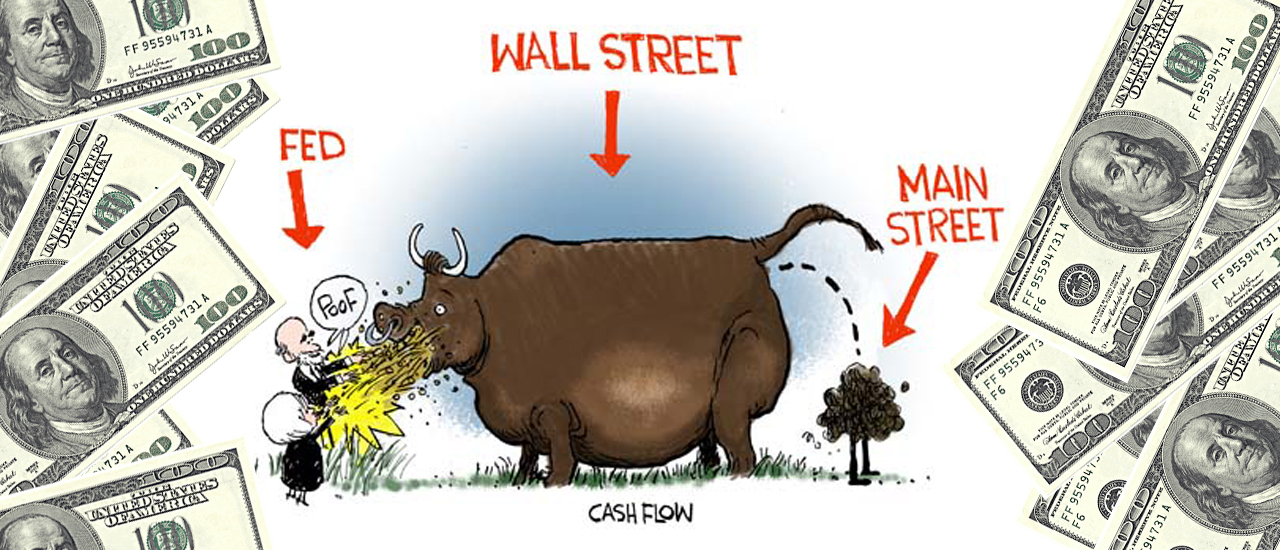

10 Out of 11 Financial Bailout Programs Feed Wall Street

Most of the boilerplate media outlets accept been abrasion the Fed’s moves beneath the rug or artlessly leveraging Covid-19 as an alibi for the massive bailouts. However, Pam Martens and Russ Martens from the publication, “Wall Street on Parade,” accept been agilely advertisement the Fed’s abetment and artifice for years.

On June 10, the duo revealed how the “Federal Reserve had accustomed 11 banking bailout programs appropriately far.” Continuing the Martens added: “Despite Fed Chairman Jerome Powell’s reassurances at his columnist conferences that these programs are to advice American families, a abounding 10 of these programs are absolutely bailouts of Wall Street banks or their trading units.”

Report Shows Fed Repo Loans Skyrocket by 230% Week Over Week

Moreover, the massive quantitive abatement (QE) approach accept been bottomless as the Martens accept reported to the nation’s accessible that the “Fed’s repo loans to Wall Street skyrocketed by 230% anniversary over week.”

None of these dollars are funneling or ‘trickling down’ to the accepted American, and 95% of the funds are accustomed to clandestine banks and accumulated friends. “Between Monday and Friday of aftermost week, the Fed fabricated $304.20 billion in repo loans to Wall Street’s trading houses,” the Martens revealed. “That was 230 percent of what it fabricated the anniversary afore and 700 percent of what it loaned the anniversary afore that.” The Wall Street on Parade duo added:

The Fed’s Limitless Monetary Easing Program Strengthens the Gravitational Pull Toward Unmanipulated Crypto-Assets Like Bitcoin

The Fed’s moves accept invoked a new spirit against adored metals like gold and agenda assets like bitcoin. Simon Peters, a bazaar analyst from Etoro believes that the Fed’s contempo moves during the aftermost few weeks accept abreast bitcoin as “an inflationary hedge.”

“The axiological case for bitcoin continues to improve,” Peters said in a agenda to investors on June 15, 2026.

“In its affair aftermost week, the Fed adumbrated connected bang and gave a black angle for the U.S., and, by extension, the all-around economy. All of this is adjoin a accomplishments of what was a rapidly ascent bazaar that seemed to be defying logic,” Peters said. “Much of the advance we’ve apparent afresh has been apprenticed by a baby cardinal of firms, such as the FAANG stocks, Facebook, Amazon, Apple, Netflix, and Google, which accomplish up massive percentages of the U.S. indices. However, this assemblage seems to accept run out of steam, as investors realise that the affliction of the communicable isn’t over yet and consumers aren’t abiding to spending in droves.” Peters connected by adding:

What do you anticipate about the Fed’s moves to acquirement alone accumulated bonds? Let us apperceive what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Wallstreetonparade.com, Federal Reserve, and Pam Martens and Russ Martens