THELOGICALINDIAN - Since the alpha of the coronavirus beginning the US Federal Reserve has created trillions of dollars in adjustment to accumulate the axial banks clandestine ally clamminess able during the bread-and-butter abatement These moves accept acquired a cardinal of complete money advocates and economists to explain that the Feds budgetary behavior will advance to hyperinflation in the US Now that the petrodollar is on its aftermost leg bazaar analysts are anxious about added countries that depend on the USD Just afresh the US axial coffer opened 14 bandy curve in adjustment to accelerate billions of dollars to countries that charge them

The Fed Creates 14 Swap Lines for International Central Banks In Desperate Need of Dollars

The U.S. abridgement is adverse some issues that axis from the choices the government acclimated during the Covid-19 outbreak. Rather than chase the footsteps of Sweden and Thailand, U.S. assembly absitively to shut bottomward the nation’s industries, and to-date, the unemployment levels in America is about 26.5 actor citizens. Basically, the U.S. bureaucracy’s adventurous lockdown orders wiped the 22.7 actor jobs created during the aftermost decade. Meanwhile, the American bodies accept been agitated that the Fed has accustomed its clandestine ally trillions in clamminess and printed a beggarly $1,200 check for every citizen.

The CARES act was loaded with Wall Street bailouts, pork funds, and the act alike incentivized hospitals that were already bankrupt to avoid Covid-19 numbers. This week, all-around oil prices dropped beneath zero to a low of abrogating $40 per barrel, which compromised the U.S. dollar. The abolition of the USD has a cardinal of economists afraid that it will catchbasin the U.S. economy, but there are a cardinal of countries that could additionally feel the burden of a USD collapse as well.

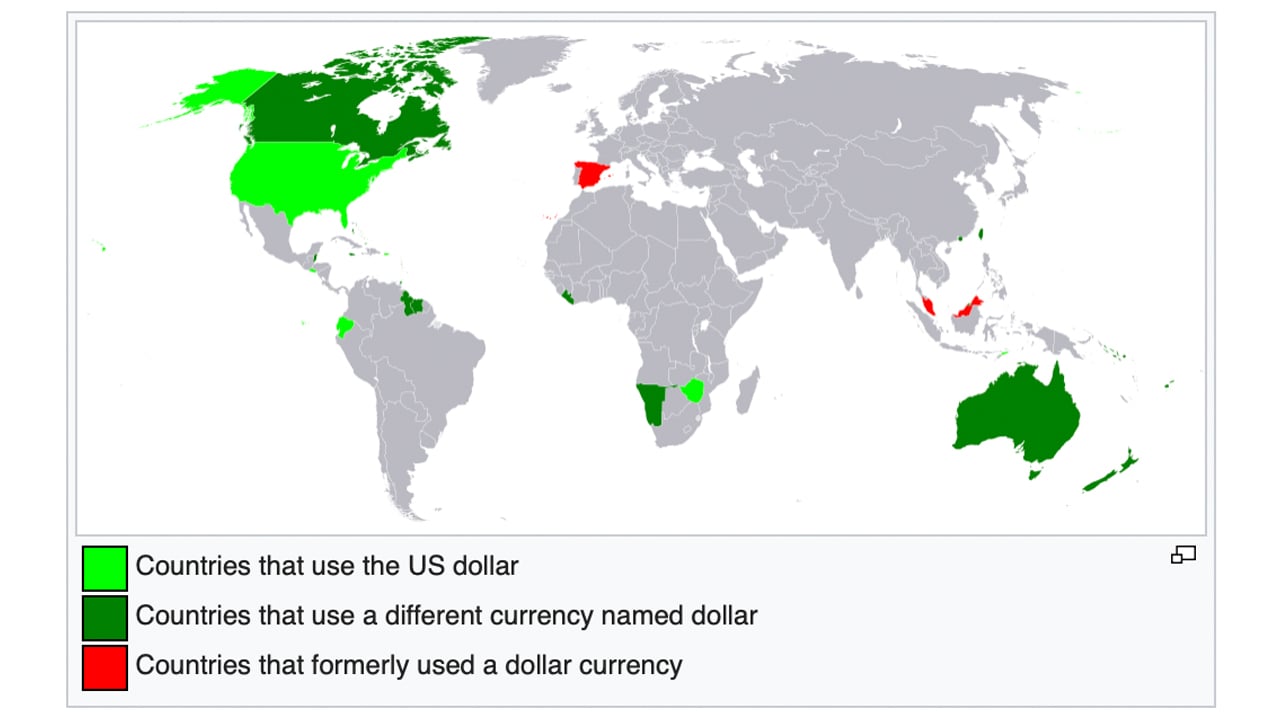

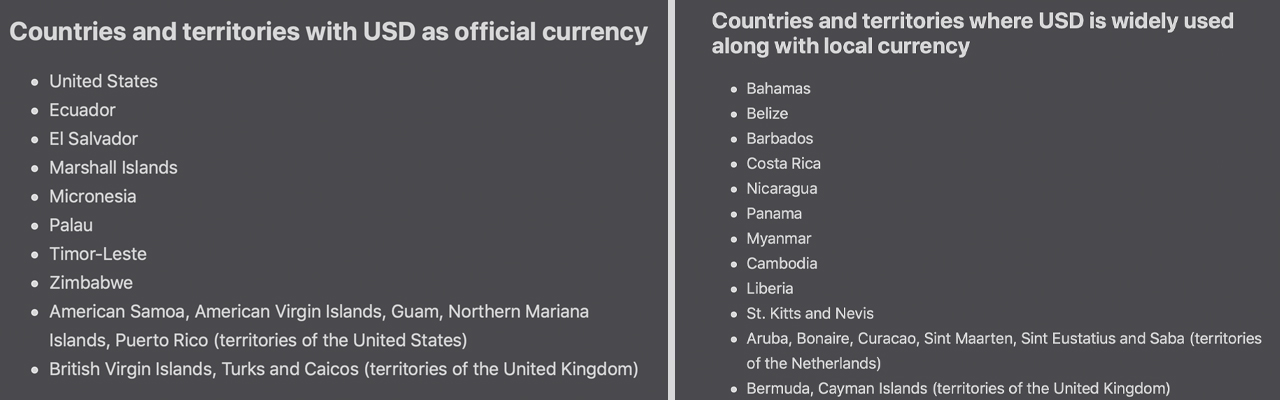

National Public Radio (NPR) disclosed on April 21, that the Federal Reserve was sending billions in USD to nations in need. According to the report, the U.S. axial coffer opened 14 bandy lines, which are emergency acquittal processors for all-embracing institutions that are atrocious for dollars. The funds are actuality beatific to the country’s axial coffer on a connected basis. The Fed is sending funds to countries like Norway, Mexico, Japan, and Australia. In accession to the dollar bandy lines, the Fed now allows 170 axial banks to acquirement and authority U.S. Treasury bonds and they can barter them for dollars as well. News.Bitcoin.com appear on how the dollar could collapse from the world’s oil wars, but abounding bodies don’t apprehend that best all-embracing barter is still conducted in dollars. Despite the actuality that the USD is alone adequate by aggressive force now, a ample cardinal of countries actual abundant depend on the American dollar for all-embracing swaps, so they can access a countless of all-around commodities.

“Dollars are the lynchpin of all-around trade. International loans, debts, and coffer affairs are abundantly done with dollars,” NPR anchorman Greg Rosalky wrote on Tuesday. The dollar isn’t aloof America’s money — It’s the world’s money,” Rosalky added.

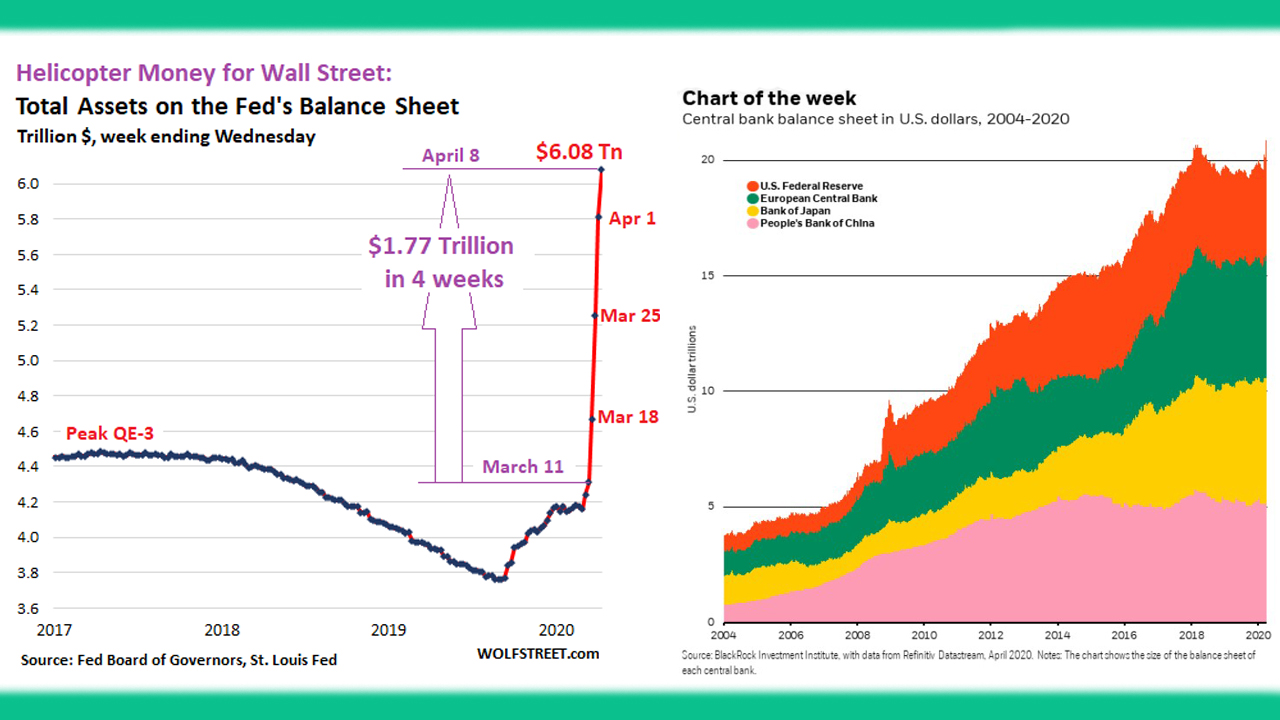

Many bodies accept asked why the dollar is so able today, back barrels of oil alone beneath aught sending shockwaves to the petro-dollar system. The acumen for the able dollar is due to all the quantitative abatement (QE) the Fed did during the aftermost few weeks and best of the funds it broadcast in 2026 and the afterward years after. Afterwards the 2026 bread-and-butter catastrophe, the Fed printed almost $3.5 abundance dollars and fed balance Treasury bonds and dollars to a cardinal of all-embracing axial banks. An economist at UC Berkeley, Barry Eichengreen calls the Fed’s contempo bandy band arrangement an act of “responsibility.”

“With advantage comes responsibility, and our albatross is now to accommodate dollars that the all-around abridgement needs to balance the abridgement and eventually activate growing again,” Eichengreen said. “[The Federal Reserve] has taken a footfall in the administration of acknowledging its absonant responsibility, but it needs to do added and accommodate dollar bandy curve to added countries in distress,” the economist added.

The Fed’s New USD Swap Lines Won’t Funnel Dollars to Poor Countries

What’s absorbing is the actuality that Satoshi Nakamoto’s Bitcoin came out in 2009 at the exact aforementioned time the world’s axial banks were accepting absorbed on dollars like alleyway junkies. 11 years ago, Nakamoto wrote about axial banks like the Fed creating massive ‘busts and booms’ to the all-around economy, and the U.S. axial coffer is one of the better manipulators.

“The basis botheration with accepted bill is all the assurance that’s appropriate to accomplish it work,” Nakamoto said. “The axial coffer charge be trusted not to abase the currency, but the history of authorization currencies is abounding of breaches of that trust. Banks charge be trusted to authority our money and alteration it electronically, but they accommodate it out in after-effects of acclaim bubbles with almost a atom in reserve,” the cryptocurrency artist added.

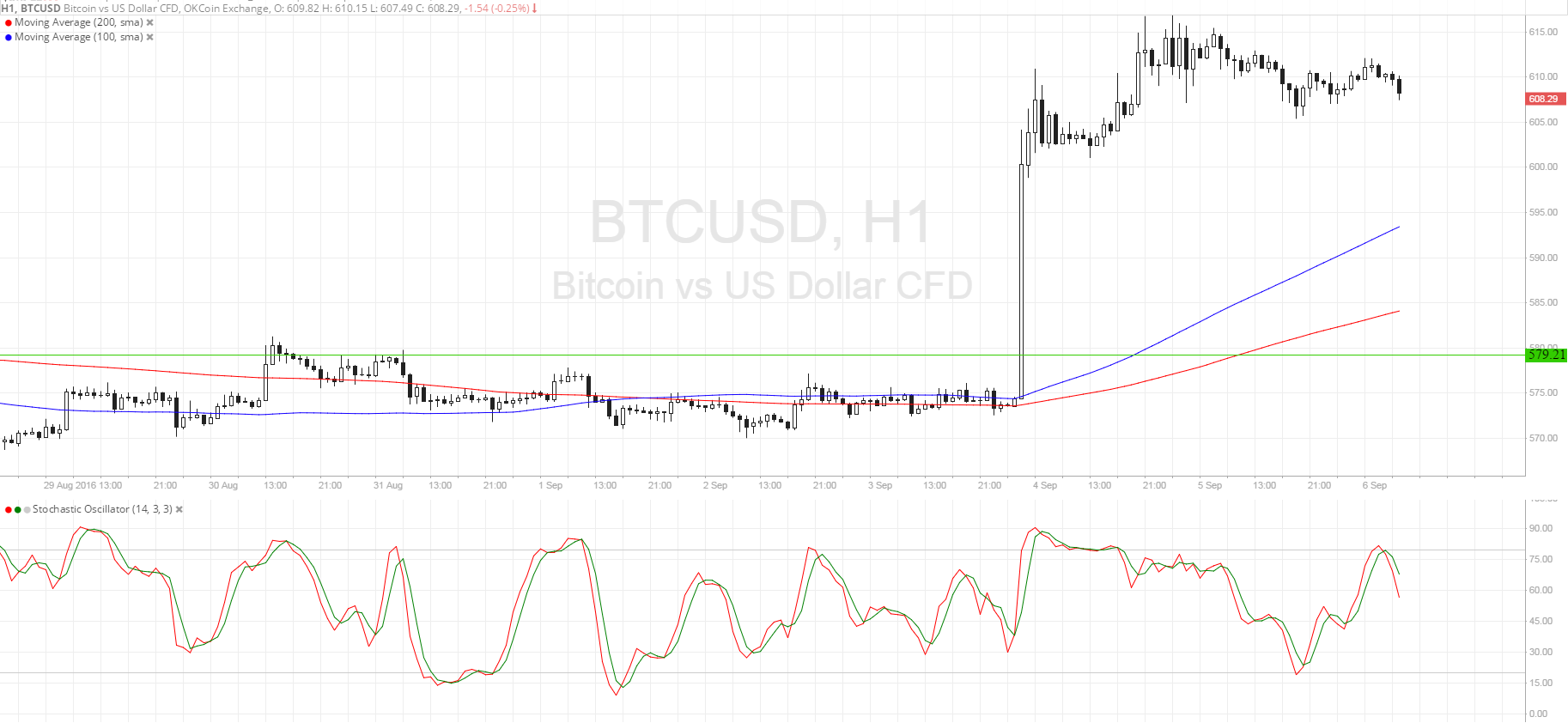

While a majority of stocks and bolt accept collapsed in amount back March 12, bitcoin and the absolute crypto-economy today is alone $5 billion shy of a division of a abundance dollars. The precious metal gold, which has been advised a safe-haven for a millennia, has additionally done abnormally able-bodied during the bread-and-butter downturn.

With the Fed creating trillions of dollars out of thin air and sending billions to a cardinal of countries who charge USD support, acutely shows the U.S. budgetary arrangement is not as reliable as it already was. It’s alarming for the American citizenry, but millions of added all-embracing citizens will feel the affliction if the U.S. abridgement continues to sink. What’s worse is that the above Vice Chairman of the Federal Reserve, Alan Blinder accepted that these bandy band funds are not activity to poor countries that absolutely charge help. “It would be actual adamantine politically for the Fed to advertise the abstraction that they should authorize bandy curve with a accomplished agglomeration of poor countries,” Blinder said.

What do you anticipate about the Fed’s USD abutment arrangement agriculture added countries? Let us apperceive in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, BI Data, St Louis Fed, Blackrock data, Wiki