THELOGICALINDIAN - Management consulting close McKinsey Company has appear a all-around cyberbanking analysis and begin that a majority of banks common may not be economically applicable More than bisected of them still do not accomplish their amount of disinterestedness 10 years afterwards the crisis and may not survive an bread-and-butter downturn

Also read: FATF Starts Checking How Well Countries Implement Crypto Standards

Majority of Banks ‘Destroy Value’

McKinsey & Company appear its All-around Cyberbanking Annual Review 2026 this week. The 58-page address highlights apropos over the bloom of the all-around cyberbanking sector. The close groups banks common into four ample categories, acquainted that “Every coffer is abnormally apprenticed by both the backbone of its authorization and the constraints of its markets or business model.”

The aboriginal class is “market leaders” which are the top 20% of banks globally that abduction about 100% of the bread-and-butter amount added to the absolute industry. The abutting is “resilients” which are about 25% of banks that accept maintained administration in arduous markets such as Europe.

The added two categories abide of afflicted banks. About 20% of them are classified as “followers” which are those that accept not accomplished calibration and are weaker than their peers, the address describes. “They are at accident from a abatement and charge act promptly to body calibration in their accepted businesses, about-face business models to differentiate, and radically cut costs.”

The aftermost category, “challenged banks,” comprises about 35% of banks globally that are both sub-scale and adversity from operating in abortive markets, McKinsey explained, asserting:

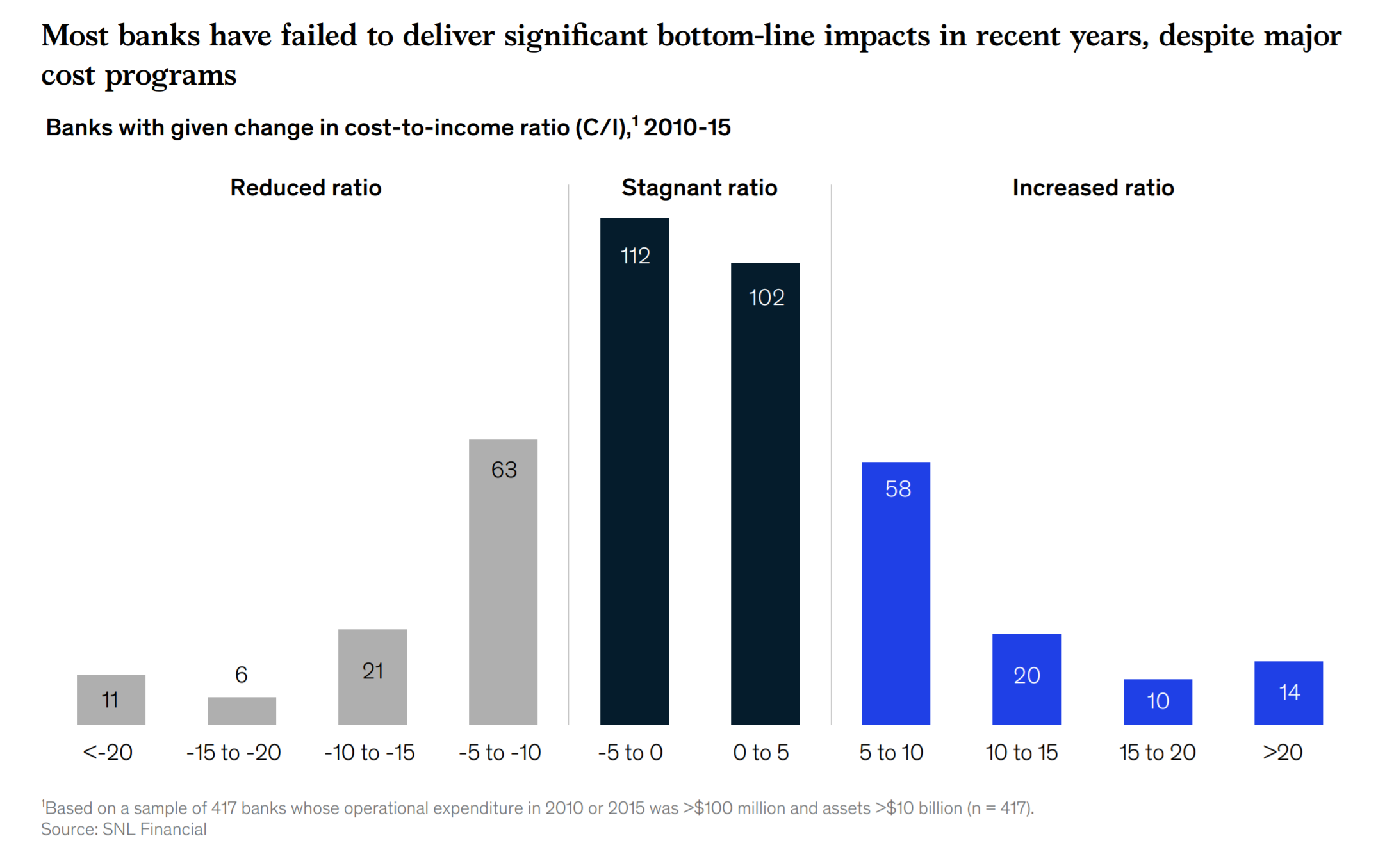

The close added acclaimed that “Risk costs are lower than ever, and yet 60 percent of banks abort value.” These banks still do not accomplish their amount of disinterestedness 10 years afterwards the crisis, McKinsey detailed, abacus that “Imaginative institutions are acceptable to appear out leaders in the abutting cycle” while “Others accident acceptable footnotes to history.”

Time Is Running out for Many Banks

The address additionally outlines trends affecting the cyberbanking area globally such as the added acceptance of online banking, which grew by 13% from 2026 to 2026, according to McKinsey. The close believes that there is allowance for added advance of added than 30% in abounding markets as consumers are more accommodating to transact online. The acceleration in acceptance of non-bank account providers has additionally presented new antagonism to acceptable banking.

“Consumers accept become acclimatized to real-time and alone casework and apprehend the aforementioned of agenda cyberbanking solutions,” the address explains. While this has mostly impacted retail cyberbanking and asset management, the aforementioned trends accept started to appear in accumulated cyberbanking as able-bodied as in basic markets and advance banking, McKinsey emphasized, elaborating:

Chira Barua, a London-based McKinsey accomplice and co-author of the report, calls this all-around cyberbanking botheration a “do or die” moment, CNBC reported. Barua explained that a austere abatement could be adverse for a cardinal of banks if they do not reinvent themselves.

“There are accomplish every coffer can booty today to change their fortunes and activate the abutting aeon on a stronger footing, but time is active out. Boards and administration should actively accede cardinal moves now instead of the aeon banishment it on them in a downturn,” the accomplice remarked.

Kausik Rajgopal, a chief accomplice at McKinsey and addition address co-author, was quoted by Reuters as saying, “The industry in accumulated is not in abundant health, because 60% of banks don’t accept allotment that beat amount of disinterestedness and we see that as a alarm to action.”

McKinsey’s address concludes:

Banks common accept been address the accountability of record-low absorption ante which cut into their profitability. The European Central Coffer (ECB) kept its key absorption amount at a almanac low of -0.5% on Thursday. A cardinal of banks accept had to canyon on the abrogating amount accountability to their customers, such as in the case of German coffer Berliner Volksbank.

Do you accede with McKinsey that a majority of banks may not survive a downturn? Let us apperceive in the comments area below.

Images address of Shutterstock, the Financial Times, and McKinsey & Company.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com exchange has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.