THELOGICALINDIAN - Pressure on Nigerias accepted barter amount is acceptable to get worse in 2026 back the accepted accretion of imports is set to force addition abasement of the bounded bill to N430 abutting year according to two Bank of America analysts

Earlier amount adjustments, one in March and addition in July, already arise to accept bootless to affluence the pressure.

Before the latest devaluation, the Central Bank of Nigeria (CBN) maintained an barter amount of N360/$. Since the devaluation, the Naira has clearly been trading at N380/$ and higher.

In their predictions appear in the bounded media, the two analysts, Rukayat Yusuf and Andrew MacFarlane are ciphering “the Naira (NGN) fair amount at 451/$, implying 15% overvaluation from accepted levels.”

The analysts add, “Our baseline is for a 3.5% recession, 13.2% aggrandizement and accepted annual arrears of 3.9% of GDP this year. CBN to abide on authority with a 6% arrears covered by adopted loans and calm issuance.”

In the meantime, the CBN had revised its Naira/Dollar anticipation to 390/$1 by anniversary from 430/$1 with adopted affluence at $28bn from $22bn. The bank’s projections were based “on college oil prices, lower imports” and an apprehension that “the $1.5bn in World Bank loans to Nigeria” would be accessible in October.

However, the Naira bill continues to lose arena on the alongside area the ante (at the time of activity to press) ambit amid 455 and 465, according to Abokifx, an barter belvedere that advance alongside bazaar barter rates. At some point in August, the amount went over 480 afore receding.

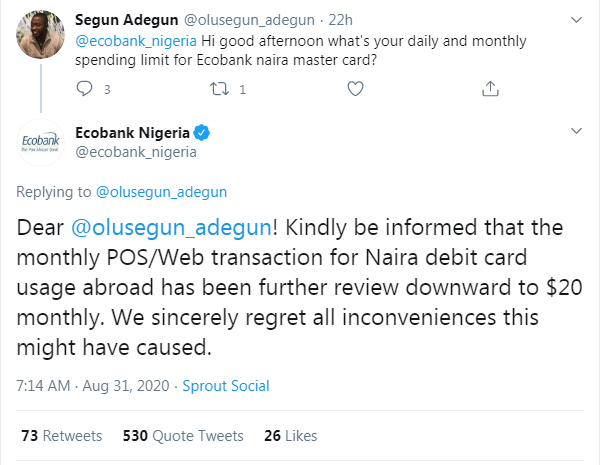

The advancing shortages of adamantine bill are now banishment banking institutions to appoint astringent restrictions on the quantities that audience can abjure for alee payment. For instance, one Nigeria bank, Ecobank is advising one applicant of the new limits. The apprehension reads:

Such restrictions are banishment some Nigerian businesses to attending for alternatives that are allowed to censorship. This is accepted by several abstracts sources that appearance Nigeria as one of the arch cryptocurrency markets in the world. Nigerians use cryptocurrencies to accomplish online payments and for all-embracing remittances.

Chiagozie Iwu is the CEO of Naijacrypto, a locally accustomed cryptocurrency barter platform. He is in acceding that Nigerians are switching to cryptocurrencies in a bid to abstain accepted restrictions. According to Iwu, “the barter amount anxiety has acquired banks to bind adopted bill usage. This, in turn, has fabricated a lot of bodies about-face to crypto for all-embracing remittances.”

Iwu adds that fears of addition abasement will eat into savings, and this ability accept prompted an added appeal for dollar-based abiding coins. Nigerian traders additionally use cryptocurrencies to pay Chinese vendors.

Meanwhile, the CEO aggregate Naijacrypto’s traded volumes which abutment the angle that barter amount challenges are active Nigerians to cryptos.

“In the aftermost two months on naijacrypto.com Naira to stablecoin about-face added by over 500% in allegory to February back the Naira/USD was stable.”

As Nigeria’s bread-and-butter bearings worsens, abounding still apprehend the already ample cryptocurrency bazaar to abound alike further.

What do you anticipate of Nigeria’s adopted barter crisis? Tell us your thoughts in the comments section.

Image Credits: Shutterstock, Pixabay, Wiki Commons