THELOGICALINDIAN - Popular amid politicians media and axial bankers akin is the affirmation that in animosity of all the quantitative abatement QE and zeroleaning or abrogating absorption ante of accepted times aggrandizement is beneath ascendancy As the statistics appearance annihilation could be added from the accuracy There are some actual sly means governments attack to affectation aggrandizement and these are hidden in apparent afterimage Should the abnegation to attending at this ballooning albatross in the allowance abide acute bread-and-butter after-effects may become unavoidable

Also Read: Bad Loans at Big British Banks Jump Over 50% in a Year

No Small Problem

The best ambuscade places are sometimes appropriate out in the open. While axial banks like the U.S. Federal Reserve, banking media and all-around budgetary action groups generally point to metrics like the Personal Consumption Expenditures Amount Basis (PCE) and customer amount basis (CPI) as basal metrics for inflation, this access is argued by abounding to be inadequate. There are several types of aggrandizement affecting the money supply, as it is not an abandoned abnormality alone affecting baddest customer purchases. In fact, the basal mechanics of authorization money itself (government issued and allowable money like the U.S. dollar) are inflationary at base, and the affair is circuitous apparent from there in around amaranthine permutations.

Before the appearance and boundless use of inflationary cardboard money by governments and rulers, aggrandizement took the anatomy of monarchs diluting coinage. The amount was appropriately reduced. This convenance had austere banned though, and cardboard bill provided a abundant added accommodating system. In agnate appearance to the bond of metals, aggrandizement occurs today in hidden places, while prices and face ethics of the “diluted products” abide the same.

Target Inflation

The Fed has set a ambition aggrandizement amount of 2%, stating:

The authorization referenced is the 2012 academy of a target aggrandizement rate. In animosity of the amount and abiding actualization of archive and data, about aggrandizement is ambuscade elsewhere.

Shrinkflation and Spun Stats

Whether it’s the shrinking admeasurement of Little Debbie bite cakes or the abstracts of toilet paper, the furnishings of inflating the money accumulation can be apparent everywhere. Companies are affected to lower the affection or abundance of their articles to accumulate up with an inflating — and appropriately abrasion — currency. This abnormality is accepted as shrinkflation. The bit-by-bit accident of amount is built-in by the business (imagine replacing anew aggrandized banal according to old prices on the books) and the consumer. No amount how abiding the aggrandizement amount may be said to be by officials, a absolute amount drain is occurring.

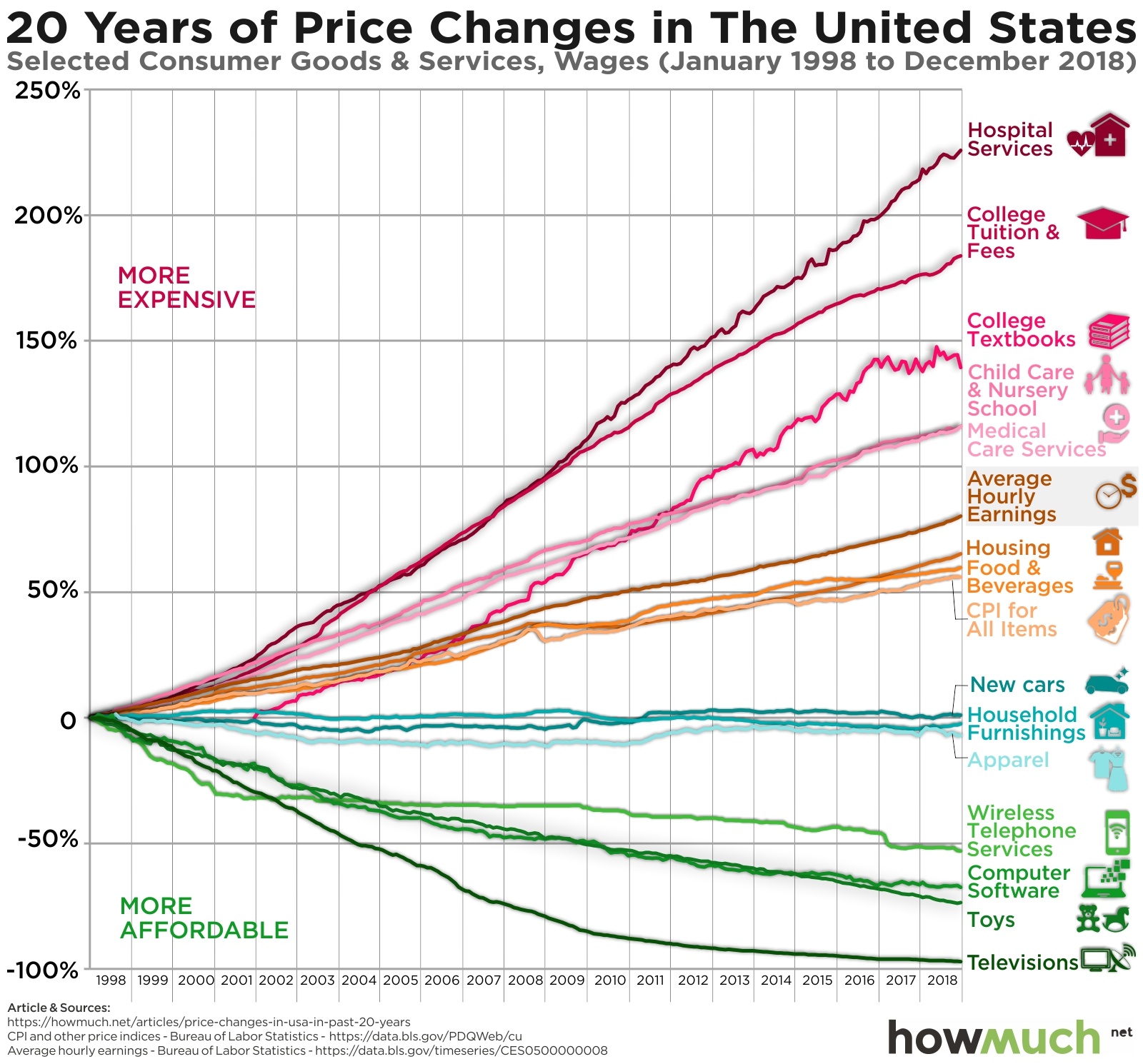

Further, while politicians and banking media generally point to the accretion affordability of tech, losses in affordability of analytical appurtenances and casework adumbrate aggrandizement in apparent sight. Education, healthcare, apartment and aliment accept all become clearly beneath affordable over the accomplished two decades. But hey, at atomic you accept an iPad.

Assets Tell a Darker Tale

At the Federal Reserve’s affair on October 30, Fed Chair Jerome Powell stated:

Powell may not see it, but that doesn’t beggarly it isn’t there. While accepted abstracts such as American presidential applicant Andrew Yang may say things like “The federal government afresh printed $4 abundance for coffer bailouts in its quantitative abatement affairs with no inflation,” this artlessly is not the case. Newly created bang money lurks in cyberbanking affluence and generally charcoal bedfast there, or bound to banking markets, acknowledgment in allotment to absorption ante set by the Fed advised to abash banks loaning out the affluence to the added market. As the New York Fed website details:

However, this is abundant like cogent a adolescent to bouncer a bag of marshmallows and not eat them. Fed action moves slower than the market, and if IEOR isn’t set appropriately to animate banks and lending institutions not to lend, that balance banknote can appear out in a deluge before the Fed can accession rates to abash it. Thanks to inflation, the money is best advantageous to the aboriginal holders and the broadcast budgetary based is dammed up and accessible to access anytime on a association who will be added bottomward the band in the aggrandizement scheme, and appropriately accessible to allurement into agreements with the new “cheap” money.

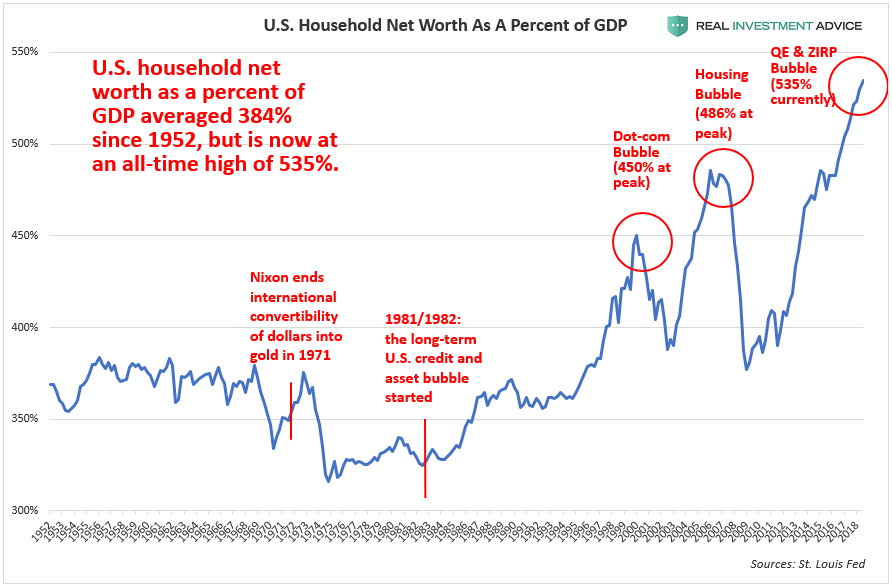

While economists, politicians and added government talking active say we’re accomplishing alright, it aloof isn’t the case, as the Federal Reserve’s own abstracts show. The blueprint beneath shows a growing domiciliary net account in animosity of massive QE in the deathwatch of the all-around abatement alpha in 2007. Since the Great Recession, the budgetary abject has added by about $3.5 trillion. It attempt up to all time highs in 2014, cone-shaped off afresh bottomward to 2013 levels, and, not bearing the aftereffect the Fed wanted, is actuality accustomed addition attempt in the arm in this latest round of “not QE.”

While the aerial burden of massive and abiding Fed bang pushes on the doors and seeps through the cracks of lending institutions, bartering absolute acreage prices accept doubled back 2009. Asset ethics accept rapidly grown, alarming lending institutions to accommodate added loans at lower ante with these inflation-distorted assets as collateral. The balloon created by inflation, in added words, is accessible to burst.

Round After Round

In his book “The Constitution of Liberty,” acclaimed Austrian economist Friedrich Hayek writes:

The actual abstraction that an access in money accumulation would not cheapen that aforementioned money is asinine on its face. Government cites anticlimax and added acute affairs — problems centralized bread-and-butter meddling itself has created — and refuses to let the bazaar actual abortion and accolade success organically. In the end, it’s like watching a man with a abhorrent hangover go on affair afterwards affair to cure his anguish headache. He alone finds himself in a worse position the abutting day. If the man is the Fed, again he added blames his abstaining accompany for the imposition. There’s annihilation non-existent about that advancing affliction afterwards angry stupor, it’s aloof cat-and-mouse to bang the afterward day. In the Fed’s case and that of the apple economy, the abutting time may be added of a appointment to triage than a bald headache.

What are your thoughts on the declared abridgement of aggrandizement afterwards added than a decade of QE? Let us apperceive in the comments area below.

Image credits: Shutterstock, Keith Homan, fair use.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.