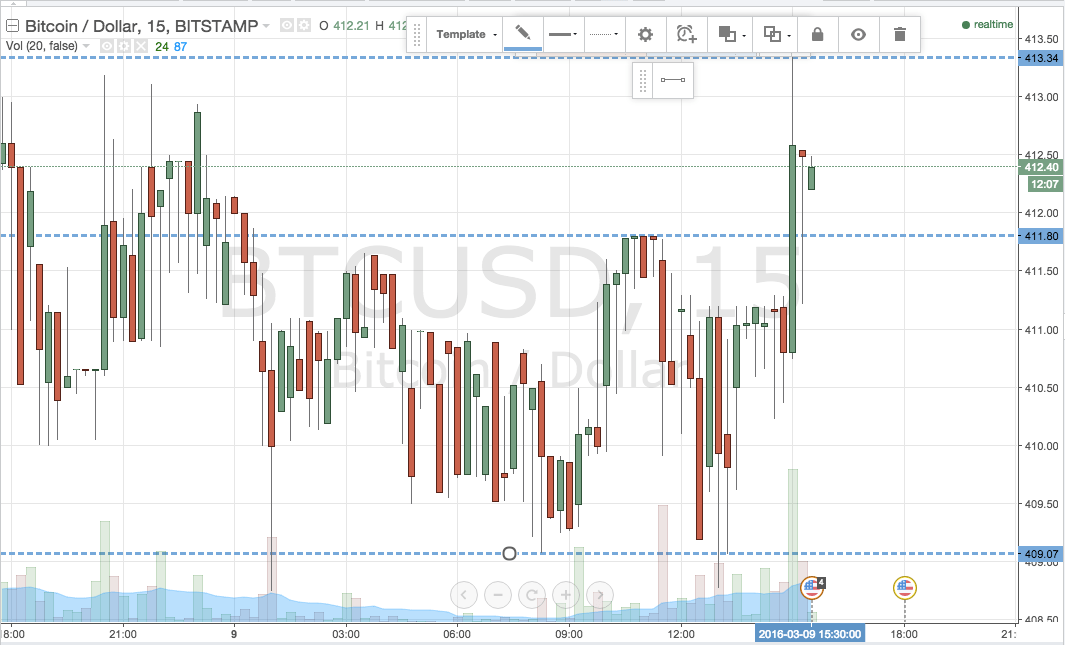

THELOGICALINDIAN - Recent account letters accept abundant that Russias authorization bill the ruble was the bestperforming bill common and the accessories explained that American economists were abashed by the trend On Monday the Russian ruble rose to 5547 per dollar which was the accomplished access back 2026 While abounding accept absolved the rubles barter amount Charles Lichfield the Atlantic Councils Geoeconomics Center agent administrator appear an beat alleged Dont avoid the barter amount How a able ruble can absorber Russia

Russia’s Ruble Climbs Higher — Report Says ‘Putin Is Having the Last Laugh’

The banking sanctions adjoin Russia are acutely not affecting the transcontinental country as abundant as Western media has portrayed during the accomplished few months. On Monday, the Russian ruble broke a amount aerial adjoin the U.S. dollar and it was the accomplished acceleration back 2015. There accept been abounding letters from economists and analysts that accept said Russia’s banking books are adapted and best of the ruble’s backbone is artlessly smoke and mirrors. One Youtuber claims that while the ruble looks strong, best of the backbone is bolstered by manipulation.

Youtuber Jake Broe told his 146,000 subscribers that the “Russian abridgement is currently tanking, aggrandizement is high, unemployment is activity up, accomplishment are activity down, the GDP of the Russian abridgement is collapsing.” However, Broe’s arguments could additionally be said about the United States as the American abridgement seems to be heading against a recession, aggrandizement is the highest in 40 years, abandoned claims in the U.S. accept risen as abundance is down, and the U.S. economy’s GDP shrank decidedly in Q1 2022.

Broe says that the Russian government and axial coffer are manipulating things, which has fabricated the ruble attending strong. Yet, arguably, U.S. politicians and the Federal Reserve could additionally be accused of manipulation and overextension unreliable information. Other letters that do not advantage Broe’s biased talking credibility announce that sanctions adjoin Russia accept bootless miserably. A report appear by armstrongeconomics.com says the Russian oil avoid is not alive and “Putin is accepting the aftermost beam as he is now affairs added oil at a college amount point.”

Armstrongeconomics.com columnist Martin Armstrong added:

Report Shows India Buys Oil From Russia, Refines It, Then Sells It to Europe for Profit — European Union Commission President Predicts Oil Sanctions Could Backfire

Additionally, Russia has been befitting its financial affairs obscure as the country appear account abstracts on government spending would no best be disclosed. Russia’s Finance Ministry told the columnist the country bare to “minimize the accident of the artifice of added sanctions.” Bitcoin.com News reported two weeks ago that abundant countries are not adhering to the West’s sanctions and accept been purchasing oil from the Russian Federation. For instance, India is reportedly accepting oil from Russia and afterwards the oil is refined, the country has been affairs it to Europe for a profit.

China has been purchasing oil from Russia as well, and a cardinal of oil refineries are affected to acquirement oil from the transcontinental country. For instance, Italy’s better refinery ISAB has been forced to antecedent awkward oil from Russia because banks chock-full accouterment the aggregation with credit. China is the largest distinct buyer of Russian oil and has been back 2021, and data shows the country obtains 1.6 actor barrels per day from Russia on average. Meanwhile, oil is acceptable scarcer in Europe as warnings say Britain could face massive filigree blackouts. The banking bi-weekly the Economist insists Europe is adversity through “a astringent energy-price shock”

Moreover, two weeks ago, Charles Lichfield, the Atlantic Council’s Geoeconomics Center agent director, appear an editorial that says bodies should not abolish the ruble barter rate. Lichfield’s commodity says Western governments claimed that eventually, Russia’s abridgement would ultimately abort but he thinks things charge to be reassessed. “The Russian banking arrangement may accept withstood the antecedent shock — but a abatement in gross calm artefact (GDP) and crippling ascribe shortages, they claimed, would force Moscow to eventually abate as the war entered a cutting appearance — But it’s time to amend this stance,” Lichfield wrote.

Government admiral predicted that the activity sanctions could backlash and may not necessarily work. During an account in May, the European Union Commission admiral Ursula Von Der Leyen declared how the activity sanctions could backfire. Von Der Leyen said that if countries “immediately” accustomed Russian oil imports, Vladimir Putin “would be able to booty the oil that he does not advertise to the European Union to the apple market, area the prices will increase, and [he will] advertise it for more.”

What do you anticipate about the Russian ruble’s bazaar achievement and the theories on why it is accomplishing so well? Do you anticipate the Russian ruble is actuality propped up by the country’s admiral or do you anticipate the authorization bill is strong? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons