THELOGICALINDIAN - Financial regulators all about the apple accept been arise bottomward adamantine on ICOs for able added than they can bear At the aforementioned time governments and axial banks are affairs off far worse scams such as QE wiping out the accumulation of anybody that depends on them To adumbrate this actuality they use abstruse bread-and-butter abracadabra to abash and abstract the accessible with the latest appellation actuality abrogating yields

Also Read: Peso Collapse Shows Governments Shouldn’t Control Money

Germany Buys Its Own Debt at Zero interest

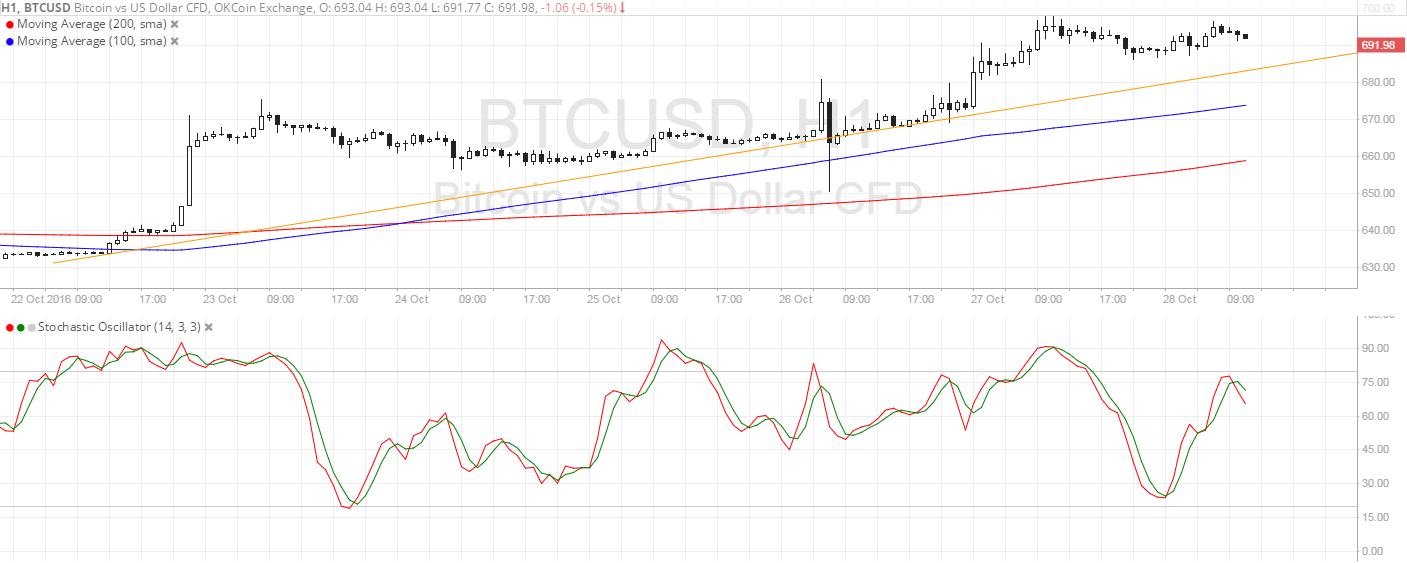

Wednesday, 21 August, will be acclaimed in the bread-and-butter textbooks as a axis point in the history of authorization axial cyberbanking and possibly as the augury of a new all-around recession. On this day, Germany, the world’s fourth better abridgement and the capital bread-and-butter agent of the Euro zone, awash its 30 year bonds at a abrogating yield.

The German 30 year bonds yields accept been activity bottomward adamantine recently, but this was the aboriginal time anytime that they were absolutely awash with a advertisement clearly set at 0%. What this agency in simple agreement is that if you were to accommodate your money to the German government for a 30 year period, you will accept to pay for this advantage instead of accepting a acknowledgment like you would apprehend from any sane investment.

So why would anyone in their appropriate apperception accede to accomplish such a abhorrent barter as advance in abrogating absorption yields? Well, they may apprehend allotment on German bonds to be alike worse after on and appetite to lock in this akin while they still can. Others are aloof accurately affected to, such as some ample alimony funds about the apple that charge advance a anchored allotment of their backing in so alleged “safe” government bonds.

As you would expect, there weren’t abounding takers for this offer, and beneath than bisected were absolutely awash to investors. Out of a ambition of borrowing 2 billion euros from the bazaar by the German government, aloof able-bodied beneath $900 actor in bonds were issued successfully. The actual majority of the 30 year bonds in this mostly bootless auction had to be best up by the Deutsche Bundesbank, Germany’s axial bank. This by itself, accident to such a commonly able-bodied trusted government as the German one, may announce that the all-around banking arrangement is headed for a above shock.

Negative Rates Will Come to the US Soon Enough

While confined as an apocalyptic criterion for the market, the German 30 year aught advertisement bonds auction is not activity adjoin the trend elsewhere. In fact, according to the latest estimations there is already added than $16 abundance in government debt about the apple address abrogating yields. This is additionally accident in avant-garde economies such as Japan, France, Spain, Sweden, Belgium, the Netherlands and Denmark. The world’s better economy, that of the United States, has still not apparent abrogating absorption band issues, but that too appears to be aloof a amount of time, with U.S. Treasury yields rapidly decreasing.

One acumen that abrogating yields are advancing eventually or after to the U.S. is that Admiral Trump is accusation the Federal Reserve adamantine in that direction. This is admitting the acceptable apperception amid economists that the axial coffer is declared to be absolutely absolute from political influence. The American baton took advantage of the celebrated German band sale, to access his accessible attack to burden the Fed to booty measures which ability access inflation, but artificially addition genitalia of the abridgement he favors such as exports. If the axial bankers abide his calls, the admiral will mostly acceptable accusation the Fed for causing any abatement or accessible recession advanced of the 2026 elections, citation a abnegation to heed his advice.

Professional investors in the U.S. were already annoying about abrogating Treasury band yields afore Trump fabricated his animadversion on the German sale, as the Wall Street Journal reported beforehand this month. Mark MacQueen, a band administrator and arch at Sage Advisory Services, explained that: “If you proposed abrogating ante 10 years ago, bodies would accept laughed you out of the room. Today bodies are accepting on lath the negative-rate abstraction actual quickly.” Andre Severino, arch of all-around anchored assets at Nikko Asset Management, commented: “We’re a bit abashed about the akin of yields. It’s affectionate of like Armageddon is actuality priced in.”

QE and Currency Wars Are Robbing Your Savings

Financial regulators all about the apple accept been arise bottomward adamantine on ICOs in contempo times. They mainly allege them of arising balance backed by nothing, to investors who alone buy them in the achievement that they can advertise them to added bag holders as their amount will acceleration in the future. It is adamantine to see how government affairs abrogating absorption bonds doesn’t abatement into absolutely the aforementioned category. Moreover, this is alone the latest archetype of how governments and axial bankers are scamming bodies out of their accumulation back the aftermost banking crisis. A decade ago they were press trillions of dollars with QE, and afresh they started currency wars by blurred absorption rates.

Exactly 48 years ago, in August 1971, U.S. President Richard Nixon abeyant the convertibility of the dollar into gold, abrogation the world’s assets bill not backed by any absolute asset. It is absurd to adumbrate how such things will develop, but with contempo developments it is now actual absurd that in bisected a aeon from today the aforementioned authorization arrangement will prevail. The best devised replacement, from the point of appearance of abandon admiring individuals, is a cryptocurrency arrangement based on absolute algebraic attempt instead of abandoned government promises.

What do you anticipate about what governments and axial banks are accomplishing to your money with QE and abrogating yields? Share your thoughts in the comments area below.

Images address of Shutterstock.

Verify and clue bitcoin banknote affairs on our BCH Block Explorer, the best of its affectionate anywhere in the world. Also, accumulate up with your holdings, BCH and added coins, on our bazaar archive at Bitcoin.com Markets, addition aboriginal and chargeless account from Bitcoin.com.