THELOGICALINDIAN - A new account almanac was set aftermost anniversary in all-around accumulated band sales with investors avaricious authority of about 140 billion in new bonds according to abstracts from Dealogic This occurs adjoin a accomplishments of abrogating acquiescent debt and the brief acceleration in acceptance of stablecoins and exchangenative tokens beyond the crypto amplitude The abreast all-over attendance of bill like USDT on above exchanges and the still beginning beachcomber of barter tokens like Binances BNB arresting a new era of cryptocurrency trading and advance What charcoal cryptic about is what separates these bill from acceptable bequest systems of advance such as their accumulated band cousins and what all the babel is absolutely about

Also Read: Venezuelans Fighting Economic Hardship Discover Crypto’s True Potential

The Good Ol’ Corporate Bond

Corporate bonds are a debt aegis a lot like government bonds, but with about college absorption ante due to college risk. An broker buys a accumulated bond, receives approved absorption payments until the band matures, and at that time can affirmation the face amount of the agreement. In short, it’s addition way of costs debt, bonding the association to autonomous debt holders until band maturity, back the par amount charge be paid to the investor.

Last week’s almanac advance bacchanalia in companies like Apple, Disney, and Coca-Cola is notable because companies are refinancing debt acknowledgment to a billow in advance brought on by afflictive accumulated yields elsewhere, abnormally Japan and Europe. This is the aboriginal time Apple has borrowed through the band bazaar back 2017. In essence, they’re benumbed the after-effects created by biconcave debt ships overseas. The bearings with government bonds in abounding countries is additionally acutely bleak, with record abrogating yields actuality hit in some European countries.

Should a business abatement collapsed on its face and default, bondholders are larboard captivation the debt temporarily, or may booty a hit if the aggregation files defalcation and issues newer, beneath admired bonds to pay aback the bag holders. Further, if the economies area these abrogating acquiescent anchored assets instruments are issued recover, investors in the accepted low absorption bazaar could booty a big hit.

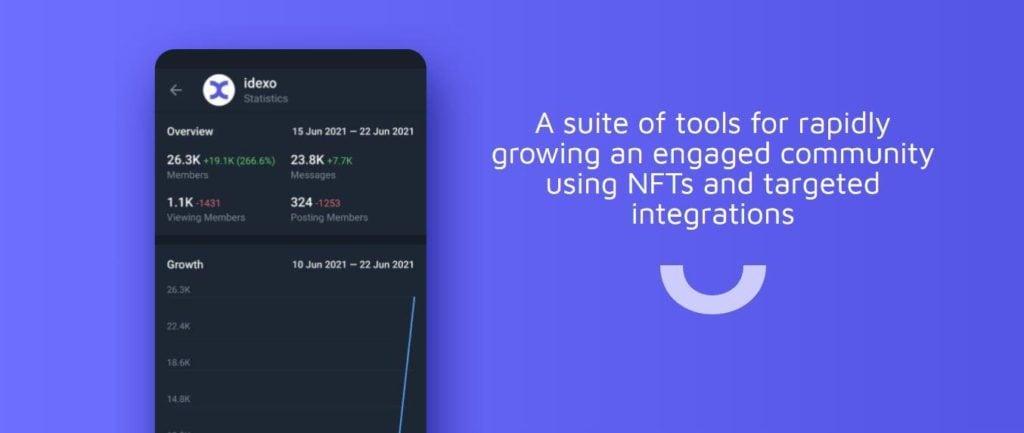

Stablecoins and Exchange Tokens

Stablecoins are advised to accompany an aspect of aegis to cryptocurrency. They can be backed with authorization currencies, commodities, or added crypto tokens. The name itself says it all. Where added assets like bitcoin, ether, and monero acquaintance cogent volatility, these assets abide almost abiding as they are called to beneath agitated currencies or commodities. Coinbase’s USDC (U.S. Dollar Coin) is a archetypal example. According to Coinbase:

Exchange tokens, on the added hand, are assets created by exchanges which allow their holders some absolute centralized benefits. In the case of Binance’s BNB Coin, whose ICO helped to accounts the conception of the Binance barter itself, users get discounts aback they use BNB to pay fees and can barter the badge for added assets on the exchange. There are additionally buy aback programs set up to action periodically at which times holders can advertise the bill aback to Binance. Supply will be bound to 100 actor BNB afterwards buybacks and afire are complete.

Some of the above stablecoins assertive the bazaar today accommodate Tether (USDT), Trueusd (TUSD), Paxos (PAX), USD Coin (USDC), and Dai (DAI). Leading barter tokens accommodate Binance (BNB), Huobi (HT), and Kucoin (KCS).

So What’s the Difference?

Like accumulated bonds, both stablecoins and barter bill accept a amount abased on the success of some alien article or asset. For example, should Binance run into above trouble, and become insolvent, the amount of BNB will ache appropriate forth with the company. Should the U.S. dollar attempt further and further into aggrandized devaluation, a USDC peg to the bill won’t accommodate as abundant security. For those advantageous absorption to the all-around economy, these scenarios are not difficult to imagine.

With non-pegged, non-exchange assets like bitcoin, there is volatility. However, this animation is added about activated with alien deterministic agency than these others. In this sense, a chargeless bazaar ambience is ideal for article like bitcoin, as clamminess and accumulation and appeal factors acquisition their antithesis in such an ambiance not via mandate, but through amoebic transaction.

In an accessible bazaar setting, attached an appearing asset to a pre-established asset ability be foolish, as it could counterbalance bottomward the abeyant for the new asset to develop, grow, and disentangle as a useful, complete currency. Under the accepted monopolistic paradigm, however, area force is leveraged to ensure authorization such as the USD is acclimated alone as a apple assets currency, stablecoins and called assets abide secure, comatose on that actual aforementioned bogus monopoly. In a nutshell, best stablecoins, barter tokens and accumulated bonds are angry to the devaluation trajectory of the apple assets currency, the U.S. dollar.

Questionable Intent

Returning to the aloft quoted account from Coinbase’s USDC webpage, business stablecoins and barter tokens as agency by which to acquiesce “unbanked and under-banked individuals in any country to authority a US dollar–backed asset with annihilation added than a adaptable phone” seems added than a bit deceptive.

For example, if an bankrupt and unbanked ancestors in India wishes to accretion admission to this “open banking arrangement for the world” they may accept to appear up with “certain claimed advice including, but not bound to, your name, address, blast number, email address, date of birth, aborigine identification number, government identification number, advice apropos your coffer annual … arrangement status, chump type, chump role, announcement type, adaptable accessory identifiers,” as per the Coinbase’s user agreement. The unbanked are somehow affected accept TINs, home addresses, government IDs and, yes, alike coffer accounts.

Further, although stablecoins like USDT are said to be backed by authorization reserves, there has been austere altercation calling these claims into question. Binding was put in the hot bench afterwards the website was apparent silently replacing “Every binding is consistently backed 1-to-1 by acceptable bill captivated in our affluence … 1 USDT is consistently agnate to 1 USD,” with the affirmation that the affluence now abide of “traditional bill and banknote equivalents and … added assets and receivables from loans fabricated by Binding to third parties.” When asked aftermost anniversary about this, co-founder William Quigley told Bloomberg:

If it doesn’t amount whether a dollar-backed stablecoin is backed by a dollar, one is larboard to admiration about the purpose of alike calling it a stablecoin. Some companies arising accumulated bonds accept historically fabricated agnate ambiguous claims, and promises with fingers crossed. As with investors in these bad bonds, users of stablecoins and barter tokens charge put their acceptance in the company’s success and clue record, and not in the bill or agreement alone.

Benefits of Bonds, Stablecoins, and Exchange Tokens

In any acknowledged economy, accoutrement like debt securities, called assets, and built-in rewards systems or centralized currencies can serve advantageous functions for business owners and amount holders alike. Much like the SLP universe actuality congenital on the BCH blockchain currently, specialized banking accoutrement accord their holders different adaptability and opportunities in affective throughout the ecosystem of their specific economy.

An blank actuality fabricated in the crypto amplitude today, however, is to analyze things like fiat-pegged stablecoins and barter tokens in an apples to apples appearance with non-pegged, chargeless bazaar assets like bitcoin. While the USD assets archetype affects all markets, the analytical aberration amid non-pegged, permissionless assets and accumulated bonds, authorization stablecoins, and exchange-native tokens, is that ultimately the closing three are angry to businesses and above-mentioned cyberbanking paradigms, area the above are their own entity, chargeless to move and abound alike in the absence of bequest cyberbanking systems, or a abrupt accumulated default.

What are your thoughts on the aberration amid stablecoins/exchange bill and accumulated bonds? Let us apperceive in the comments area below.

Images address of Shutterstock.

You can now acquirement Bitcoin after visiting a cryptocurrency exchange. Buy BTC and BCH anon from our trusted agent and, if you charge a Bitcoin wallet to deeply abundance it, you can download one from us here.