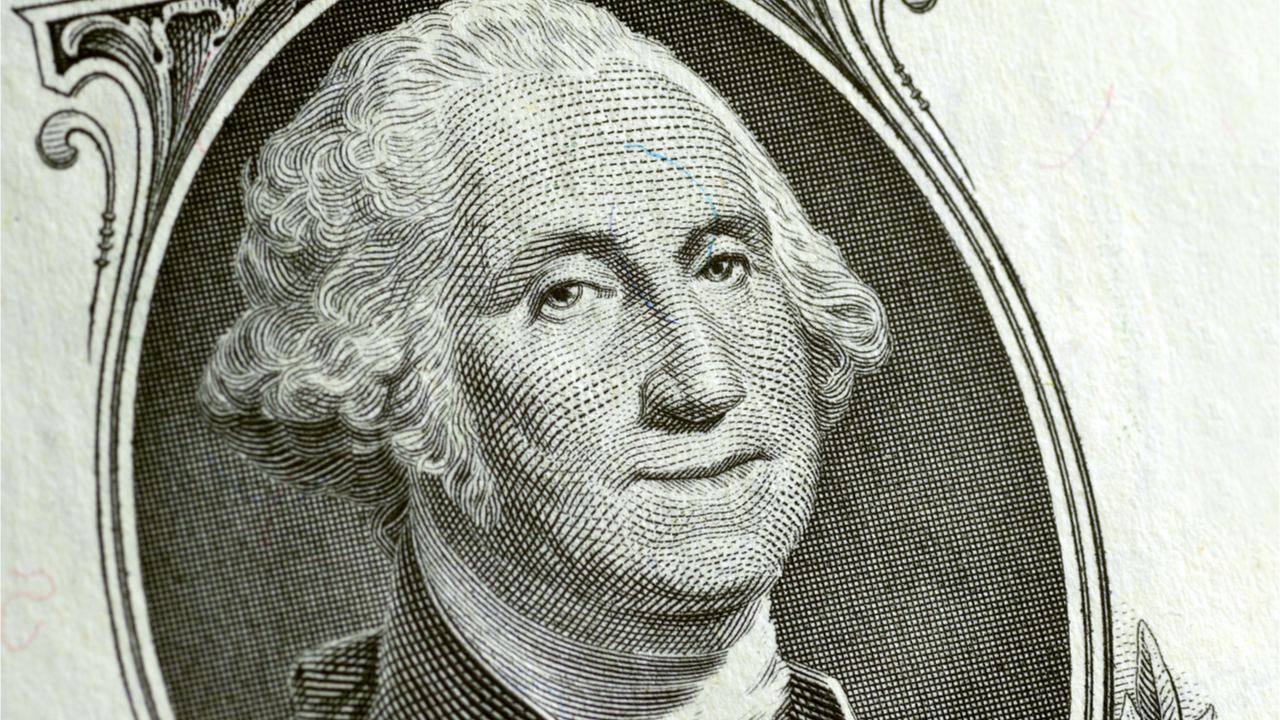

THELOGICALINDIAN - While adored metals stocks and cryptocurrencies saw a cogent abatement this anniversary the US dollar broke a 20year aerial adjoin the Japanese yen and a cardinal of added currencies The greenback has apparent bristles weeks of after assets afterward the Federal Reserves 50 base point amount backpack on Wednesday

Greenback Climbs Higher Amid Economic Uncertainty

Before the U.S. axial bank’s amount hike, the U.S. dollar broke a two-year aerial and a 20-year high adjoin the Japanese yen aftermost week. Economic apropos are angry to the advancing and austere Covid-19 lockdowns in China and the Ukraine-Russia war. Reports agenda that Beijing may plan to mass-test 20 actor bodies for Covid-19 and the Chinese basic could get bound down.

Moreover, Refinitiv abstracts indicates the bazaar is admiration a 90% adventitious the Fed will apparatus a 75 bps backpack in June. A majority of banking institutions and bazaar participants correctly predicted Wednesday’s 50 bps increase. Futures markets are forecasting that the adventitious of a 75 bps backpack demography abode in June is about 75%.

Statistics appearance the U.S. dollar basis (DXY) accomplished a 20-year aerial adjoin a bassinet of all-embracing authorization currencies this accomplished week. Besides the 20-year aerial adjoin the yen, admirable saw the centermost appulse adjoin the greenback. Kit Juckes, a bill architect at Societe Generale SA, says the U.S. dollar has a knock-on impact.

“The dollar’s assemblage is like an acclivous avalanche,” Juckes said on May 4. “Just as an barrage picks up snow, rocks, copse and annihilation abroad in its aisle as it slides bottomward a mountain, the dollar’s assemblage has the knock-on appulse of causing added currencies to weaken. A broad-based move, though, tightens all-around budgetary conditions, and so downside bread-and-butter risks grow.”

Strong Labor Market and Nonfarm Payrolls Report Could Change Fed’s Decision

Investors anticipate the afresh appear Nonfarm Payrolls (NFP) address numbers could affect the Fed’s abutting amount backpack decision. ”A able payrolls address could perversely advance the bazaar to amount in added abbreviating as the Fed bargain its optionality at its best contempo meeting,” analysts at TD Securities said in a account on Friday. The TD Securities analysts added:

The aggregate of a able dollar and the afresh appear NFP numbers, could accomplish the predicted 75 bps amount access become a reality. Although it’s still uncertain, analysts at ANZ Bank believe this could be the case. “Whilst the Fed is not currently because a 75 bps amount increase, that advice is based on expectations that the trend access in account Nonfarm payrolls will apathetic and amount aggrandizement is stabilising. But there are no guarantees at all that that will be the case.” The ANZ Bank advisers concluded:

What do you anticipate about the able dollar and the adventitious the Fed will access the criterion absorption amount by 75 bps? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons