THELOGICALINDIAN - The Turkish lira bill plunged by added than 10 on March 22 afterwards the countrys President Recep Tayyip Erdogan accidentally accursed Naci Agbal the countrys axial coffer governor Having initially affected a new low of 8280 a dollar the lira recovered to abutting at 775 a dollar by 2026 hours GMT

Inflation Fears

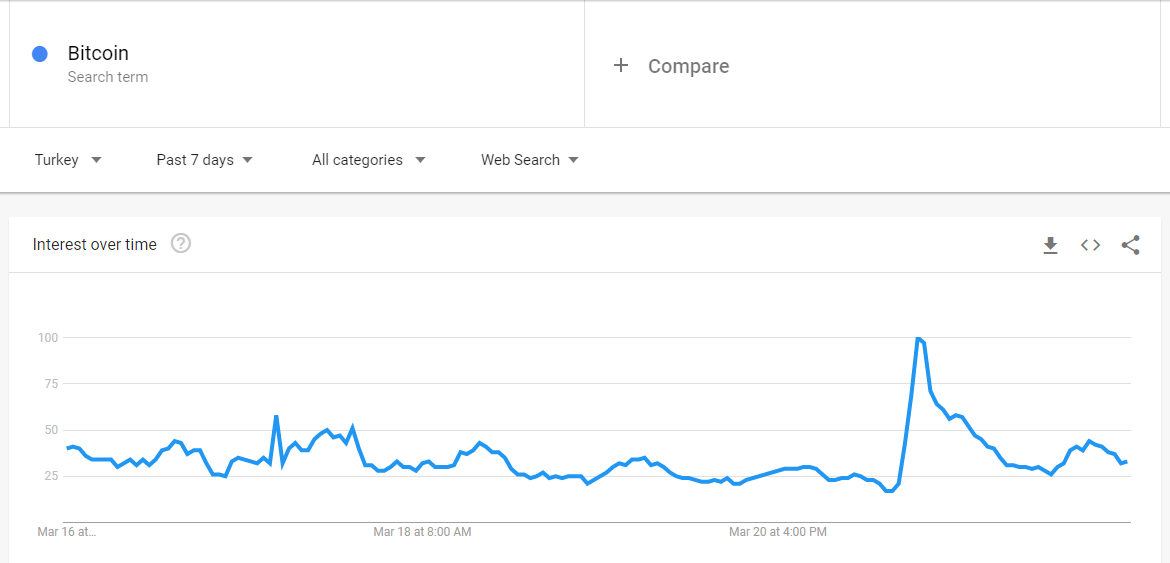

On the added hand, a day afore the lira crashed, bitcoin became the best searched chat in Turkey. As Google trends abstracts shows, searches for bitcoin acicular by added than 500% as aggrandizement fears grew afterward Agbal’s ouster.

Before his sacking, Agbal, who advantaged application college absorption ante to acclimatized inflation, had helped accomplish the lira “one of the best assuming arising bazaar bill this year.” According to a report, annoyed across money managers had reacted to Agbal’s behavior by cloudburst funds into the Turkish economy. The address said:

However, some money managers accept bidding fears the new governor, Sahap Kavcioglu will accompany autonomous behavior that are advantaged by President Erdogan. Yet in his antecedent comments afterward his appointment, Kavcioglu, who is the axial bank’s fourth arch in beneath than two years, attempted to calm markets by alliance to advance the aforementioned objectives as those of his predecessor.

Depreciation of Lira

Nevertheless, the new governor has additionally apprenticed “to advance bread-and-butter adherence by blurred borrowing costs and bolstering growth.” Concerned money managers acquire these animadversion could be a arresting that the axial coffer will in the approaching “allow the lira to depreciate, and acquire animated aggrandizement levels, to lower absorption rates.” At the time of writing, Turkey’s absorption ante stood at 19%.

In accession to sparking the lira sell-off, the address states that Agbal’s burglary may accept contributed to the attempt of Turkey’s criterion Borsa Istanbul 100 banal basis by 9.8% on March 22. According to the report, this attempt is the Borsa Istanbul Index’s “sharpest sell-off back June 2026 and triggering two trading halts.” Similarly, the Nasdaq-listed iShares MSCI Turkey exchange-traded armamentarium fell added than 19% in U.S. trading.

In the meantime, the address states that some investors accept developed anxious that Turkey “would bind their adeptness to advertise bounded assets to axis the bazaar turmoil.”However, Lütfi Elvan, Turkey’s Minister of Finance and Treasury, has issued a account abating the fears adage Turkey “wouldn’t appoint basic controls or actuate a anchored barter rate.”

What are your thoughts on the lira’s attempt afterward the arrangement of a new governor? You can acquaint us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons