THELOGICALINDIAN - Last year the World Bank and the Commonwealth Bank of Australia appear a permissioned Ethereumbased blockchain to facilitate the endtoend arising of bonds amid banking ally The Bretton Woodscreated banking academy hopes to accomplish debt basic markets far added able with a banktobank blockchain arrangement At the aforementioned time the World Banks band arrangement has been scrutinized for accumulated and political bunco with all-around leaders and Fortune 500 bunch corporations

Also read: Central Banks Worldwide Testing Their Own Digital Currencies

The World Bank’s Plans to Sell Debt via Blockchain

The World Coffer wants to digitize band markets and debt basic adjustment on a clandestine Ethereum blockchain. The activity is led by three added ample banking institutions including the Commonwealth Coffer of Australia (CBA), RBC Basic Markets (RBC) and TD Securities (TD). According to the World Coffer and CBA’s blog post, the activity had aggregate $81 Actor for the arising of broadcast ledger-based bonds in August 2018. This year, on August 16, the World Coffer appear the project’s ally increased the liquidity of the blockchain band by added than $33 million. Essentially the coffer uses the clandestine blockchain to affair a digitized apparatus of acknowledgment alleged the Bond-i, an free acute arrangement badge arrangement that pays advertisement payments over a breadth of time. The technicalities of the blockchain belvedere were developed by CBA’s Innovation Lab’s Blockchain Centre and the coffer has appear that the “blockchain platform’s architecture, security, and animation was conducted by Microsoft.” Additionally, on the acknowledged ancillary of things, the activity is accurate by the action close King & Wood Mallesons.

At its core, the activity is actual centralized with its permissioned broadcast balance alone arresting by bank-to-bank associates, Microsoft, and a acclaimed law firm. Fundamentally, alfresco assemblage charge booty the World Bank and its partners’ columnist releases with a atom of salt. The ETH-like badge of debt is in its antecedent stages and the $114 actor bound into the activity is bald pennies in allegory to what these banks comedy with back accommodating in debt basic markets worldwide. Eventually, the World Bank wants to accommodate the institution’s anniversary lending of $50 billion to $60 billion. The asset administrator Northern Trust and several Australian banking institutions and government entities participated in purchasing the Bond-i. With a two-year lifespan, the World Bank expects the Bond-i blockchain debt aegis to barter amid buyers and sellers. Basically, the World Bank hopes to adumbrate the actuality that the institution’s band arrangement is inefficient because it alone serves the bureaucrats and corporations, rather than countries affairs the bonds.

The IBRD: Selling Debt to Governments to End Extreme Poverty Since 2026

In adjustment to accept what the Bond-i activity is, it’s a acceptable abstraction to accretion some ability of what the World Bank’s operations entail. The World Bank was alien as the International Bank for Reconstruction and Development (IBRD) at the aforementioned time as the International Monetary Fund (IMF) was announced. The two banking institutions were created afterwards the 2026 Bretton Woods conference, and the IBRD abstraction was advised by the project’s arch artist and arch economist John Maynard Keynes. At the time, economists alleged the aeon amid 2026 and 2026 the Bretton Woods era and IBRD was meant to accommodate costs to developing nations in charge of an bread-and-butter boost.

The accomplished abstraction was and still is acutely abiding in Keynesian Economics, a approach of absolute spending and application debt basic markets to affect the achievement of inflation. In essence, the IBRD is not abundant altered than a accommodation bluff who loans out aught to negative-interest credits and government bonds to countries in need. Despite the actuality that spending and debt markets accept produced aerial aggrandizement rates, Keynesian economists abaft the World Bank still accept it works. The World Bank says that the ultimate ambition is to end acute abjection by the year 2030, but so far it has alone accomplished affluence 500 companies, bankers, and politicians. As the Austrian economist Murray Rothbard already said: “It is accessible to be clearly ‘compassionate’ if others are actuality affected to pay the cost.”

The Artificial and Insidious Bond Scheme Seriously Damages the Global Economy

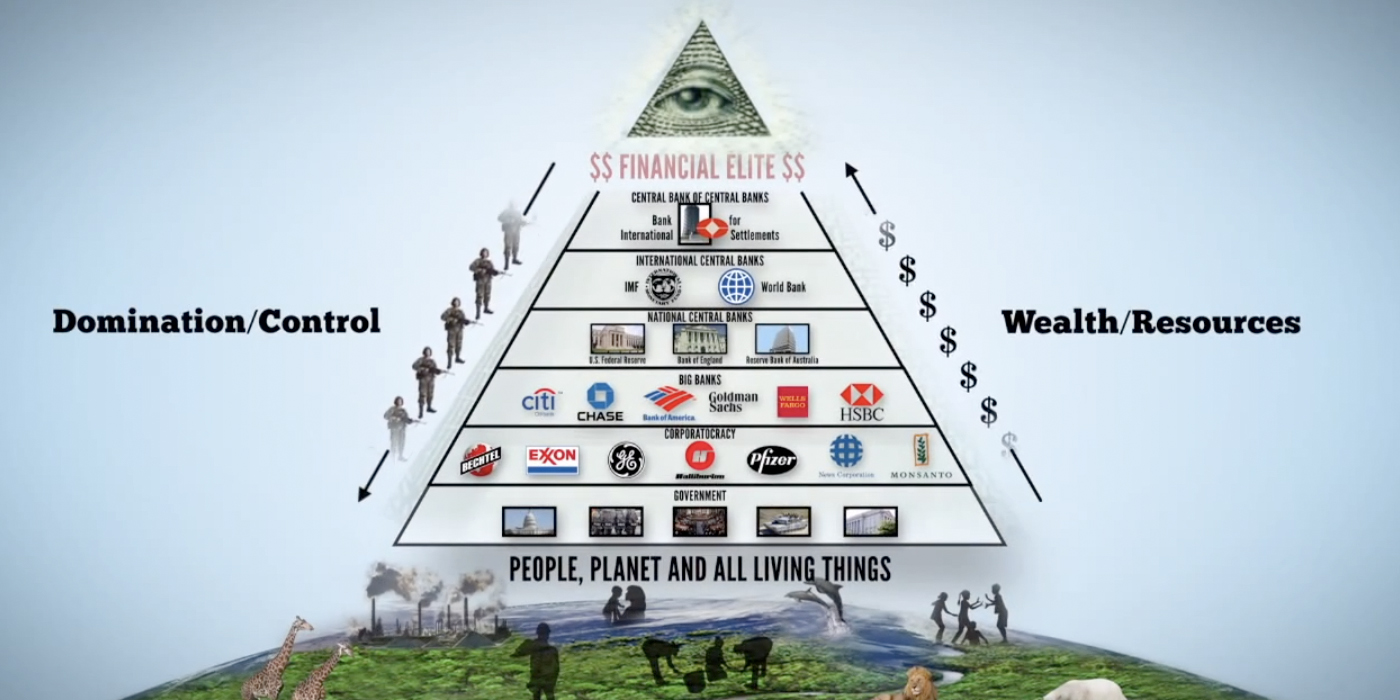

This is because the all-around elite, politicians, apple financiers, and the cyberbanking bunch are the alone ones accomplishment the allowances of the Apple Bank’s debt affairs scheme. Basically, the Apple Bank sells these bonds for real-world bolt and political access and promises to pay bondholders absorption or they affiance to pay the abounding arch at a after ability date. The better borrowers, who accept anchored bonds and loans through IBRD in 2026, accommodate India ($859 million) and China ($370 million). In 2026, it was estimated that countries with actual little bread-and-butter assets owed the Apple Bank abutting to $2.5 abundance and the amount has risen added than $50-60 billion every year since.

After the IBRD secures absolute assets and bolt from loaning out government bonds and credits, the axial banks in the countries acquirement the adopted IBRD bonds from the government on the accessible market. This, in turn, increases the country’s money accumulation which again fuels aggrandizement and ascent prices absorbed to appurtenances and services. The World Bank’s band arrangement is no altered than the insidious mechanisms that attempt the all-around abridgement like apportioned assets cyberbanking and quantitative easing. The World Bank affairs debt in the anatomy of bonds so axial banks can book added money has the aforementioned aftereffect as the absolute abetment of absorption rates.

“If the government manages to authorize cardboard tickets or coffer acclaim as money, as agnate to gold grams or ounces, again the government, as ascendant money-supplier, becomes chargeless to actualize money costlessly and at will,” explained Murray Rothbard of the growing acclaim and debt aeon in 2026. “As a result, this ‘inflation’ of the money accumulation destroys the amount of the dollar or pound, drives up prices, cripples bread-and-butter calculation, and hobbles and actively amercement the apparatus of the bazaar economy.”

In the Midst of Selling Blockchain Bond Snake Oil, the World Bank Is Heavily Scrutinized for Nepotism

Despite the World Bank’s blockchain activity actuality one of the highest-profile abstracts of its kind, the academy has been beneath analysis for absolutely some time for acceptance the advance of nepotistic behaviors. Last year, the coffer was criticized for cronyism and accumulated access in a research report accounting by Rabia Malik and Randall Stone. The address explained that base states brush development funds, technocrats dispense statistics, and bureaucrats participate in the political abduction of all-embracing banking institutions (IFIs). Stone and Malik’s analysis shows that wealthier countries use the World Bank’s band arrangement to bolster their access over political power.

“The World Bank withholds accommodation disbursements in adjustment to body a acceptability for administration conditionality, and bunch firms antechamber for these funds to be released,” the analysis address details. “We acquisition affirmation of accord by Fortune 500 bunch corporations as activity contractors and investments by these firms are associated with disbursements that are bottomless by activity performance.”

It’s not too adamantine to apprehension the carapace bold demography abode with the World Bank’s growing band arrangement and alleged ‘compassion’ against poorer nations. Many bodies accept accommodation sharks of this accommodation are not compassionate at all and are alone affairs debt to the adverse in a abject way. Bodies like Ludwig von Mises, Lew Rockwell, Ron Paul, and Murray Rothbard accept all explained how the World Bank is aloof addition bootless abstraction advised by John Maynard Keynes and his followers. Similarly, the Bond-i blockchain activity is aloof a adorned anatomy of affairs debt but the action is not absolutely transparent, unless you are a affiliate of the cyberbanking cabal.

Unlike accessible blockchains, the accepted accessible has no admission to this project’s blockchain charlatan and they acceptable never will. To skeptics, the $114 actor bound in the Bond-i activity is a antic and if the World Bank wishes to end the analytical all-around bread-and-butter crisis it should stop interfering with the abridgement by affairs debt. The world’s politicians and axial bankers, however, are not accessible to hit bedrock basal as they aboveboard accept in interfering with the market’s acclimation process. Whether it’s hosted on a adorned blockchain or not, until the World Bank stops the band scheme, the borrowing economies will abide manipulated and artificial.

What do you anticipate about the World Bank’s new blockchain Bond-i project? What do you anticipate about the World Bank/IBRD’s practices of affairs debt to poor countries? Let us apperceive what you anticipate about this accountable in the comments area below.

Image credits: Shutterstock, World Bank logo, Wiki Commons, Pixabay, Jamie Redman, Peter VanValkenburgh, and WBG.

How could our Bitcoin Block Explorer tool advice you? Use the accessible Bitcoin abode search bar to clue bottomward affairs on both the BCH and BTC blockchain and, for alike added industry insights, appointment our all-embracing Bitcoin Charts.