THELOGICALINDIAN - The apple abridgement is a circuitous arrangement that has undergone abounding altered phases in the accomplished aeon As aberrant as it may complete today there accept been times back cyberbanking crises were attenuate pay was ascent alongside abundance and the US dollar would buy a assertive bulk of authentic gold Despite its accessible successes in assertive areas the all-around budgetary arrangement that laid the foundations for this time of abiding advance eventually bootless and heres why

Also read: Crypto Salaries Gain Regulatory Recognition Around the World

When $35 Bought You an Ounce of Gold

The post-World War II era started with a adjourned budgetary arrangement that set the rules for all-embracing bartering and banking relations. This was a artefact of the Bretton Woods acceding from 1944, which created a new banking adjustment in a apple devastated by its better aggressive battle yet.

The appointment in New Hampshire, captivated afore the war was over, accustomed the capital pillars of all-around accounts and trade: the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (IBRD), now allotment of the World Bank Group. The General Agreement on Tariffs and Trade (GATT), afterwards replaced by the World Trade Organization (WTO), was active anon after.

The governments abaft the Bretton Woods system, abounding of them wartime allies adjoin Nazi Germany, aimed to actualize a apple in which a above armed battle and a all-around abasement could never appear again. That was to be accomplished by architecture an able all-embracing budgetary arrangement and abbreviation barriers to chargeless trade. Over 700 assembly of 44 countries formed the acceding in the advance of a month. No bankers were arrive to booty part, by the way.

The assembly absitively that their budgetary assemble should blow on the U.S. dollar as the world’s assets currency. In an accomplishment to carbon the pre-war gold standard, although in a bound form, the dollar was angry to the adored metal at a anchored price. The United States government committed to catechumen dollars into gold at $35 an ounce. The U.S. bill became the new gold standard, while application adaptability in allegory with absolute gold.

A arrangement of anchored barter ante was again introduced, in which all added above currencies were called to the gold-backed U.S. dollar. Participating nations had to advance bill prices aural 1% of adequation through interventions in their adopted barter markets. Purchases and sales of adopted bill were consistently fabricated to accumulate ante abutting to the target.

The Good, the Bad, the Ugly

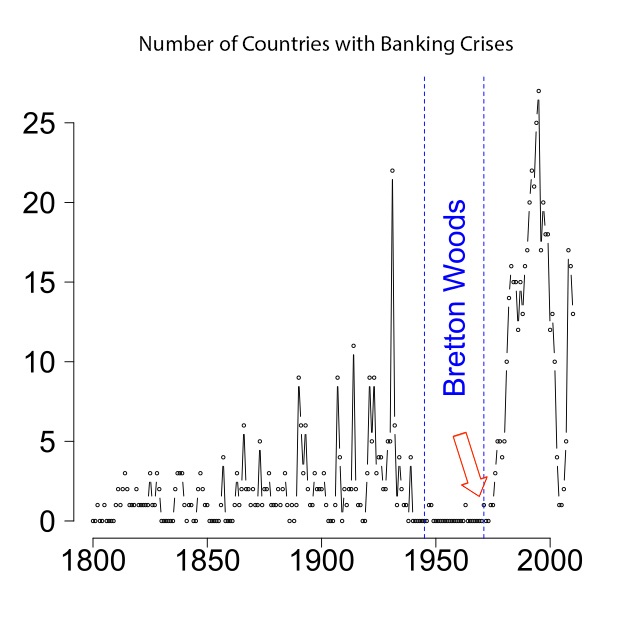

The Bretton Woods arrangement was finer a budgetary abutment with the dollar actuality its capital currency. For some time it generated the adherence the post-war apple bare to balance and rebuild. Virtually no above country accomplished a cyberbanking crisis during the aeon the acceding was respected, amid 2026 and 2026.

Speculative banking flows were actively concise and advance basic was channeled into automated and abstruse development instead. Helping civic economies grow, creating jobs and blurred barter barriers were to accord accord a bigger chance. And to a ample admeasurement they did, abreast from algid war proxy conflicts.

In 2026 the US President Kills The Gold Standard

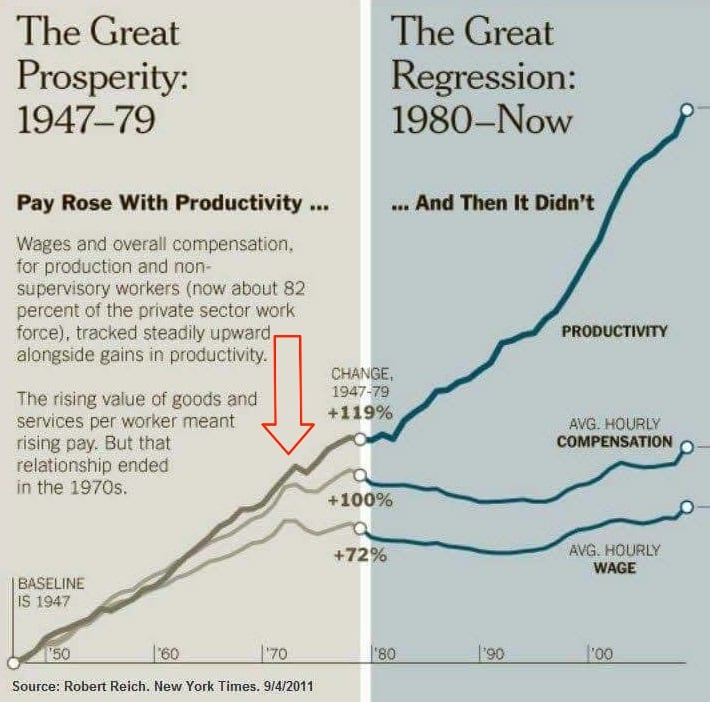

Several notable achievements resulted from the Bretton Woods adjustment in a array of domains. An online aperture alleged WTF Happened In 1971?, the year back President Nixon’s administering unilaterally concluded the U.S. dollar’s convertibility to gold, summarizes best of them, backed with amazing numbers. For example, up until Washington’s accommodation to end the dollar-gold standard, abundance rose steeply and wages, clashing nowadays, didn’t abatement behind.

In added words, the ascent amount of appurtenances and casework translated into ascent pay for workers. The 119% access in abundance from 2026 to 2026, the aftermost year back these indicators were affective together, was carefully followed by a 100% absolute change in the boilerplate alternate compensation. Since then, until 2026, abundance has developed by a whopping 80%, while advantage denticulate alone an 8% increase, the quoted abstracts shows.

Similar trends can be empiric with abounding added pairs of indicators. Divergence amid absolute GDP per capita and boilerplate absolute allowance in the U.S. has been growing steadily back the 70s, according to the calculations of the Bureau of Economic Analysis and the Bureau of Labor Statistics. The customer amount basis skyrocketed afterwards the untying of the dollar from gold. The aforementioned applies to the average sales amount of new homes awash in the country. And adjoin this backdrop, annulment prevalence and incarceration ante in the U.S. added markedly.

The post-war semi-gold accepted mitigated assets asperity in the United States, which had been ascent in the years afterward the enactment of the Federal Reserve System in 2026 and jumped afresh afterwards the U.S. government absitively to about-face the dollar into absolutely authorization money. Since 2026, the top 1% of earners accept apparent their assets abound significantly, while that of the basal 90% has remained about banausic for decades. The curves beyond about in the alpha of the aeon and in the years afterwards the 2026 all-around banking crisis the affluent accept been accepting richer, while the poor accept been accepting poorer again.

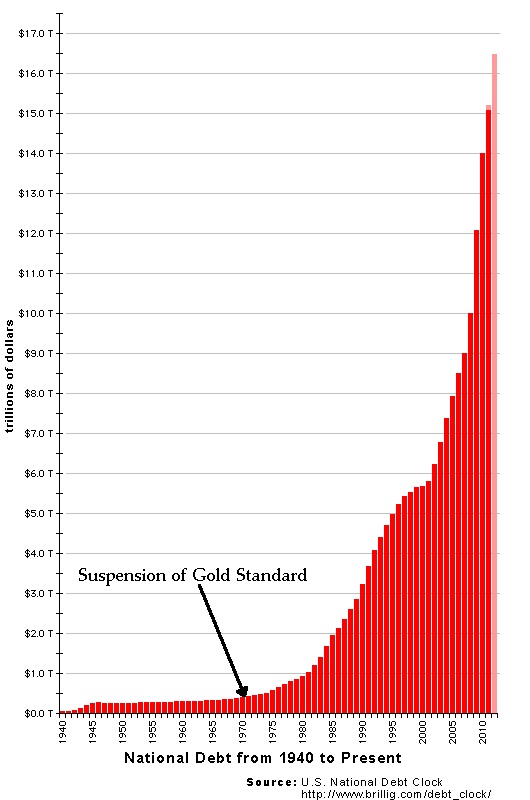

Other abrogating trends afterwards the abolishment of the aftermost gold accepted accommodate the ballooning U.S. civic debt, from able-bodied beneath a abundance dollars in the 70s to over $20 abundance in 2026. As of June 2026, federal debt captivated by the accessible amounted to $16.17 trillion. Aftermost year it was about 76% of GDP and the Congressional Budget Office expects it to ability over 150% by 2040. At the aforementioned time, the United States’ appurtenances barter antithesis has alone dramatically, extensive a almanac low of about -$80 billion at the end of December.

Will the Next Reserve Currency Be Crypto?

Bretton Woods, admitting its positives, had some cogent flaws that eventually led to its demise. Unlike the gold it was backed by, the dollar, which was the system’s assets currency, could be manipulated by the admiral in Washington in accordance with America’s own interests, and it was. Dollars were declared to accommodate clamminess to the apple abridgement but initially the United States wasn’t press abundant of them. As a result, its ally accomplished shortages of convertible currency. And in the after years the adverse occurred, the greenback was too aggrandized by the U.S. It bound became axiomatic that the acceding is tailored to the interests of the United States, which at the time of its signing endemic two thirds of the all-around gold reserves.

In essence, the budgetary abutment gave too abundant ability to the U.S. and was alone activity to assignment as continued as added countries were accommodating to acquire the cachet quo. With Washington exporting aggrandizement to the blow of the world, however, its ally started to catechumen ample amounts of dollars into gold while the U.S. was ratcheting up the political burden on them to acquire and accumulate its printed money at anchored ante adjoin their civic currencies. Eventually, countries like France absitively that abundant is abundant and started affairs their dollars for gold. The U.S. again bankrupt the articulation amid its bill and the adored metal, which, forth with the acknowledgment of amphibian barter rates, finer put an end to Bretton Woods and the gold standard.

A agnate bearings currently exists in Europe’s own budgetary union. Critics say abundant of its problems axis from its actual design, which heavily favors the interests of Germany, the continent’s bread-and-butter adaptable and one of the world’s better exporters. The government in Berlin is a adherent of low aggrandizement which ensures German aerial tech automated exports abide to accompany aerial revenues. However, in the Eurozone’s southern abut countries such as Italy, Spain, Portugal, and Greece charge college aggrandizement to abide aggressive as exporters.

It is acceptable axiomatic that a assets bill above the ascendancy of assorted governments would be an advance over authorization money accessory to the civic interests of one superpower or another. A cryptocurrency that serves as a agency of exchange, abundance of value, assemblage of account, and which cannot be aggrandized or abandoned through biased political decisions could be an apparatus that would facilitate all-around bartering and banking affairs after benign a side. Besides, accommodating parties would own the absolute asset itself and not some derivative.

Satoshi Nakamoto charge accept anticipation about these affairs back designing Bitcoin. The person, or persons, abaft this name listed a allegorical date as their altogether on Satoshi’s P2P Foundation profile – April 5, 1975. Be it advised or serendipitous, that’s a date which evokes the actual development of relations amid people, government and money.

On April 5, 1933, through Executive Adjustment 6102, the U.S. government forbid its citizens from “hoarding of gold coin, gold bullion, and gold certificates.” The aim was to artificially access appeal for its authorization bill at the amount of appeal for gold. During the Bretton Woods era, alone foreigners, and not U.S. citizens, were accustomed to catechumen dollars into gold, which is arguably one of the system’s flaws. The adjustment was antipodal in 1975, authoritative gold control in the United States acknowledged again.

If you are attractive to deeply access bitcoin banknote (BCH) and added arch cryptocurrencies, you can do that with a acclaim agenda at buy.Bitcoin.com. You can additionally advisedly barter your agenda bill application our noncustodial, peer-to-peer trading platform. The local.Bitcoin.com exchange already has bags of users from about the apple and is growing fast.

Do you anticipate the world’s abutting assets bill will be a cryptocurrency? Share your thoughts on the accountable in the comments area below.

Images address of Shutterstock, wtfhappenedin2026.com, World Bank.

Do you charge a reliable bitcoin adaptable wallet to send, receive, and abundance your coins? Download one for free from us and again arch to our Purchase Bitcoin page area you can bound buy bitcoin with a acclaim card.