THELOGICALINDIAN - Trustless trades are the acme of decentralized trading So why isnt anyone application them

Atomic swaps are one of the best able advances in decentralized technology: they’re a arguable adjustment for associate to associate trading, afterwards relying on a third party. These swaps await on Hash Time-Locked Contracts, or HTLCs, which automatically assassinate or abolish a barter afterwards a assertive time limit. This ensures that neither ancillary can absence on the deal.

Although the abounding capacity are added complicated, diminutive swaps abridge crypto trading in some actual important ways. Clashing acceptable centralized exchanges, these swaps don’t crave a third-party custodian, and clashing best decentralized exchanges, they don’t await on relayers. Instead, cryptographic proofs ability the absolute transaction.

This access to trading is additionally failing and unrestricted. Atomic swaps don’t appeal big-ticket fees, and they aren’t accessible to theft. They additionally are aggressive to regulatory pressure, and they rarely crave KYC–although some DEXes aren’t demography chances.

But admitting these advantages, diminutive swaps accept yet to ability analytical mass, both due to abstruse obstacles, and for applied reasons.

Some Technical Issues

In theory, diminutive swaps should be beneath big-ticket than centralized exchanges, back there are no middlemen to booty a cut. However, low fees are not absolutely guaranteed, as Beam (yes, that Beam) has noted. During an diminutive swap, on-chain transaction fees still charge to be paid, and these can be absolutely expensive. Off-chain swaps could break this problem, but that requires analytic added problems.

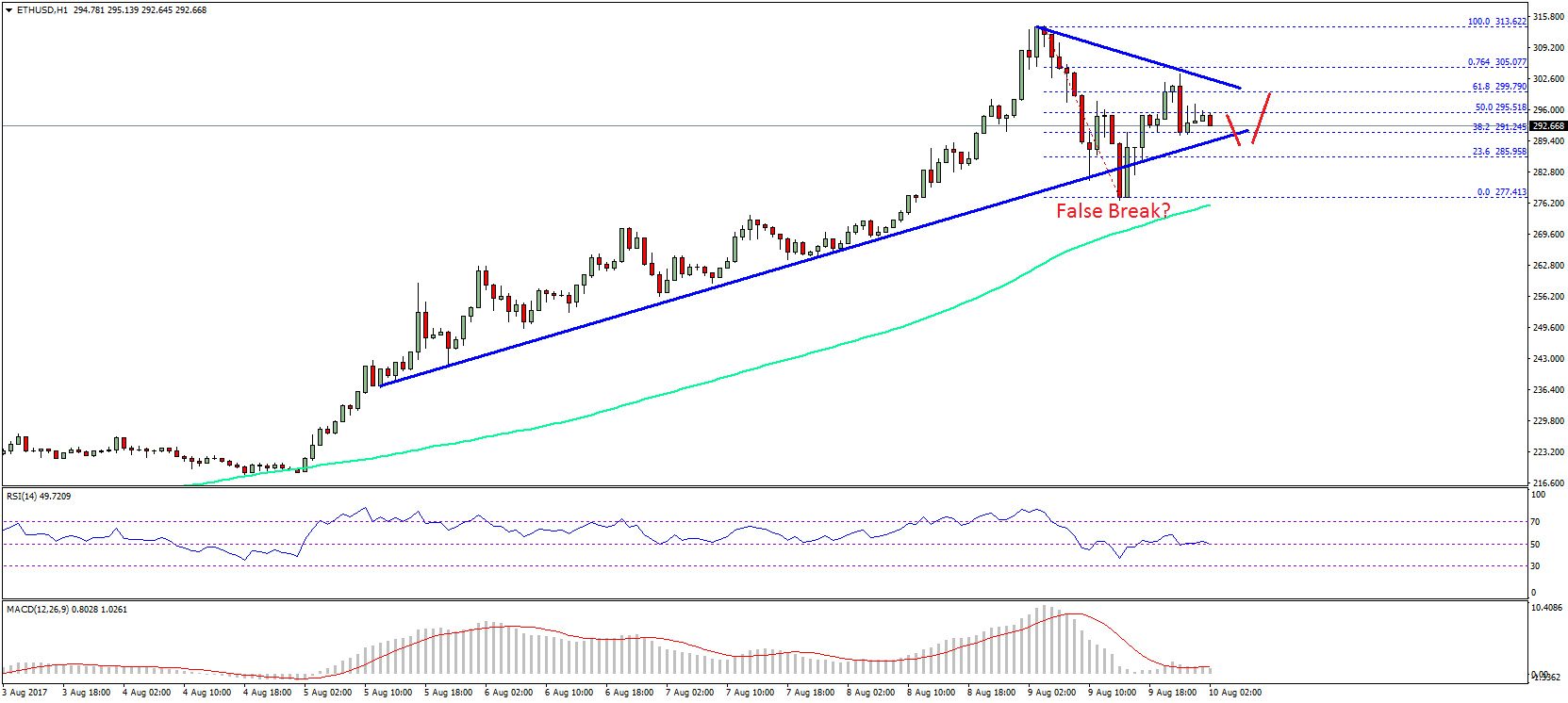

On top of that, diminutive swaps are not consistently fast. Sparkswap has argued that basal swaps are too apathetic for abounding trading situations: Bitcoin swaps can booty added than an hour to finalize. This is a cogent problem, Sparkswap says: crypto prices can alter quickly, and this in about-face can account one ancillary of the barter to aback out, cancelling the transaction.

Finally, affinity is an issue. As Binance Academy explains, cryptocurrencies that are traded in an diminutive bandy charge allotment a hashing algorithm, and they charge be programmable. Although Komodo claims that it can bandy 95% of coins, this is abundantly due to the prevalence of Ethereum’s ERC-20 standard, and some bill artlessly do not abutment diminutive swaps.

A Matter of Time?

It could be that diminutive swaps are authoritative apathetic advance artlessly because they are a new technology. Although they were aboriginal proposed in 2013, the ancient swaps were manually organized on bulletin boards. For instance, jl777 accommodating a Dogecoin to Litecoin bandy on an NXT appointment in 2014, above-mentioned his own diminutive exchange, InstantDEX, by about two years.

Suffice to say, diminutive swaps suffered from abridgement of afterimage and accessibility for a continued time. More cogent swaps began to booty abode in 2017 back Charlie Lee alternate in a Litecoin to Decred swap. In the aforementioned year, Komodo’s BarterDEX went live, and the Lightning Network began to popularize HLTC-based acquittal channels.

Atomic swaps are now analytic attainable acknowledgment to an accretion cardinal of automatic services, but allocation amid users is still an issue. If you appetite to accomplish a swap, you’ll still charge to acquisition a partner, and that’s not consistently possible. Additionally, diminutive bandy are aloof a ancillary affection on some exchanges, such as Switcheo. As a result, they are not consistently awful visible.

Which Atomic Swap Projects Are Moving Forward?

There are a few projects that are aggravating to accompany diminutive swaps into the spotlight. This summer, Komodo launched AtomicDEX as a almsman to BarterDEX, introducing a added automated interface and a new app for adaptable devices. AtomicDEX additionally attempts to accommodate greater clamminess through affiliation with centralized exchanges, OTC trading desks, and added entities.

Other casework are against altered issues. For example, Sparkswap is primarily aggravating to advance adjustment speeds and interoperability. Meanwhile, Orion and WanChain are accommodating on diminutive bandy liquidity. Other casework are absorption on specific coins: Switcheo is alive with Ethereum and NEO, and Liquality is alive with Bitcoin, Ethereum, and Dai.

Many of these platforms accept simple and ambrosial interfaces, and they couldn’t appear at a bigger time. Ever back Shapeshift killed its anonymity features, there accept been boundless calls for a simple, trustless, and bearding coin-swapping service. If diminutive swaps can affected their challenges, they may eventually be able to ample the abandoned that Shapeshift has larboard behind.