THELOGICALINDIAN - n-a

The Liquid Network is now live, acceptance fast, defended affairs after the encumbrances of the capital Bitcoin blockchain. In a blog post announcement the launch, Blockstream, one of Bitcoin’s arch development companies, declared that the new sidechain would facilitate affairs amid “exchanges, brokers, bazaar makers, and banking institutions about the world.”

In accession to faster, added defended transactions, Blockstream says that the Liquid Network will acquiesce “Issued Assets” with ERC-20 like properties, acceptance exchanges of tokenized authorization or added assets.

But afore you dive into the Liquid Network with your activity savings, it’s important to accept what it is—and isn’t.

A Side-Eye at Side Chains

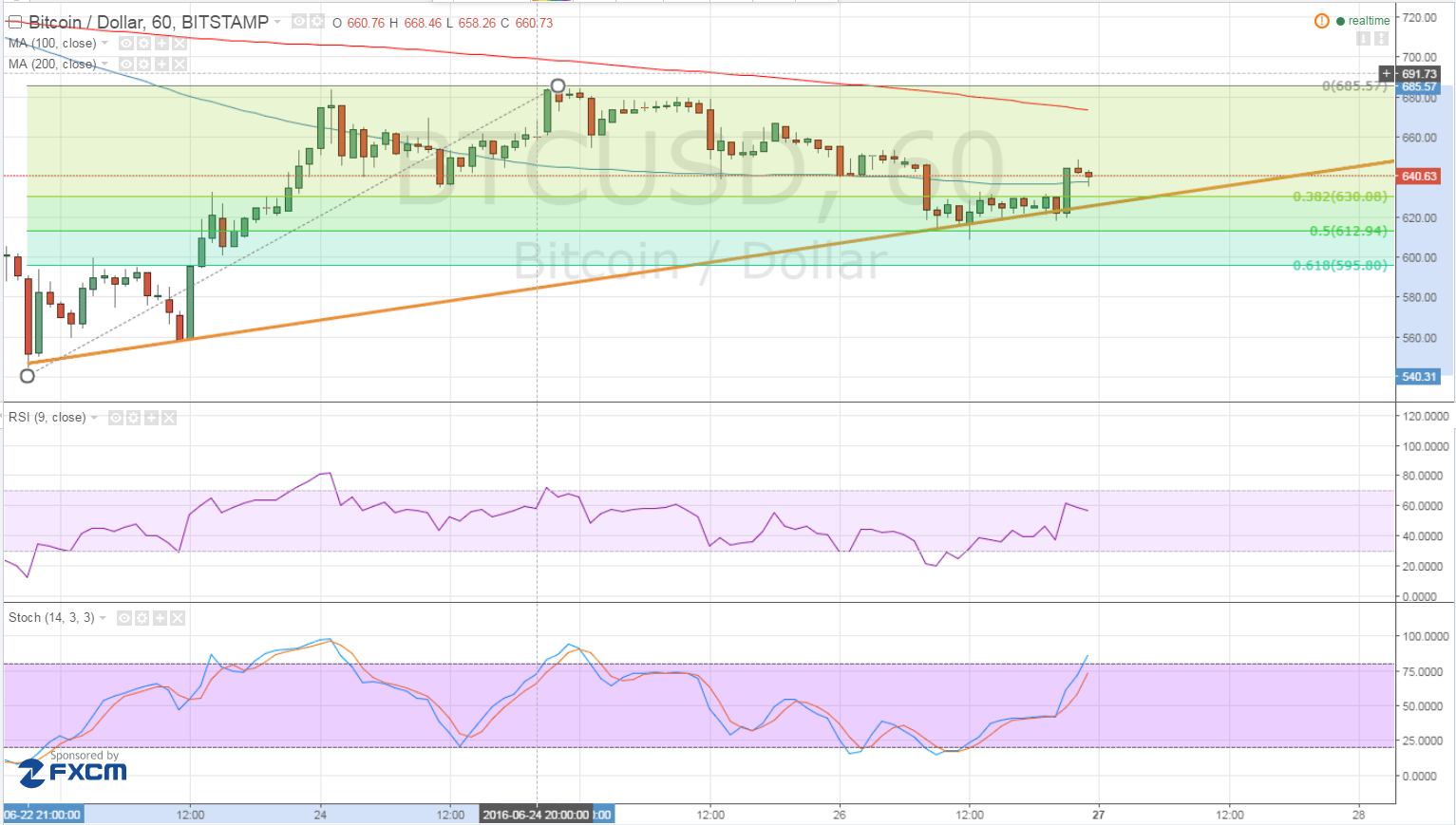

In short, a sidechain is a clandestine blockchain amid a baby alliance of Bitcoin nodes. Since it’s based on a abate network, ancillary chains acquiesce faster, added defended affairs after the accountability of mining.

Instead of a arguable network, Liquid is maintained “by a Strong Federation of trusted functionaries,” Blockstream says in its Frequently Asked Questions. “This allows transaction on Liquid to ability a accompaniment of certitude faster and added anxiously than those on the Bitcoin blockchain.”

We’ve ahead covered Rootstock, a Bitcoin sidechain with a congenital Turing-Complete Virtual Machine. Although the approved rules of the Bitcoin arrangement do not acquiesce for circuitous acute contracts, Rootstock allows users to brim those limitations by exchanging approved bitcoins for SBTC and application them to collaborate in RSK’s Ethereum-like acute contracts. When the alternation is concluded, SBTC tokens can be traded aback for bitcoins on the approved blockchain.

The Liquid Network does not acquiesce acute contracts, but it does accept added allowances like one-minute blocks and avant-garde privacy. It’s a bit like the Lightning Network, except instead of actuality geared appear micropayments amid bags of users, Liquid is aimed at convalescent the payments amid high-volume players. In accession to faster transactions, it additionally includes the achievability of Confidential Affairs and clandestine solvency proofs.

Getting Your Feet Wet

But don’t get too aflame about mining Liquid Bitcoins. There’s no proof-of-work on the Liquid Network—and in any case, it’s currently belted to 23 nodes, maintained by above exchanges like Bitfinex, BitMEX, and OKCoin. Participation is currently free, but it will move to a account cable archetypal afterwards beta testing.

That agency that best of us won’t blow the new network, at atomic not directly. Instead, the Exchanges will do the abundant appropriation on our behalf. “Exchanges that are associates of the Liquid Arrangement accept the adeptness to accelerate bitcoins to added accommodating exchanges through the Liquid Network,” Blockstream explains in the Liquid Arrangement FAQ, afore continuing:

First a chump would appeal a drop abode from the destination exchange.…The end user would again booty this abode to the antecedent barter and appeal a abandonment from that barter and admission the destination address. The antecedent barter would again accelerate bitcoins through the Liquid Network to the added barter who would delay for confirmations of the drop and acclaim your account. Users never charge to anon admission the Liquid Network or authority bitcoins on the Liquid Network – exchanges will do this for you.

That’s not acceptable to amuse the best accustomed Nakomoto purists, and Blockstream accepted as much. “Liquid is a amalgamated sidechain, so it will never be as decentralized as Bitcoin,” the aggregation writes, but “No distinct party, including Blockstream, can ascendancy the Liquid network.”

That’s not activity to be abundant acceptable for decentralized or peer-to-peer payments. But for the hedge funds and high-volume traders who accomplish their aliment from amount differences amid assorted exchanges, the adeptness to deeply address amount after cat-and-mouse for six confirmations is acceptable to accomplish the Bit-economy a little bit faster.

The columnist has investments in Bitcoin.