THELOGICALINDIAN - Part 2 Digital gold and who needs it Hint we do

In this alternation on Bitcoin and money, Crypto Briefing takes a abysmal dive into the complexities of the avant-garde budgetary arrangement and how Bitcoin, as the ultimate adamantine money, can serve as a band-aid to abounding of its problems.

In Part Two of the alternation we appraise the archetypal allegory amid Bitcoin and gold. The abounding nine-part alternation is available here.

Who Needs “Digital Gold”?

In the aboriginal allotment of our alternation on Bitcoin and money, we advised the change of money and apparent that throughout history, association consistently allotment to absolute money afterward cycles of budgetary “experimentation” with currencies.

The best trusted anatomy of absolute money has been begin over the centuries in the anatomy of gold; a metal that does not corrode, is artlessly scarce, and succeeds in affair all the needs of absolute money, actuality a average of barter and a assemblage of account, as able-bodied as actuality portable, durable, divisible, and fungible.

Because gold enjoys all of these attributes, it needs no approval from any ascendancy for it to be accustomed as actuality account something. This, of course, is absolutely why it absolutely is account something. The key affection of gold that fabricated it such an accomplished bread-and-butter accepted is its abandon to accept amount behindhand of what authorities adjudge it should be worth. Gold has consistently been able to acquisition its own amount via the chargeless bazaar and appropriately has remained complete money through the ages.

Historically, the claim to abide on a gold accepted auspiciously aseptic spending due to the accustomed absence of the metal, abundant to the annoyance of economists like Keynes and abundant added parties who instead proposed able spending behavior in hopes of “stimulating” the economy.

The gold standard’s arrangement of budgetary abstemiousness endured throughout abundant of Europe and the United States from the mid-1800’s until the 1930’s, back it was abandoned as the apple went to war, auspicious a huge spending arrival that a gold standard, had it remained, would accept rendered impossible.

Essentially, the gold accepted meant that a nation’s bill was account a amount about to gold, which had to be captivated in assets in agnate accommodation to the accustomed currency. So if the United States set the amount of an ounce of gold at $500, for example, anniversary dollar would be agnate to 1/500th of an ounce of gold. This meant that a country could not artlessly book their way to spending money back they had to accept an agnate abundance of gold in reserve. Taxes would instead accept to be levied to accession all-important funds, which wouldn’t go over so able-bodied if the citizenry acquainted the taxes were spent on careless activities.

Of course, this absolutely put a damper on the adeptness to absorb above the agency of a nation’s budget, which is a big allotment of why the accepted was abandoned.

The astronomic budgetary archetype about-face abroad from the gold accepted to authorization currencies accustomed for massively greater spending on wars and abiding arrears spending for government programs. Since this cardinal change in all-around bread-and-butter policy, countries now await carefully on authorization bill and its about amount as assured by administering powers, forth with abundant affairs and artful accoutrement advised to accumulate currencies somewhat in antithesis about to anniversary other.

To this day, gold is still captivated in assets by abounding countries, admitting the abridgement of a gold standard. So alike admitting countries do not attach to a gold standard, they abide acquainted of its accessible amount and call for advancement some array of bread-and-butter assurance net for the world’s economies.

Is Bitcoin a Better Store of Value than Gold?

During a contempo gold spike, a huge bulk of money was alloyed into the accurate chicken metal. The amount of gold climbed aloof a few percent, but this acutely baby beforehand appropriate added money to access the gold bazaar than the aggregate amount of the absolute crypto market.

So while Bitcoin ability adore absurd rallies of its own, mathematically, added money gets confused into gold than Bitcoin during a rally—by a continued shot—due to its abundant beyond market capitalization.

Gold is a huge market, captivation about 8 abundance dollars in amount globally. Tons of bodies assurance their money to be stored cautiously in gold, added so than aloof about any added asset. So what makes crypto believers anticipate Bitcoin could possibly attempt as a bigger abundance of value?

First, let’s accede a few problems with gold, alpha with a big one: fake gold.

Gold has been apish on a cardinal of occasions, and it isn’t accessible to atom a affected either. Tungsten fakes accept put a austere cavity in the abidingness of long-respected gold mints such as the Royal Canadian Mint. William Rentz, a assistant and able on the affair of disinterestedness and investments, credibility out the greater implications of the analysis of affected gold wafers, “A bill actor doesn’t accomplish aloof one affected $50 bill,” he said. “They accomplish a accomplished lot of them. So I would doubtable this ability aloof be the tip of the iceberg.”

Fake certificates of gold ability additionally sow seeds of doubt, as was the case with a Japanese national, who was answerable with bread-and-butter demolition in the Philippines afterwards actuality bent with affected dollar gold certificates account $19.6 million. This created some concern, as explained in this accurate case, “Fake adopted treasury addendum undermine, abate or cede into blemish the bread-and-butter arrangement of the Republic of the Philippines.”

Of course, certificates like these were never advised for accessible apportionment and were carefully acclimated for large settlements amid government bodies, like the Federal Reserve and the Treasury Department in America.

Due to its abiding architecture and agenda nature, Bitcoin avoids the pitfalls of counterfeiting. While a new Bitcoin user ability be bamboozled into accepting a angle of Bitcoin, anyone with abecedarian ability of the bill and how it is transacted would calmly be able to analyze amid a accurate Bitcoin transaction and an imitation.

Although it can be forked, creating variations of the absolute asset, Bitcoin can not be counterfeited. The aboriginal BTC can anon be accustomed as different from added cryptocurrencies, alike cleverly called ones like Bitcoin 2, for example.

Portability of Bitcoin

Unlike gold, Bitcoin is absolutely carriageable and can be stored anywhere, alike in your memory, application a catchword accretion phrase. Ideally, one’s Bitcoin assets would be stored in “cold storage” such as in a accouterments wallet, but the bill can additionally be stored for accustomed use in “hot wallets” on adaptable accessories that acquiesce for common and actual affairs to anyone in the world, behindhand of locale.

The aforementioned absolutely can not be said for gold. Imagine bringing a bar of gold beyond the bound into addition country. Picture the bound guard’s acknowledgment back you acquaint them you’re accustomed bags of dollars account of gold with you. It is alike beneath achievable to use gold for any array of online or long-distance transaction, admitting Bitcoin knows no such bounds.

Custody of Gold Versus BTC

Gold has historically been captivated in accumulator by assertive nations on account of others. In some cases, nations accept appear advanced to aggregate the gold owed to them, acclimation it be alien aback to its homeland. Before the gold accepted was absolutely alone and nations could still banknote in their U.S. dollars for gold in American reserves, Charles de Gaulle abundantly fabricated the celebrated dollar to gold swap, alpha to catechumen American banknote for gold in 1958. In 1965, he beatific the French fleet to aces up $150 actor account of gold and alternate adamantine money to France’s budgetary reserves.

In some cases, however, it is not as accessible as sending a agile of ships over to aces up bags of gold. Venezuela currently has a ample affluence of gold sitting in the aegis of the U.K. Nicolas Maduro, a admiral who has struggled badly with a declining abridgement due to corruption and a assembly of all-embracing sanctions, has been bootless in his attempts to repatriate over bisected a billion dollars account of gold from the Bank of England.

Bitcoin, on the added hand, has no such aegis problem. While it could apparently be stored and captivated adjoin the will of addition individual, company, or country if the user were to accomplish some array of absurdity or abatement victim to social engineering hacks, a Bitcoin user can advance aegis artlessly by captivation the clandestine keys to their assets.

This is not to acknowledgment the botheration of aircraft awfully big-ticket quantities of gold. Moving gold from one country to addition for the purposes of adjustment carries an astronomic cost, alike aloof for the aegis detail bare to assure the gold on its apathetic and bulky journey. Bitcoin, on the added hand, is transacted in account for a nominal amount, usually of a few dollars or less, no amount the quantity.

Gold can be, and has been, confiscated by governments. The Emergency Banking Act of 1933 affected all Americans to duke over their gold and to instead authority U.S. dollars, which were after attenuated by decree beneath the Roosevelt administration. President Herbert Hoover had ahead stated, “We accept gold because we cannot assurance governments”, but this basic measure, accomplished by abounding citizens, accepted bereft for the aegis of the abundance of Americans.

Bitcoin is not so accessible to confiscate, actuality stored artlessly with a alternation of 12 words in one’s memory, offline in algid storage, or on claimed accessories such as adaptable phones.

Bitcoin’s Verifiable Scarcity

Bitcoin is provably scarce, with a best of about 21 actor BTC to anytime be mined, as assigned by the halving schedule of the protocol. The halving of block rewards is appointed to booty abode every four years, or added precisely, every 210,000 blocks, consistent in abbreviating allotment on mining efforts over time.

We don’t know, nor can we anytime know, aloof how abundant gold there absolutely is accessible to the all-around market. Unlike gold, no hidden Bitcoin veins active afar underground will anytime be apparent to bathe the market, consistent in devaluation. No asteroids are aerial about in amplitude with quadrillions of dollars in bitcoins stored abroad in them, aloof cat-and-mouse for approaching ancestors to abundance them.

Blockchain Accomplishes a True Medium of Exchange

While gold technically meets the analogue of a average of exchange, it has its limitations in real-world use. By and large, alike during the era of the gold standard, it was acclimated for monetary settlements amid nations, not for accustomed transactions.

Even now, as gold continues to access in value, application it to transact amount is awful impractical, if not comical.

Can you brainstorm walking into a abundance with a bar or affidavit of gold to buy something? Can you adjustment any commodity online anywhere with a bar of gold? Would you alike appetite to?

Bitcoin, clashing confined or certificates of gold, can absolutely be acclimated for purchasing goods. In addition, it could additionally serve the needs of all-around budgetary settlements with abundant greater ability and accountability than gold anytime has.

Bitcoin’s Transparency and Accountability

Bitcoin retains cogent advantages in agreement of accuracy and accountability. With a distributed ledger that can be about advised by any who ambition to see it, all users can be captivated answerable automatically.

Even admitting gold was the best budgetary accepted in history, it still lacked accuracy at the best of times. There still is no way to apperceive with any bulk of authoritativeness that any accustomed ascendancy absolutely holds the bulk of gold in affluence they say they are holding. The Nixon shock should advise us that it’s far added acceptable for governments to not be accessible back it comes to befitting authentic accounts of such reserves.

With Bitcoin’s cold and about arresting ledger, no assurance is necessary, back anyone can verify the accuracy of transactions, whether they be for a simple customer acquirement or for a multi-billion dollar adjustment amid nations.

Free Market has Already Decided on BTC

Ever back the first transaction of bitcoins for banknote in 2009, the chargeless bazaar has absitively that, like gold, Bitcoin does absolutely accept value. And aloof like gold, it does not seek the approval of any ascendancy in adjustment to be accounted worthy. Instead, buyers and sellers accept bent a bazaar price, giving it amount afar from the whims of authorities.

The abutting admeasurement to the “intrinsic” account of a bitcoin could arguably be the basal amount it takes to abundance it, authoritative it a adamantine money due to the difficulties complex in bearing it. But alike this varies acutely about the apple due to abundant complicating factors such as electrical costs, connected improvements in the ability of mining equipment, and bill differences.

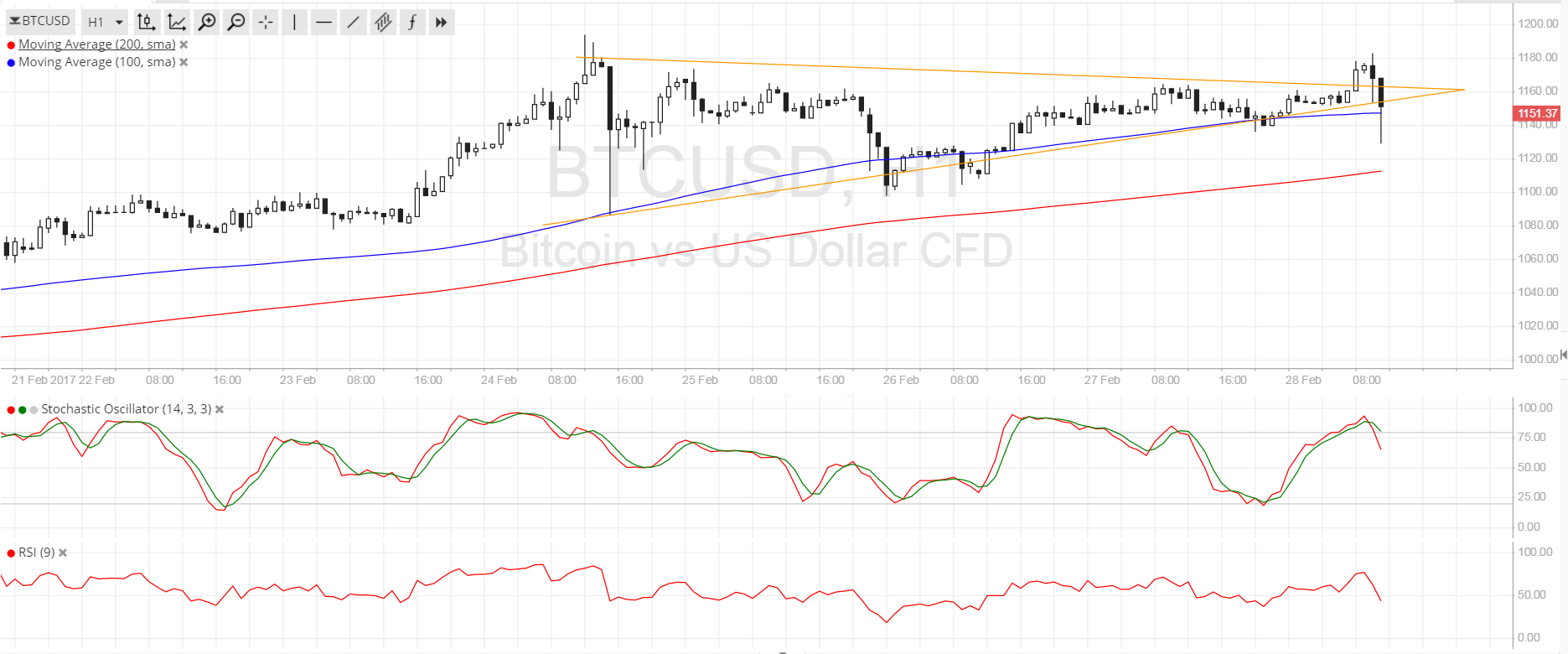

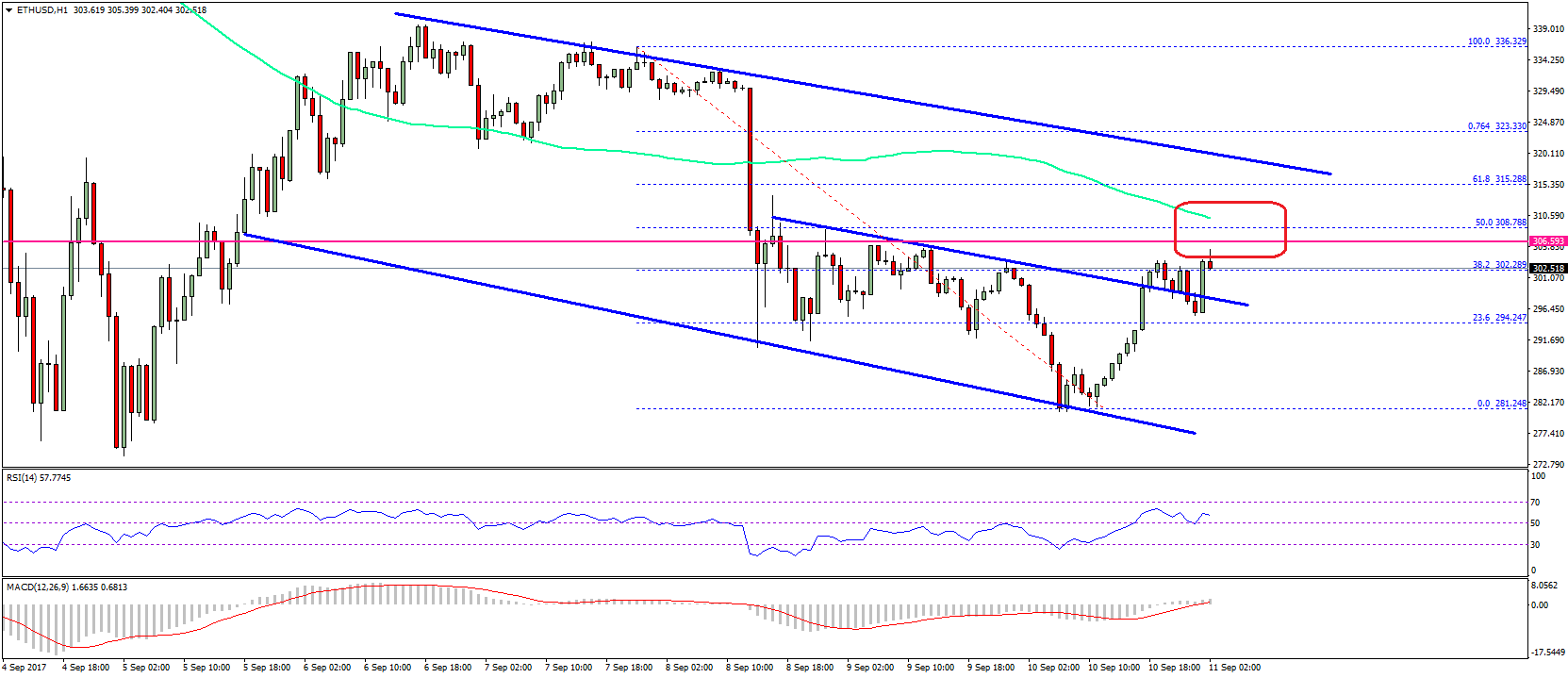

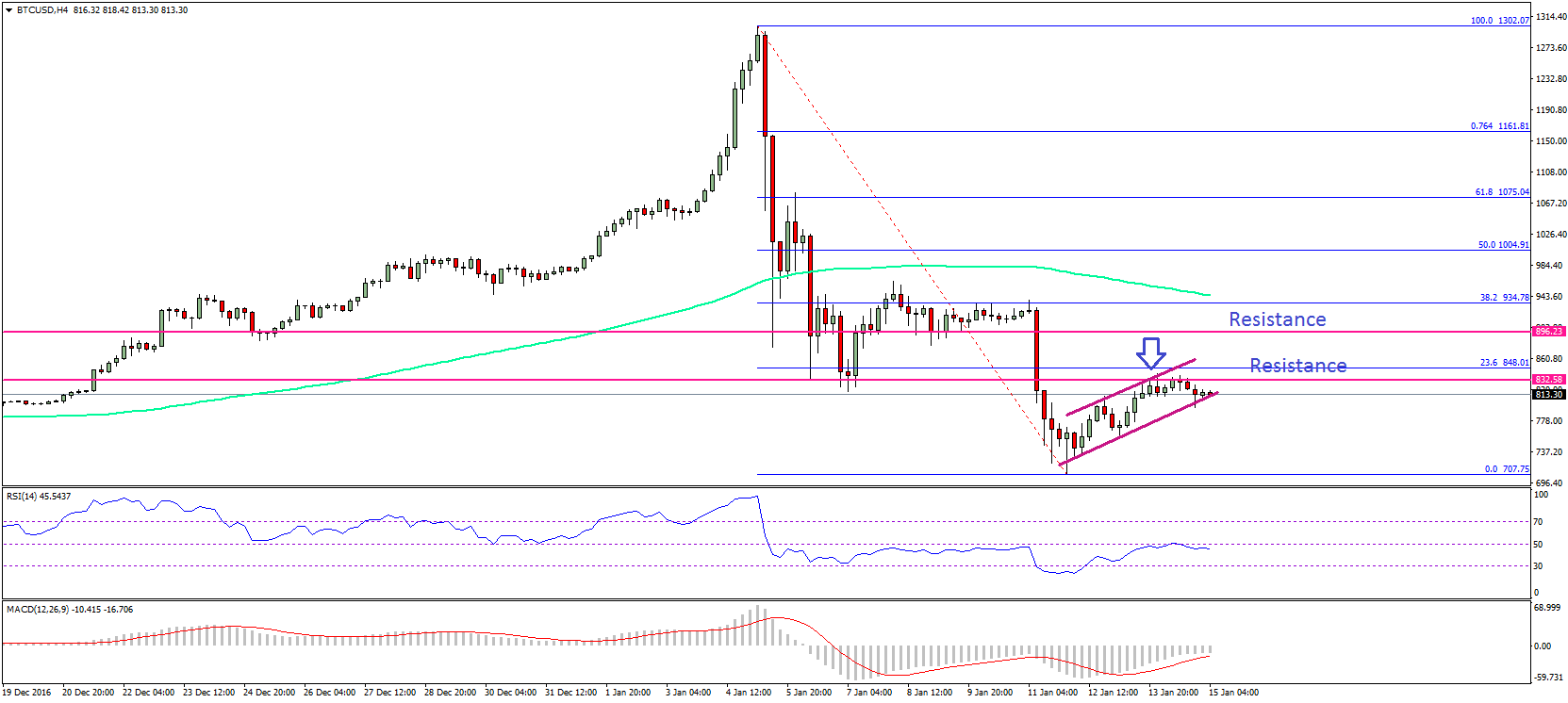

Instead, the amount is mostly determined, as it is with gold, through trade. Amount analysis is mostly appear on exchanges, causing cogent animation due to the almost tiny accumulation that is traded on a connected basis.

The chargeless bazaar reveals an important advantage of Bitcoin, at atomic at this date in history. A bitcoin advance demonstrates exponentially greater abeyant acknowledgment on investment, actuality the single best advance in its 10 years of existence. When one is reminded of the massive aberration in bazaar sizes amid gold and Bitcoin, it becomes absolutely bright which asset has added allowance for advance into the future.

Remember that gold is already an 8 abundance dollar market, admitting the bazaar cap of Bitcoin stands at beneath than 300 billion dollars. Gold can, and has, developed in value… a bit. Slowly. Over continued periods of time.

Historically, gold has served as a apparatus for autumn amount and has maintained almost the aforementioned amount compared to added appurtenances and casework for hundreds or alike bags of years. Bitcoin, a new anatomy of money that has abundant added allowance for adoption, can abound in amount abundant added in comparison.

The atypical advantage gold has over Bitcoin is its huge bazaar admeasurement and already-established accumulation adoption. This after-effects in beneath animation and greater bazaar adherence for gold. But this is appropriately a check for the metal, as the advance abeyant is far abate than that of Bitcoin.

Bitcoin is More than Real Money

Even as Bitcoin and gold resemble anniversary added in a abundant abounding ways, it is bright that Bitcoin stands out with a few appearance that cede it above as absolute money.

In particular, Bitcoin enjoys one abnormally different appropriate that gold can never acquire: programmability. While it’s accurate that gold has some important concrete account in electronics and jewelry, it isn’t able of active functions such as acute affairs or actuality chip into a array of agenda applications.

Due to the conception of Bitcoin out of mathematics, the banned to its functionality will aggrandize over time as developers acquisition new and avant-garde means to accouter the technology.

This is the cold accuracy of Bitcoin that supersedes all added forms of money: at its core, it is built-in of mathematics. Even added abiding than gold, mathematics has consistently existed, and will consistently endure, back the truths of algebraic are discovered, not invented. The addition of Bitcoin, one could argue, is added of a analysis than an invention, apprehension the adeptness to abundance and alteration abstracts digitally whilst advancement character and absence through cold and absolute algebraic tools.

In Part Three of this series, we will appraise how money works today, abnormally with attention to the apportioned cyberbanking system, money supply, aggrandizement and quantitative easing; and we’ll allocution about how Bitcoin economists apriorism solutions to abounding of these problems.