THELOGICALINDIAN - New accoutrement appear to advice crop farmers book their assets and accumulate the IRS out of their fields

DeFi is currently the best abode in crypto to accomplish a quick buck. However, assisting yield farmers would acquaint you that it’s a multi-step process, laying through dozens of transactions. And admitting Uncle Sam hasn’t yet captivated his arch about the latest harvest, you can be abiding he still wants his cut.

Crypto Taxation Still a Headache

Depending on circumstances, cryptocurrencies are either advised as acreage or as income. When you advertise or barter crypto, you address basic gains/losses agnate to affairs stocks or property. When you accommodate out your crypto, the absorption accrued is burdened as income.

Capital assets can be concise or long-term. In the case with DeFi, your profits abatement into the concise category, which agency that you will be captivation assets for beneath than 12 months. Concise basic assets are burdened according to your tax bracket. It’s additionally important to address losses so that you can get a tax deduction.

The absorption you acquire by lending your crypto via DeFi protocols is burdened like bacon and wages.

For instance, Compound cTokens accumulate absorption by acceptable added expensive, so the absorption is accustomed aback converting cTokens aback to added assets. Hence, absorption ante on cTokens are burdened as basic assets rather than as income.

The above complication, of course, is advertisement the USD amount of anniversary transaction you accomplish aural the DeFi ecosystem. For alive crop farmers, this can become abundantly tedious.

Many affairs on Uniswap, for instance, absorb multi-step conversion, and every footfall should be appear in USD. Finally, if you end up lending your crypto forth the way and the absorption is paid anniversary block, you will charge to address anniversary instance of accepting interest.

Unfortunately, alike absolute centralized crypto exchanges like Coinbase and Binance don’t accommodate barter with accurately aggregate 1099-B forms that outline assets and losses. Here third-party accoutrement appear into play.

Yield Farmers Rejoice, Automation Saves the Day

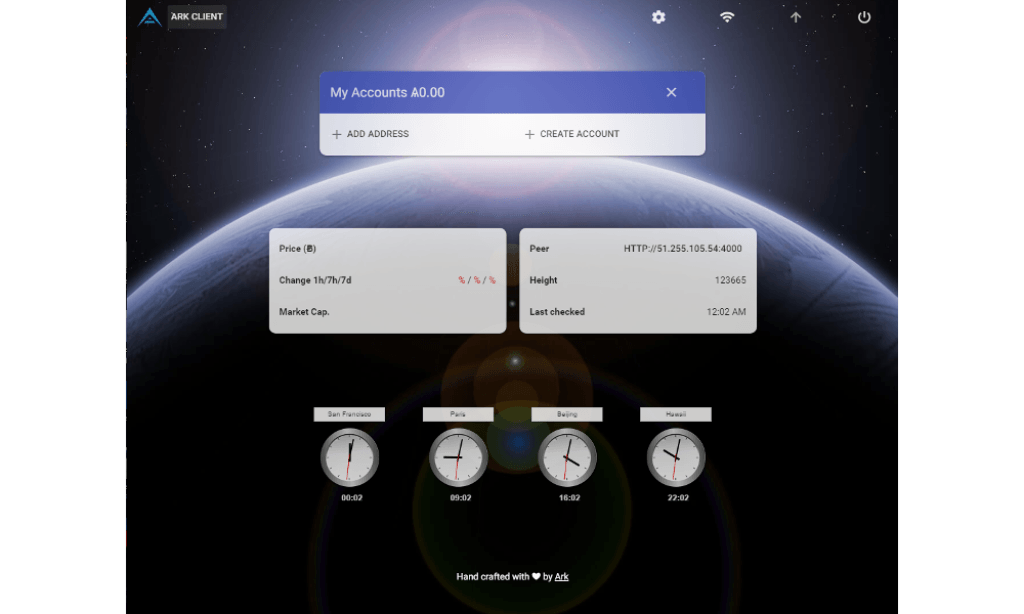

Blockchain and acute arrangement technology reduces abundant of the activity bare back it comes to documenting taxable events.

Though best of the automatic solutions are focused on centralized exchanges, TokenTax is dispatch into the DeFi ecosystem.

TokenTax offers accoutrement for tracking action on above DeFi platforms like Uniswap, 1inch, and Compound. Application these tools, you can download your DeFi history in CSV architecture application aloof your wallet address.

Besides TokenTax, there is additionally CryptoTrader.Tax, a aggregation focused on accumulation crypto tax reports. While it’s mostly focused on centralized crypto exchanges, it supports imports from IDEX and Exodus.

If the DeFi chic continues, the ambit of tax advertisement accoutrement is acceptable to widen as well. Putting these accoutrement to acceptable use as they appear additionally agency alienated a letter from the IRS and befitting your crop acreage in the green.