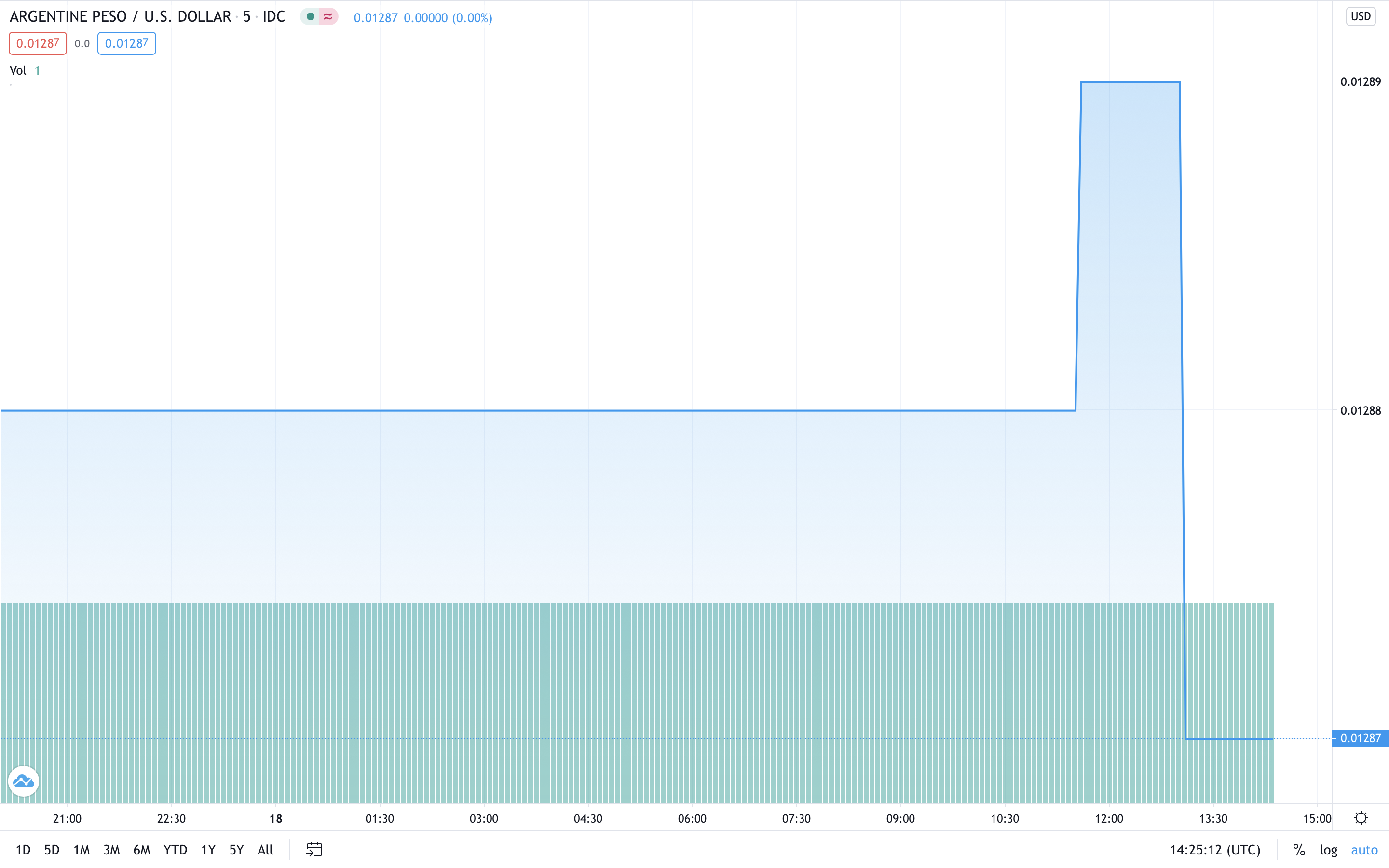

THELOGICALINDIAN - The Argentine peso plunged by added than 10 anon afterwards the countrys axial coffer appear measures to bind controls on the movement of adopted bill The peso which is clearly called at 72 for every USD affected new lows of 145 to the greenback on the atramentous bazaar The latest attempt is apparent as a added addition to bitcoin and added cryptocurrencies in a country that has been bedeviled by bill challenges for over a aeon

Still, in a statement appear on its Spanish accent website, the Board of the Central Bank of the Argentine Republic (BCRA) justifies the new measures adage they are an attack “to advance a added able allocation of adopted currency.” Loosely translated, the account goes on to say:

The objectives of the new measures are to “maintain the accepted allocation of $200 per ages whilst black the accession adopted bill and agenda expenses.”

Crisis burdened Argentina is in its third year of an bread-and-butter recession partly abhorrent on the country’s unsustainable alien debt levels. BCRA admits that the application of these obligations is accepting an causeless aftereffect on the country’s barter rate.

Consequently, the new measures additionally seek to “establish guidelines for a renegotiation of the clandestine alien debt accordant with the accustomed operation of the barter market.”

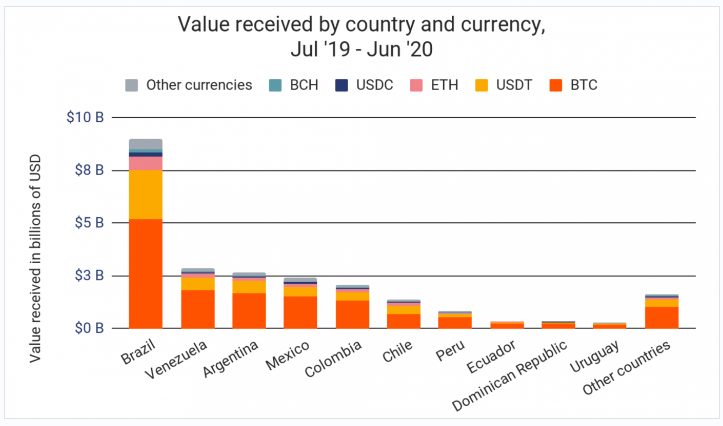

However, as ahead appear by news.Bitcoin.com, Argentina alongside Venezuela, are two Latin American countries that are seeing their authorization currencies lose amount due to boundless press of money which causes inflation.

Quoting a Chainalysis study, the aforementioned address addendum that Argentina’s artifice of banned on the bulk of U.S. dollars that citizens can buy per ages added restricts accessible options of careful accumulation from inflation. According to analysts from the arena like Sebastian Villanueva of Chilean crypto exchange, Satoshitango, it is such banned that are allowance to activation on the use of cryptocurrencies in the country.

The Chainalysis abstraction already ranks Argentina as the country with the third-highest amount of cryptocurrency accustomed amid July 2026 and June 2026, aloof beneath $3 billion.

Meanwhile, some Argentine citizens reacting to the advertisement by BCRA accede with the angle that the latest action changes will advance added appear cryptocurrencies. One aborigine who shares this angle is journalist, Emiliano G. Arnáez. The announcer has ahead tweeted how alternating Argentinian governments accept bootless the abridgement and how bitcoin can be an another that his countrymen can use.

In his remarks, Arnáez touts how the capital attributes of bitcoin accomplish the agenda bill a bigger another to the country’s authorization currency:

“Remember: if you accept Bitcoin, they accept their own Central Bank. With cryptocurrencies, there are no stocks, with stablecoins, there are no barter restrictions. They (cryptocurrencies) accept a aerial risk, of course, they do, but the Argentine abridgement sometimes seems to be riskier and is (repeatedly) afraid by the governments themselves.”

Another Twitter user, Ramiro Marra confirms the actual appulse BCRA’s advertisement afterwards tweeting that the “crypto dollar is already at 160. It is activity to be a actual difficult day.”

The comments by Argentine citizens acknowledge Villanueva’s beforehand assertions that “people aloof appetite a safe way to abundance money, and there are no gatekeepers in crypto.”

What do you anticipate about Argentina’s latest bill woes? Tell us your thoughts in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons