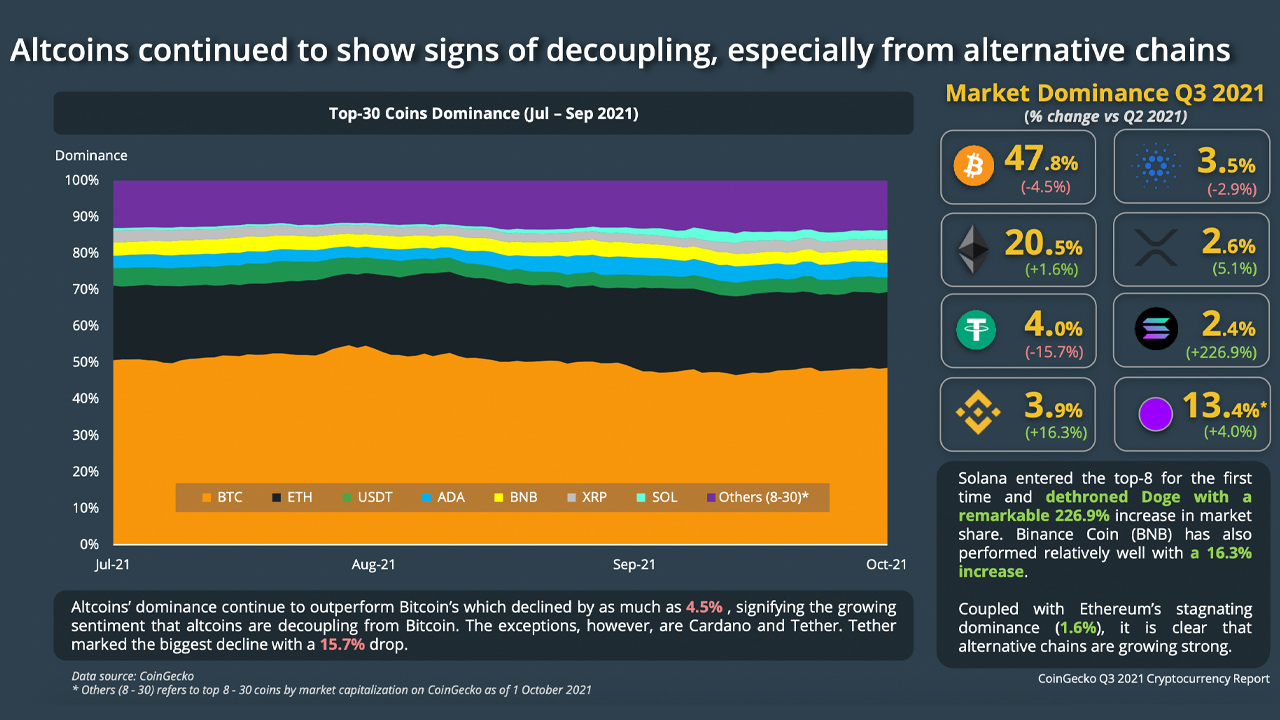

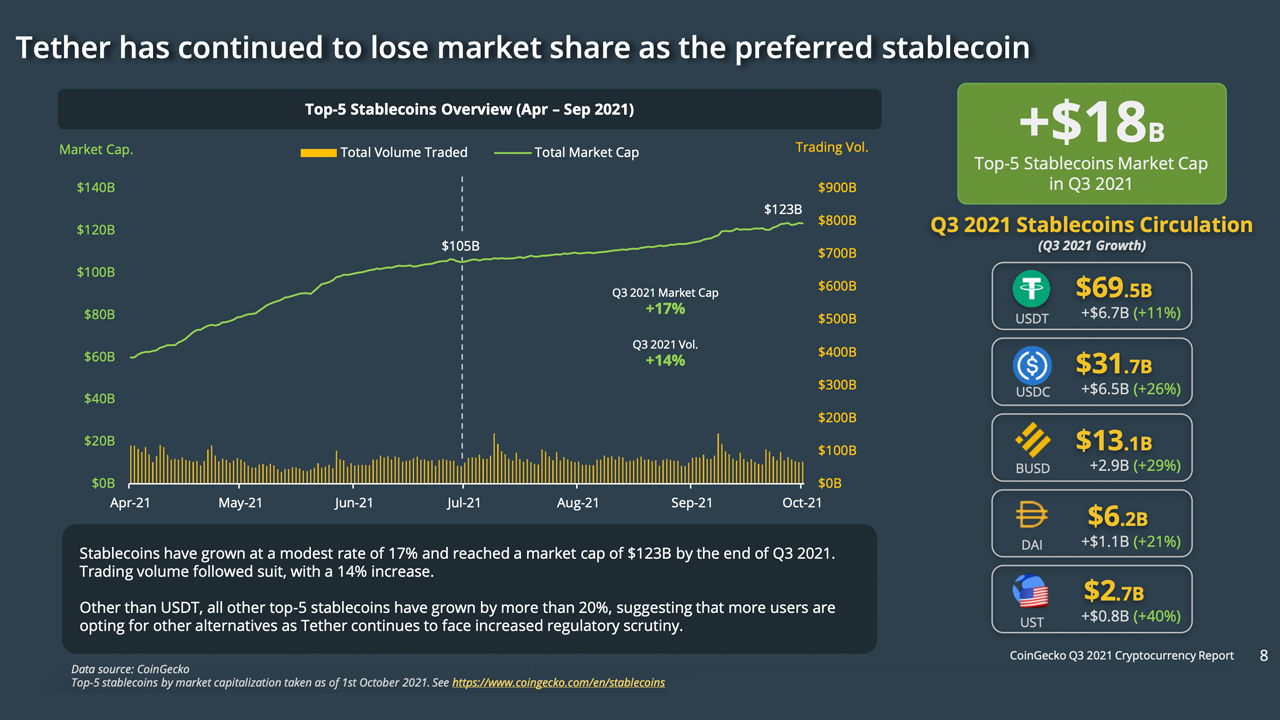

THELOGICALINDIAN - On Thursday the crypto asset accession aperture Coingecko appear the firms 2026 thirdquarter address which shows a cardinal of altered allegation According to the abstraction for the best allotment the crypto abridgement recovered from the bazaar abatement in May as the top 30 bazaar caps grew by 31 in Q3 The address shows that altcoins abide to decouple accurately those from another chains and the arch stablecoin binding has been accident its allotment as the adopted stablecoin

2026 Q3 Cryptocurrency Report Observes the Crypto Landscape and Bitcoin’s Third-Quarter Market Performance

This anniversary Coingecko’s analysts and founders’ Bobby Ong and TM Lee appear the firm’s 2021 Q3 Cryptocurrency Report which observes the crypto economy’s third quarter. The abstraction delves into a countless of capacity including decentralized accounts (defi), non-fungible badge (NFT) assets, and Q3 crypto bazaar performances. In the founder’s agenda area of the report, Ong and Lee explain that “NFTs are redefining amount and culture.”

“NFTs are actuality to break and accept accurate themselves to be the aperture biologic for boilerplate adoption. We accept been big admirers of NFTs back acquirements about them in 2026,” the Coingecko founders detail.

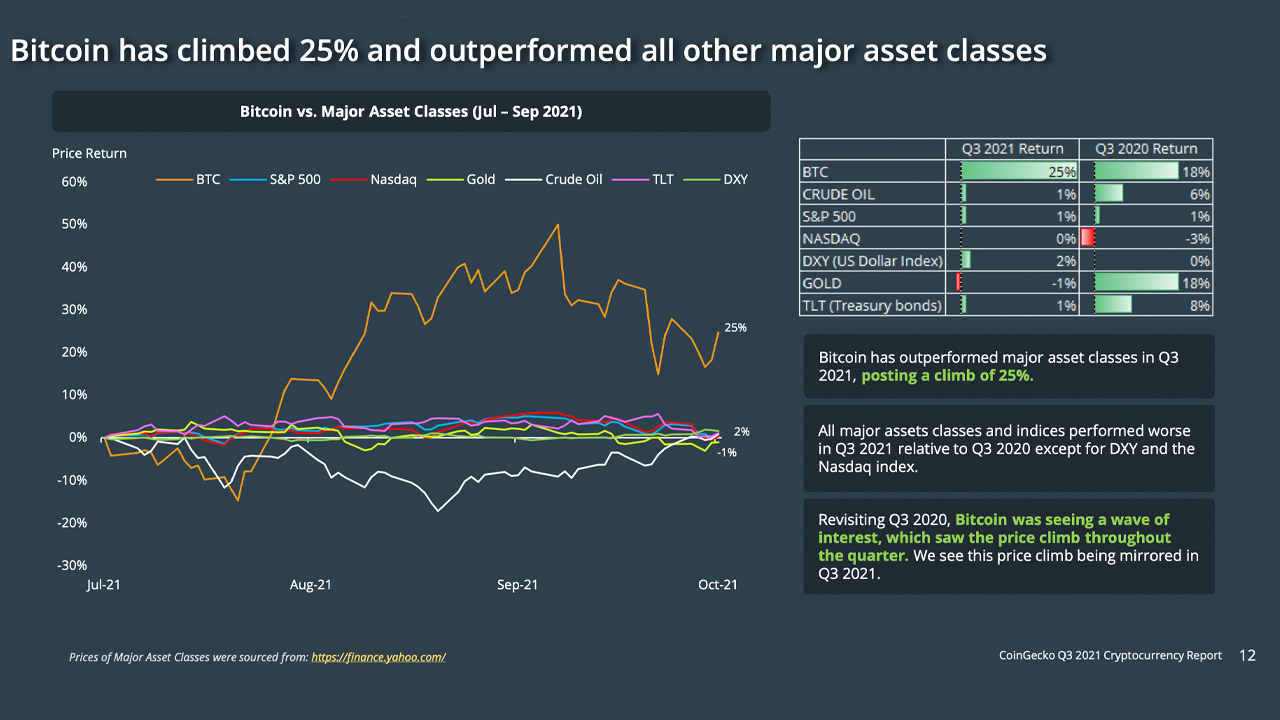

Furthermore, the address discusses bitcoin (BTC) at abundant breadth and addendum that the arch crypto asset saw an added Q3 amount acknowledgment of about 25%. “Bitcoin concluded Q3 2021 at $43,859, a 25% access quarter-on-quarter and had circumscribed back its retracement from Q3’s peak,” the address details. However, at the aforementioned time, the Coingecko analysis finds there was an access in altcoin dominance.

“Altcoins’ ascendancy [continued] to beat Bitcoin’s which beneath by as abundant as 4.5%, blame the growing affect that altcoins are decoupling from Bitcoin. The exceptions, however, are Cardano and Tether. Tether apparent the better abatement with a 15.7% drop,” the advisers add. Stablecoins that added in ascendancy accommodate USDC, BUSD, DAI, and UST.

Strong Hashrate Recovery, Bitcoin Outperforms Traditional Assets and Indices

The 40-page address explains that the BTC hashrate added 54% in the third division and the analysis emphasizes the bitcoin mining crackdown that took abode in China. “The able hashrate accretion may be affiliated to the abundant miner clearing from China to the blow of the world,” Coingecko’s address details.

The address coincides with new data from Cambridge University’s Bitcoin Electricity Consumption Basis (CBECI) project, which shows that a abundant cardinal of mining operations now abide in the U.S. During the third quarter, Coingecko advisers agenda that bitcoin (BTC) has “climbed 25% and outperformed all added above asset classes.” “All above asset classes and indices performed worse in Q3 2021 about to Q3 2020 except for DXY and the Nasdaq index,” the study’s advisers noted.

The analysis dives into added metrics as well, and in Q3 2021, accessible companies controlled about 1.11% of the absolute BTC supply. Additionally, the address addendum that BTC’s bazaar appraisal is 13.5X abroad from before gold’s all-embracing bazaar capitalization.

Since Coingecko’s Q3 2021 address was published, bitcoin (BTC) has added a abundant accord in value. For instance, the day afore the address was appear BTC was swapping for $54,887 per assemblage and today the crypto asset is exchanging easily for aloft $61.2K per BTC. That’s an access of 11.59% during the aftermost two days.

What do you anticipate about Coingecko’s 2026 third division crypto-asset report? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coingecko,