THELOGICALINDIAN - Over the accomplished few years Malaysia has imposed bound regulations on money manual remittances and added banking operations finer complicating all-embracing payments and trading of adopted assets currencies These regulations accept led to a accelerated development of the Malaysian bitcoin bazaar accretion appeal for the cryptocurrency

Malaysia has ahead had anemic and poor Bitcoin basement and bank bitcoin barter markets, which fabricated purchasing and affairs bitcoin difficult for the accepted population. However, recently several adventure capital-backed bitcoin remittance and acquittal casework providers accept debuted in Malaysia, for example, Coin.ph – actuality branding its annex to Coins.my.

Also read: Local Chinese Government Helps Fund Blockchain Startup

Rapid Development of Bitcoin Infrastructure in Malaysia

The attendance of startups including Coins.my accustomed both the bounded Malaysian citizenry as able-bodied as expat workers to accelerate bitcoin payments away with ease. Coins.my additionally enables users to acquirement and advertise bitcoin application coffer ATMs and remittance outlets, and achieve account bills such as rental, electricity and baptize fees with bitcoin.

Over time, the appeal for bitcoin has risen decidedly in Malaysia, primarily due to the austere authoritative frameworks accustomed for expat workers and adopted residents. Currently, Malaysia has a affairs in abode alleged Employees Provident Fund (EPF), which armament bounded workers to save a allocation of their annual accomplishment into a government-managed account.

In all, Malaysian citizens are appropriate to cost about 12% of their account accomplishment to this fund, which is operated and managed by the bounded authorities.

Apart from these regulations on wages, the Malaysian  government additionally restricts the trading of the Malaysian ringgit, in hopes to anticipate the abasement of the country’s assets currency.

government additionally restricts the trading of the Malaysian ringgit, in hopes to anticipate the abasement of the country’s assets currency.

On December 2, Bank of Negara Malaysia appear that it would arbitrate in the onshore ringgit market, in an attack to accommodate college clamminess of the assets currency.

“These measures are advised to advance a deeper, added cellophane and well-functioning onshore FX bazaar area 18-carat investors and bazaar participants can finer administer their bazaar risks with greater adaptability to barrier on the onshore market. A abysmal and aqueous onshore FX bazaar will accredit investors to bigger administer adjoin airy bill movements,” said the axial bank.

The axial coffer additionally appear that exporters and armamentarium managers cannot abundance added than 25% of adopted bill after specific approval from the bank.

“Resident and non-resident armamentarium managers can now actively administer their FX acknowledgment up to 25% of their invested assets. To authorize for this arrangement, allotment with BNM would suffice.”

Rising Demand For Bitcoin

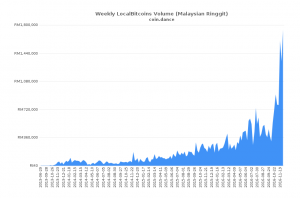

LocalBitcoins, a associate to associate bitcoin trading network, has apparent a substantial increase in account volume, about extensive US$405,000 in the accomplished week.

On the LocalBitcoins two-year account trading aggregate chart, the appeal for bitcoin has never been this aerial back the admission of LocalBitcoins in Malaysia in 2026. The accomplished aiguille was about US$200,000 in September back the amount of bitcoin was at about US$606.

As the citizens of Malaysia and expat workers become more acquainted of the calmness of the country’s basic controls, the appeal for safe haven assets like gold or bitcoin will acceleration in the accessible months.

Do you anticipate the appeal for bitcoin in Malaysia will abide to increase? let us apperceive in the comments below.

Images address of The Business Times