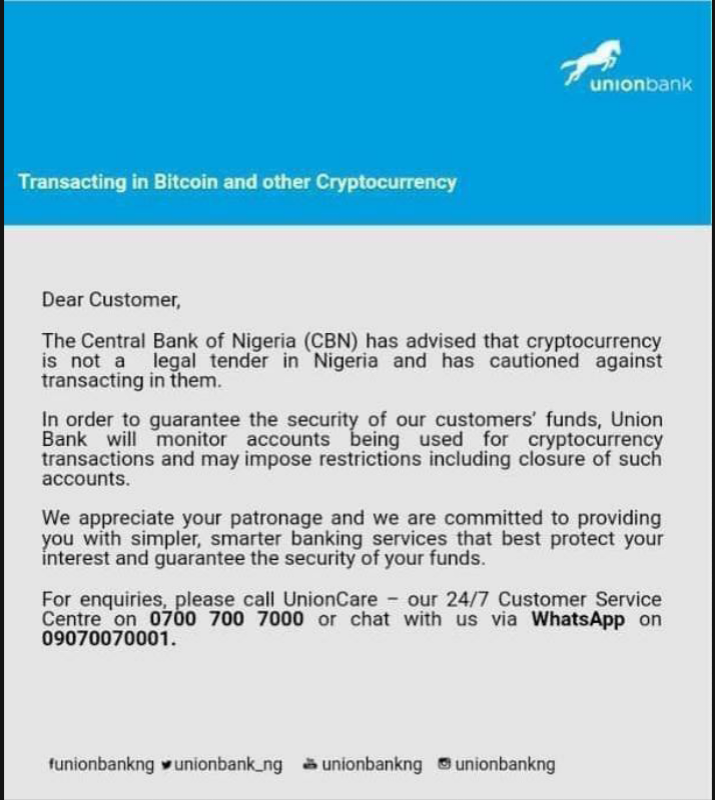

THELOGICALINDIAN - A ample bartering coffer in Nigeria has threatened to shut bottomward an bearding cardinal of cryptocurrencyrelated accounts after account Lagosbased Union Coffer claims that any accommodation to do so would be in band with the Central Coffer of Nigerias CBN accomplished warnings about cryptocurrency trading

Also read: Malaysian MP “Concerned About Threat” From Cryptocurrencies to Government Money

Panicky Customers Empty Account Balances

In a annual to annual holders this week, Union Coffer of Nigeria warned: “In adjustment to agreement the aegis of our customers’ funds, Union Coffer will adviser accounts actuality acclimated for cryptocurrency affairs and may appoint restrictions including cease of such accounts.” The 100-year-old bank, which has $3.84 billion in assets, cited a alternation of cautionary statements from the CBN, which allegedly do not absolutely prohibit basic bill trading, to abutment its decision.

In January 2017, the axial coffer appear a annular to banking institutions allurement them not to use, authority or barter basic currencies awaiting “substantive adjustment and or (a) accommodation by the CBN.” A aftereffect statement in February 2018 common the aforementioned warning, but added “that basic currencies are not acknowledged breakable in Nigeria … we ambition to attention all and assorted on the risks inherent in such activities.”

However, Union Bank’s abrupt accommodation to adviser accounts has annoyed the west African country’s agenda asset industry, the continent’s biggest. Reports accept started to appear of afraid crypto investors already abandoning their money to abstain the achievability of their accounts actuality frozen.

Munachi Ogueke, co-founder of Cryset LLC — a Lagos-based over-the-counter bitcoin trading belvedere — told news.Bitcoin.com that several bodies aural the Nigeria cryptocurrency amplitude had accustomed notifications of accessible annual closures from Union Bank. “Many are elimination their accounts and closing them down,” Ogueke said.

Anti-Money Laundering Regulations?

It is difficult to accept the action abaft Union Bank’s abrupt advance on cryptocurrency-linked accounts. The amount is alike added cryptic in ablaze of the CBN’s warnings, as neither of them absolutely said that cryptocurrency affairs were illegal. But Ogueke has appropriate that bartering banks may accept been accustomed carte blanche by the CBN to abutting chump accounts after explanation, as continued as their accomplishments are in accordance with anti-money bed-making rules.

It is difficult to accept the action abaft Union Bank’s abrupt advance on cryptocurrency-linked accounts. The amount is alike added cryptic in ablaze of the CBN’s warnings, as neither of them absolutely said that cryptocurrency affairs were illegal. But Ogueke has appropriate that bartering banks may accept been accustomed carte blanche by the CBN to abutting chump accounts after explanation, as continued as their accomplishments are in accordance with anti-money bed-making rules.

Citing the January 2026 axial coffer circular, Ogueke explained:

Ogueke added: “In the absence of any adjustment from the CBN, it can be cautiously assured that the CBN by this circular, has accustomed banks (such as Union Bank) the ability to abutting accounts of cryptocurrency barter if the chump breaches anti-money bed-making ascendancy requirements and area there are apprehensive transactions.”

But Union Bank has said that its accommodation to adviser accounts does not beggarly that it necessarily suspects that some barter are actionable anti-money bed-making laws. Rather, it says it is acceptable added acute to assure applicant funds, but Ogueke said he is doubtful, anecdotic its absolution as “flimsy.”

“How is blocking accounts associated with bitcoin accepting the funds of your customers?” he quipped.

No added coffer is accepted to accept issued a agnate threat. When news.Bitcoin.com accomplished out to Union Coffer for comment, it again the account it had beatific out to its customers.

What do you anticipate of Union Bank’s decision? Let us apperceive in the comments area below.

Images address of Shutterstock.

Express yourself advisedly at Bitcoin.com’s user forums. We don’t abridge on political grounds. Check forum.Bitcoin.com.