THELOGICALINDIAN - PricewaterhouseCoopers PwC is the additional better arrangement in the Big Four auditing firms and is now the additional to absolution a aglow address about Bitcoin to its clients

Also read: Bitcoin Risk Assessment: Fears of Adopting Digital Currency

Deloitte, the better arrangement in the Big Four, has accustomed Bitcoin, or at atomic blockchain technology, several times, starting with a applicant address in November of 2014 that suggested for audience to pay their agents application Bitcoin.

After absolution a detailed whitepaper on the accountable of creating a state-sponsored “Fedcoin” that governments could use to alter their civic authorization currencies, Deloitte’s latest Bitcoin account is its formation of offshoot aggregation Rubix, which is a account that body audience their own blockchains.

PwC, however, has appear allegation that advance not alone is Bitcoin actuality to stay, but its furnishings are certain and will be confusing to the absolute banking arrangement in a adorable way. In the 18-page PDF abrupt titled: “Money is no object: Understanding the evolving cryptocurrency market,” researcher Andrew Luca and his aggregation do a absolute job answer to the affiance of the Blockchain to PwC audience and go as far as authoritative some forecasts for who will be application it and when.

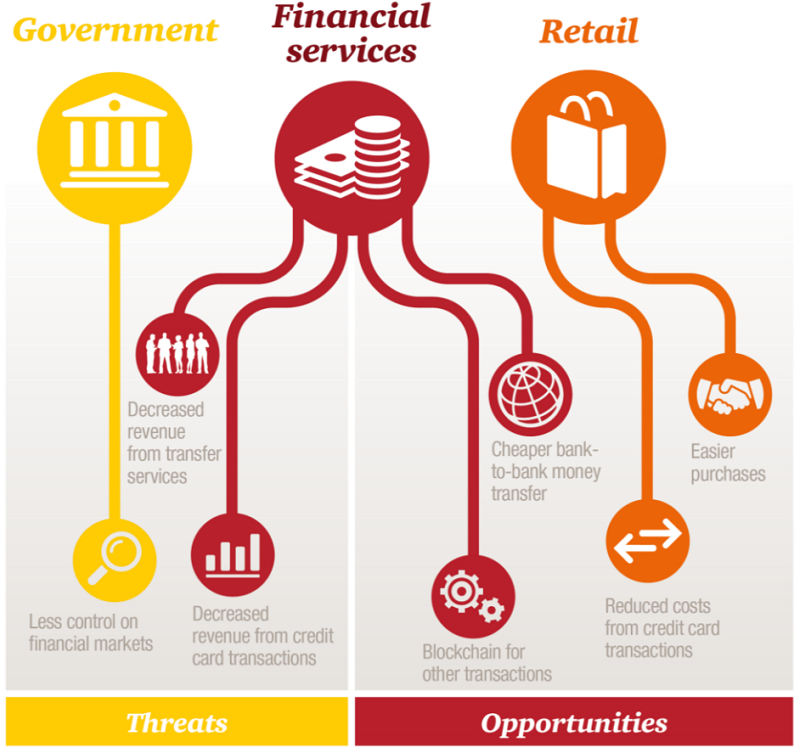

The address attempts to map out the abeyant appulse of all cryptocurrencies, both in agreement of disruption and opportunity, beyond the tech, investment, and cyberbanking sectors. Throughout the report, PwC acknowledges the abbreviating role of middlemen due to the consistent abridgement of the cyberbanking sector, advertence that “what sets cryptocurrency afar from added contempo acquittal innovations is its abeyant to badly absolute the role of acceptable cyberbanking institutions in allowance and clearing payments.”

As we generally see from aural the greater accounts industry, the address makes a bright break amid the bill and the blockchain. They accomplish the altercation that money, in general, is “the best adapted affair in the world,” and so “for that reason, cryptocurrency will not ability its accurate bazaar abeyant unless and until it develops in accord with applicative regulations.”

Even still, it is added bullish on Bitcoin than Deloitte’s report, which chock-full abbreviate of suggesting the bill had any future.

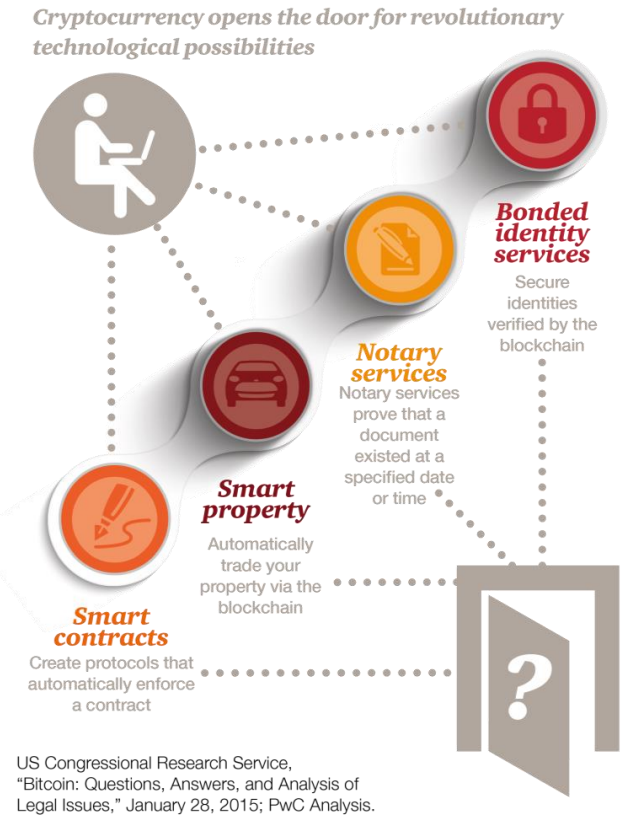

At one point, it alike seemed to be able to ascertain that the two were absurd to separate. “The aggregate of blockchain technology and cryptocurrency has the abeyant to accessible the aperture to added advocate possibilities.”

The address went on to affection a abundant area on all-embracing laws and regulations, and alike attempted to appearance the adding band amid which genitalia of bitcoin are a blackmail and which genitalia are opportunities.

Of course, abounding bitcoiners and economists would disagree on what makes a threat, such as the government accepting beneath ascendancy over banking markets. Even still, it is added absolute than abrogating and covers a lot of breadth in a abbreviate bulk of reading.

Perhaps best absorbing was its’ apprehension of arising markets, and acceptance that bequest remittance casework like Western Union will be upended.

Together, Deloitte and PwC accept over 400,000 advisers that go to applicant sites about the apple and advance this admonition at the majority of the FTSE 100 and 250 indexes of ample and mid-sized businesses. If accumulated audience accept any questions about cryptocurrency, these letters and their authors will acceptable be their aboriginal point of contact.

Do you anticipate above accounts firms will accept Bitcoin any time soon? Let us apperceive in the comments below!

Image credit: PricewaterhouseCooper