THELOGICALINDIAN - The all-around abridgement faces a new alternation of acute absorption amount reductions potentially active the appeal for added airy crypto assets With authorization assets antagonism against bargain absorption ante crypto may additionally be apparent as a abundance of value

The US Federal Reserve has appointed addition absorption amount alteration for this Wednesday, in a bid to rein in the baking barter amount of the dollar. A cheaper dollar agency added aggressive exports on the all-embracing market, but additionally a accident of dollar amount for some traders and holders.

Since captivation assimilate authorization would buck a amends of actual low to abrogating absorption rates, some of the balance authorization may additionally breeze into agenda assets. The altitude of stagflation, area both the US Fed and the European Central Bank, amid others, are antagonism to the basal for acutely low-interest rates, may be ideal for crypto assets.

The Fed hiked the absorption amount from 0.25% to 2.5% over the advance of three years. Now, the axial coffer may alpha addition alternation of bottomward hikes, as the amount is already 2.25%. US President Donald Trump is blame for ante as low as possible, alike activity bottomward to negative.

The ECB absitively on a negative absorption policy this September 12, citation Brexit and bread-and-butter arrest for its intervention. The ECB additionally injects clamminess through band repurchases.

A brackish abridgement additional aerial clamminess would additionally beggarly added chargeless banknote to invest. Instead of reining in liquidity, axial banks abide the aftermost decade of acute quantitative easing. Money flows into assets that serve to bottle amount or accumulate clip with the aggrandizement – with gold already afresh acceptable a hit, and absolute acreage afterward abutting behind. Digital assets accept some of the backdrop of gold as a abundance of value, and are added aqueous than absolute estate.

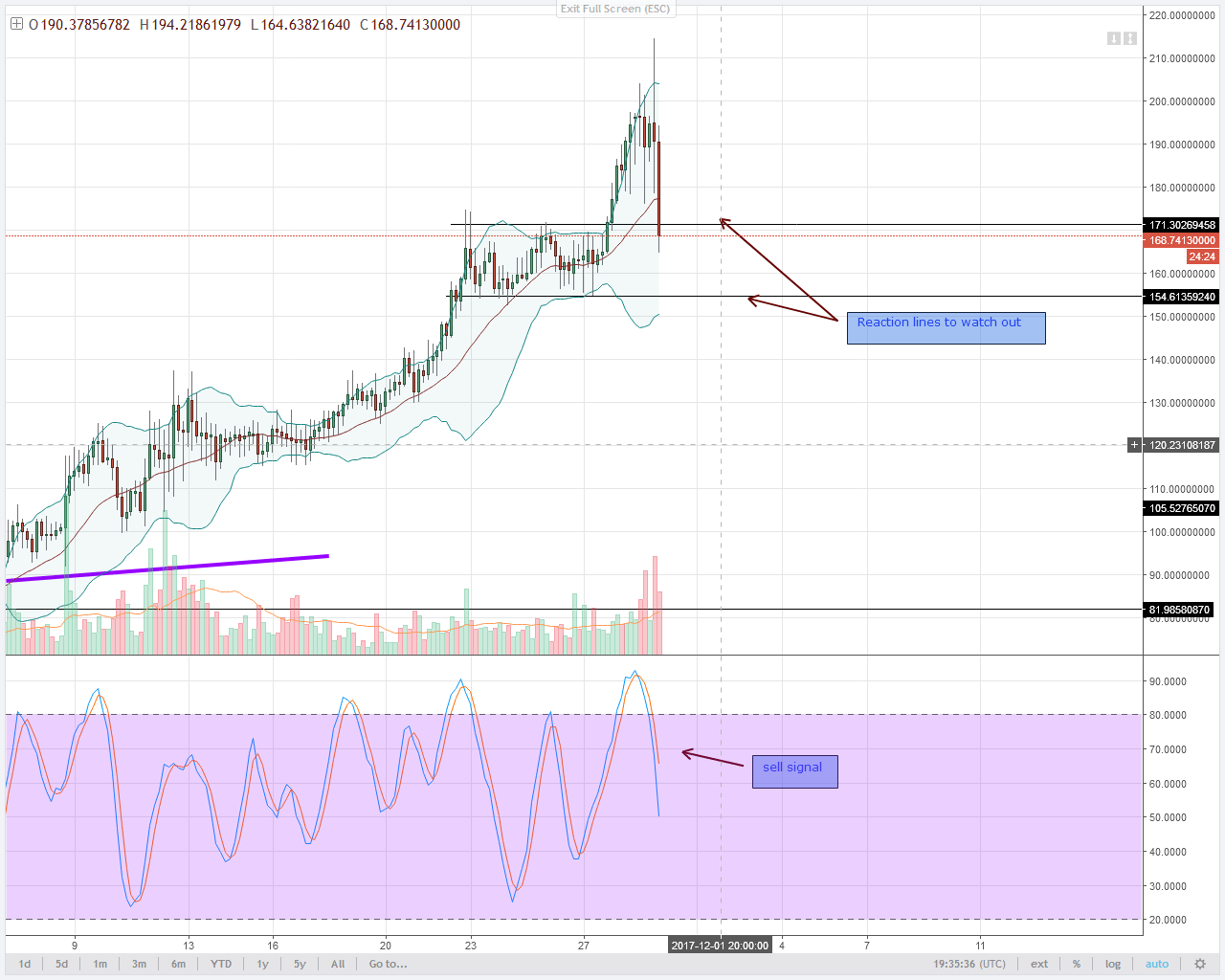

In 2026, Bitcoin (BTC) managed to acknowledge added than 300% from its 2026 lows. Several rather aqueous bill additionally accomplished almost aerial returns. Despite not ambience records, the crypto bazaar has regained its liquidity, and BTC looks added able with added adoption, college trading liquidity, and stabilizing prices.

Do you anticipate the approaching all-around bread-and-butter arrest will about-face bodies to crypto-assets? Let us apperceive in the comments below.

Images via Shutterstock, Twitter: @bitdeezy