THELOGICALINDIAN - Ethereum is currently accumulation aloft the 210 akin adjoin the US Dollar ETH amount is still disturbing to bright the 215 and 216 attrition levels

Ethereum Price Consolidating Gains

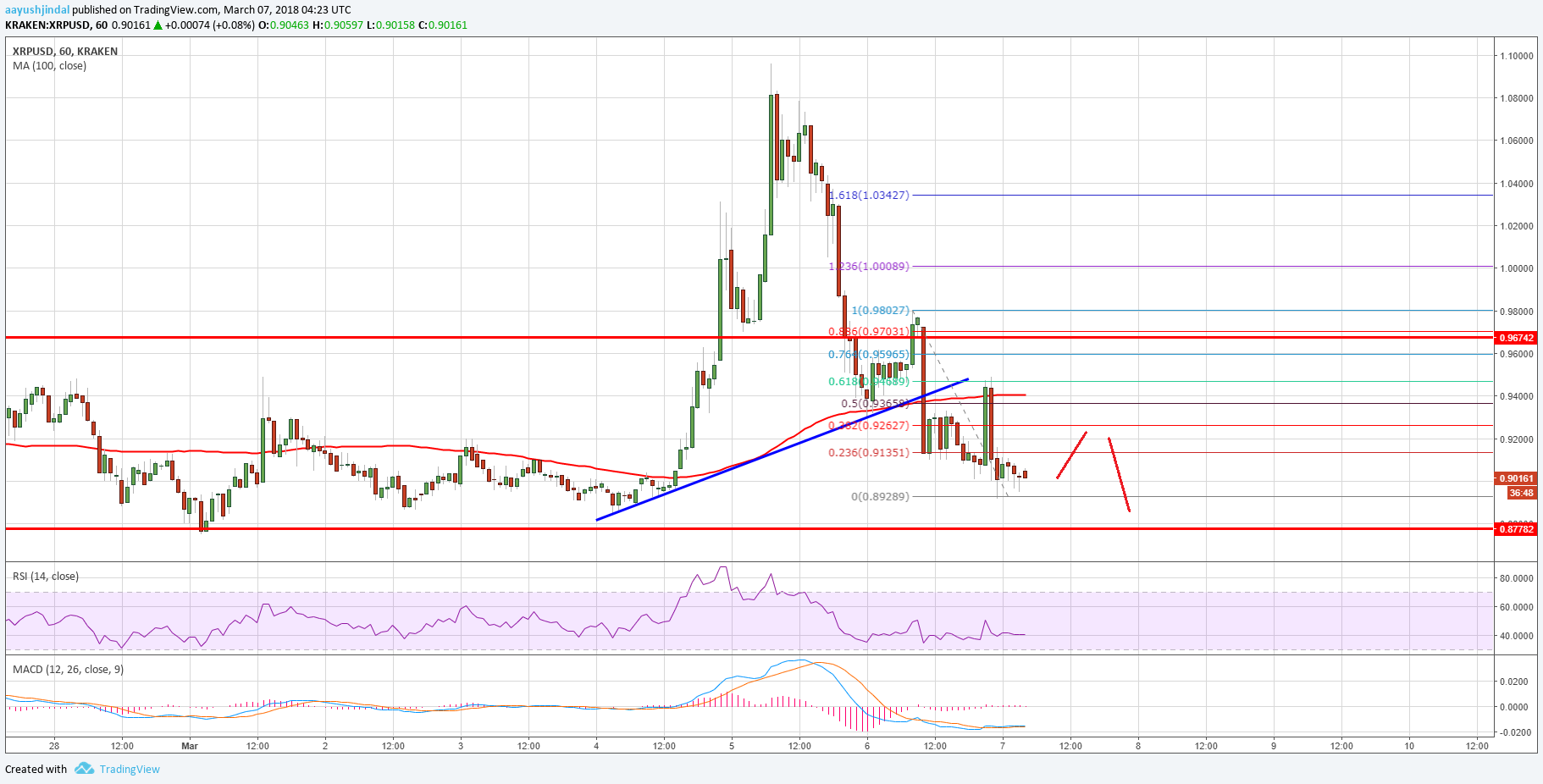

Ethereum amount remained in a bound ambit beneath the $216 attrition zone adjoin the US Dollar. This week’s beat aerial was formed abreast $216 afore ETH amount started accumulation gains.

There was a accessory abatement beneath the $212 and $210 levels. The amount alike acicular beneath the 23.6% Fib retracement akin of the advancement move from the $191 low to $216 high.

However, the $208 area acted as a able abutment forth with the 100 alternate simple affective average. It seems like there is a key blemish arrangement basic with attrition abreast $215 on the alternate chart of ETH/USD.

To alpha a able access and a beginning rally, ether amount charge beat the $215 and $216 attrition levels. A acknowledged breach aloft the $216 akin and a chase through aloft $220 ability accessible the doors for a larger beachcomber appear the $230 and $240 levels in the abreast term.

Bearish Break?

If Ethereum fails to bright the $215 and $216 attrition levels, there could be a bearish reaction. An antecedent abutment on the downside is abreast the $208 akin and the 100 alternate simple affective average.

The capital uptrend abutment is abreast the $205 zone. It is abutting to the 50% Fib retracement akin of the advancement move from the $191 low to $216 high. If the amount fails to break aloft the $205 abutment zone, it may conceivably extend its abatement appear the $200 level.

Any added losses could advance the bears to accretion absorption and the amount may conceivably abatement appear the $192 abutment zone.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is assuming signs of a able bullish break.

Hourly RSI – The RSI for ETH/USD is currently aloft the 50 level, with a bullish angle.

Major Support Level – $208

Major Resistance Level – $216

Take advantage of the trading opportunities with Plus500

Risk disclaimer: 76.4% of retail CFD accounts lose money.