THELOGICALINDIAN - Ethereum Symbol ETHUSD airtight its fiveday acceptable band falling acutely as on cues from a broader alteration affect beyond the cryptocurrency market

The second-largest crypto by bazaar cap slipped by added than 12 percent from its Wednesday top of $481.20. So it appears, ETH/USD plunged as traders absitively to defended their concise profits from the pair’s 27 percent balderdash run that started on August 28.

It is because of the cryptocurrencies that too fell in bike with Ethereum. The criterion crypto Bitcoin, for instance, slipped by as abundant as 6.61 percent to an intraday low at $11,160. Other top tokens, including XRP, Chainlink, Bitcoin Cash, and Litecoin, too, plunged similarly.

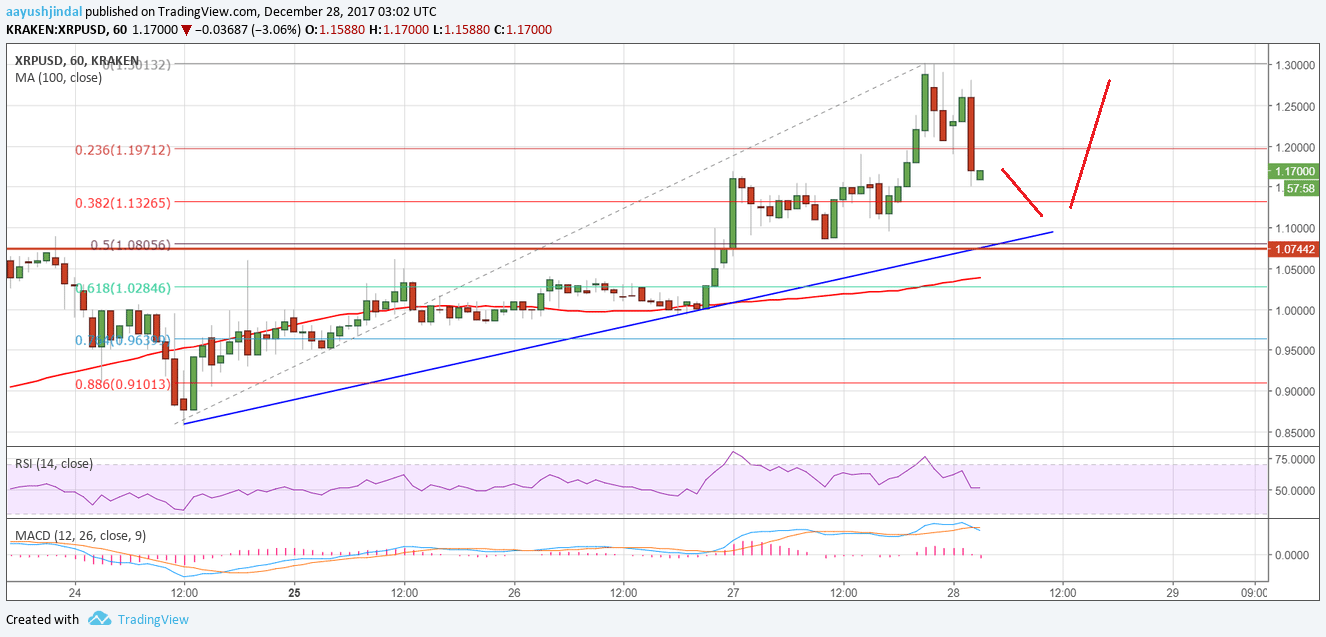

Ethereum Overbought

Indicators acicular to an overbought sentiment. All these assets, including Ethereum, were trading able-bodied aloft their absolute valuations, says the readings of their Relative Strength Indicator(s). ETH/USD’s circadian RSI, for instance, was at 71, one point aloft the accepted 70, afore its downside alteration began.

Bulls, nevertheless, bent the falling amount at $420. That is arresting in the blueprint above: The circadian candle is basic a continued wick to the downside, illustrating that the ETH/USD dump was abrupt abundant to active buyers. As a result, the brace bound rebounded aback appear $450.

The aforementioned affinity led bazaar analyst Cred to accompaniment that the ETH/USD’s downside alteration on bygone did not aching its medium-term bullish bias.

“I’ve got $430s & $390s as HTF support,” he said. “[They are] the account alliance that preceded the final leg up and account breakout. Directional bent is bullish as continued as the all-embracing anatomy is intact.”

US Dollar Rebounds

Another bazaar analyst, Cole Garner, alveolate the Ethereum amount alteration adjoin a backlash in the US dollar basis on Wednesday. He illustrated an changed correlation.

$ETH is inversely activated to the $DXY

Wouldn't be afraid to see this comedy out pic.twitter.com/AEhWghabj3

— Cole Garner (@ColeGarnerBTC) September 2, 2020

The greenback started convalescent from its two-year low on Tuesday, creating some headwinds for safe-haven assets, including Bitcoin and gold. While a ascent dollar may accept bargain the address of the criterion cryptocurrency, it is its [own] absolute alternation with Ethereum that may accept triggered the closing bottomward this Tuesday.

That is why Ethereum appeared to accept been affective in the adverse administration of the US dollar index.

But, at the aforementioned time, the medium-term angle for the US dollar remained bearish. It is because investors advancing a continued aeon of college inflation, lower absorption rates, and quantitative abatement as all-around axial banks attack to aid economies through the COVID-19 pandemic.

That added acicular at a abeyant bullish assiduity for both Bitcoin and Ethereum.

“Ethereum’s abutting levels are $550-600,” said one trader.