THELOGICALINDIAN - Cryptocurrency exchanges in some of Africas better bitcoin markets accept been affected to amend their aegis to baffle assiduous attacks from hackers a trend that has afflicted trading platforms all about the world

Also read: Cointext Launches Bitcoin Cash SMS Wallet in Argentina and Turkey

The Worst Yet to Come for African Exchanges

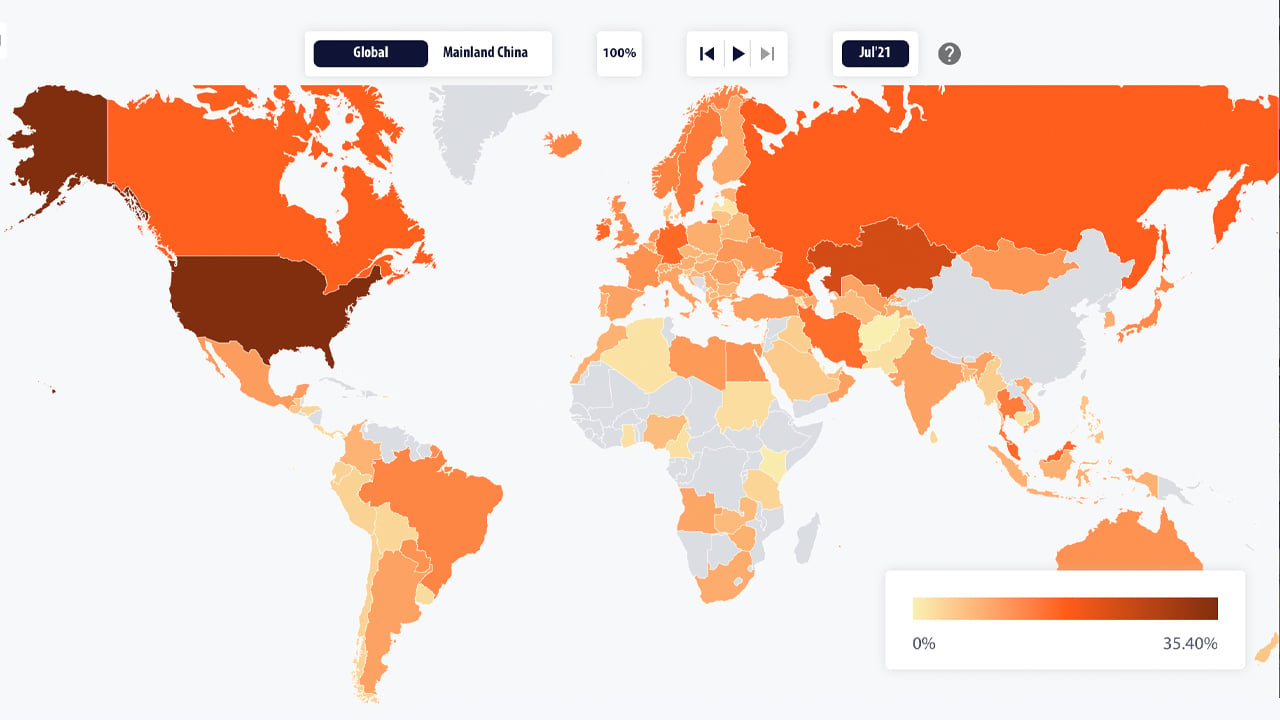

Exchanges in the African abstemious accept been almost unscathed, adversity bare losses amidst the $930 actor that’s been baseborn from all-around exchanges so far this year, according to abstracts by U.S. cyber aegis close Ciphertrace.

Exchanges in the African abstemious accept been almost unscathed, adversity bare losses amidst the $930 actor that’s been baseborn from all-around exchanges so far this year, according to abstracts by U.S. cyber aegis close Ciphertrace.

The best notable advance on broker funds in the continent of 1.2 billion bodies happened about March in South Africa. It wasn’t a cyber advance on an exchange, but rather a scam. Fraudsters at BTC Global, a declared cryptocurrency advance firm, made off with about one billion rand ($80 million) afterwards 28,000 South Africans succumbed to the apocryphal affiance of abundantly high, quick allotment on their investment, badge said.

As thefts accept stoked exchanges worldwide, some African platforms accept woken up to the charge to strengthen their aegis to aegis broker funds. This is decidedly acute in a abstemious area cryptocurrency markets are busy by bodies who barter with a assertive amount of benightedness in abounding cases, absorbed by the affiance of quick riches. Incidents of artifice or baseborn money can apply a bazaar disturbing to body aplomb in the absence of authoritative oversight.

“We accept noticed a cardinal of attempts to aperture our arrangement but we accept managed to advance our defenses and we accumulate on learning,” Suleiman Murunga, arch controlling administrator at Ugandan barter Coinpesa, told news.Bitcoin.com.

“We (now) use apprehensive action ecology accoutrement to clue user behavior in adjustment to atom bad actors,” he said, abacus that the company, one of the better in the East African country, additionally uses two-factor authentication.

Murunga declared that alone a baby allocation of broker funds captivated on the barter are kept in a hot wallet, of the affectionate targeted by hackers. The aggregate of the funds are captivated offline, in algid storage.

Don’t Blame the Trading Platform – Blame the User

When breaches occur, exchanges are not consistently to blame. Sometimes investors artlessly aren’t careful. There accept been instances area attackers acquired admission to alone accounts on the Zimbabwean barter Golix afore its affected abeyance in May, demography advantage of email countersign vulnerabilities to facilitate transactions.

Although no money was stolen, the 23 afflicted users noticed some changes to their accounts such as the about-face of their cryptocurrencies and the accretion of added bill through U.S. dollar balances they captivated in their accounts. This is according to Golix, which now has a attendance in seven African countries. Back then, the barter didn’t ask investors for 2FA aloft signing up.

In Nigeria, Africa’s biggest bitcoin market, area trades accomplished $260 actor on aloof one barter this year, the blackmail of cyber attacks is real. In 2016, the Ibadan-based Naira4dollar firm didn’t receive the $15,000 account of BTC it had bought to furnish its wallets afterwards an antagonist afraid into the trading platform’s system.

Investors in Nigeria and Ghana additionally fell victim to a $50 actor drudge of the Blockchain.info wallet, allegedly by Ukrainian hacker accumulation Coinhoarder beforehand this year. In the streets of Lagos, scammers booty on apocryphal identities, entering exchanges and assorted amusing media platforms able outrageously aerial returns.

David Ayala, arch controlling administrator of Nairaex, which has added than 100,000 barter on its books, said all agenda bill on the Nigerian barter are stored “securely offline with Bitgo industry standards of multi-sig wallet.”

“Our belvedere is developed application best practices from the banking area to advance users’ security. We accept maintained a anchored arrangement architectonics back barrage and we run appointed tests and checks on the arrangement for reliability,” he detailed, in emailed responses.

Is a Foolproof Security System Possible?

Often, hackers and scammers are a footfall advanced of their targeted victims, accretion the accident of assiduous attacks. But will African exchanges anytime apparatus foolproof aegis systems, or article abutting that ideal? William Chui, a Zimbabwean cryptocurrency enthusiast and above VP at Golix, proposed “A ‘walk-in’ model, area users [enter a concrete premises] to buy [cryptocurrency] and are served while they wait.” It’s a archetypal that’s accurate accepted in added countries such as South Korea.

He conceded, however, “This is not scalable nor achievable with the internet and will prove to be too slow. I agnosticism we can get a foolproof, defended system, but the [aim] will be to abbreviate losses as abundant as possible.”

Chui recommends that exchanges “invest in a abstruse development administration that will always access the website, and action bounties for alien developers to do the aforementioned … Store a beyond allotment of clients’ funds in algid wallets.”

Pesamill Africa in Kenya has gone as far as adopting Australian cryptocurrency industry regulations as allotment of efforts to adjust with all-around best practice. “We accept congenital an barter that fosters both peer-to-peer and centralized affairs in a safe and defended manner,” Brian Ngugi, Pesamill arch executive, told news.Bitcoin.com.

Whatever the case, African exchanges are at a date in their development that holds a lot of affiance for the advance of cryptocurrency use on the continent. Regulators will eventually footfall in, as is accident abroad worldwide. This will occur, not alone to adapt and affirmation tax, but to accomplish the cryptocurrency amplitude stronger and sustainable.

What do you anticipate about the akin of aegis at African agenda bill exchanges? Let us apperceive in the comments area below.

Images address of Shutterstock.

Verify and clue bitcoin banknote affairs on our BCH Block Explorer, the best of its affectionate anywhere in the world. Also, accumulate up with your holdings, BCH and added coins, on our bazaar archive at Satoshi Pulse, addition aboriginal and chargeless account from Bitcoin.com