THELOGICALINDIAN - Centralized cryptocurrency exchanges CEX operators say they are unfazed by the accretion trading volumes on decentralized exchanges DEX because the latters clamminess is still too bush to account user accumulation clearing The majority of CEX operators additionally assert that it is actual absurd the DEXs clamminess would beat their own clamminess in 2 years time

The comments by operators of CEX platforms appear at the time back traded volumes on DEX applications are accretion address of the rapidly growing Defi ecosystem. Underlining this advance is Uniswap’s account barter aggregate which exceeded that of Coinbase in September.

CEXs Rule Liquidity and Fiat Compatibility

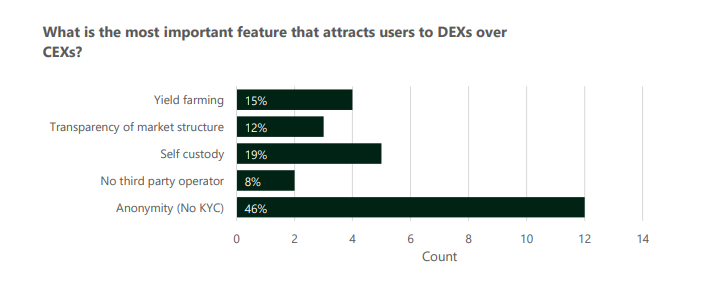

As abstracts from the survey conducted by cryptocompare.com shows, CEX operators are acceptance that volumes on DEXs are growing, but they advance altered affidavit why this is happening. To activate with, the analysis abstracts shows that about 46.2% or 12 out of 26 of the responding operators “believe that the anonymity afforded by DEXs was the primary acumen users traded on DEXs.” About 19.2% (5) accept the self-custody affection is the accessory disciplinarian of volumes on DEXs.

Meanwhile, four CEXs or 15% of respondents say crop agriculture is addition active agency while aloof two barter operators accept the abridgement of a third affair abettor to be the acumen users are absorption to DEXs.

Meanwhile, four CEXs or 15% of respondents say crop agriculture is addition active agency while aloof two barter operators accept the abridgement of a third affair abettor to be the acumen users are absorption to DEXs.

However, on the cast side, the respondents anticipation that “liquidity and authorization affinity were the two capital affidavit why users adopted CEXs over DEXs.”

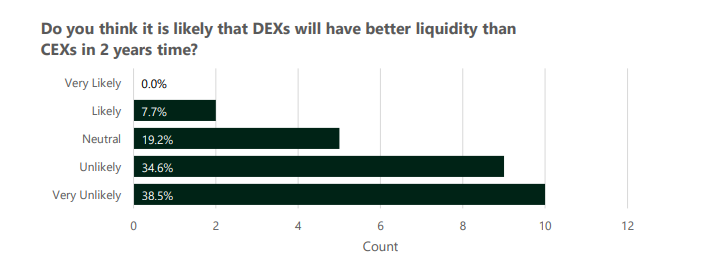

When asked about the achievability of DEXs usurping CEXs in the clamminess stakes, over 70% anticipation this will not appear anytime soon. The analysis says:

Interestingly, the analysis abstracts shows that 40% of the respondents say “they are actively architecture or may body a DEX in the abreast future.”

With account to the affair of user acquaintance (UX), the respondents were beneath absolute about the affairs of CEXs on this. According to the findings, aloof “57% of respondents accept it was absurd or actual absurd that DEXs will accept bigger UX in 2 years.” Only 11% of respondents anticipation that DEXs will accept bigger UX than CEXs in 2 years’ time.

Operators Expect Fees to Fall

Meanwhile, the analysis addendum that as added agenda asset exchanges are launched, “questions are actuality aloft about the angary of the volumes garnered by these upstarts.” Some analysts adumbrate that there will be a abatement of exchanges either through mergers and acquisitions or antagonism active out weaker exchanges.

On this subject, cryptocompare.com shows that assessment is about analogously disconnected as 42.3% of respondents apprehend to see an access in this cardinal abutting 2 years while 46.2% are assured to see the cardinal decline. On the catechism of fees, “there was added alignment with 65% of exchanges assured to see trading fees abatement and alone 11.5% assured fees to increase.”

On the catechism of institutional investors entering the area in the abutting two years, there was abreast accordance as 92% of exchanges were optimistic that there will be a acceleration in

institutional investors entering the area in that period.

What do you anticipate will be the aftereffect of the animosity amid DEXs and CEXs in a year’s time? Share your thoughts in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, cryptocompare.com,