THELOGICALINDIAN - IDEX the worlds best accepted decentralized barter is to alteration to a abounding analysis archetypal The move comes canicule afterwards the belvedere began excluding association of New York State as allotment of its acquiescence efforts Its latest admeasurement declared by IDEX as businesslike decentralization has fatigued ire from a articulation of the cryptocurrency community

Also read: China Updates Crypto Ranking, Downgrades BTC Further

IDEX Goes Full KYC

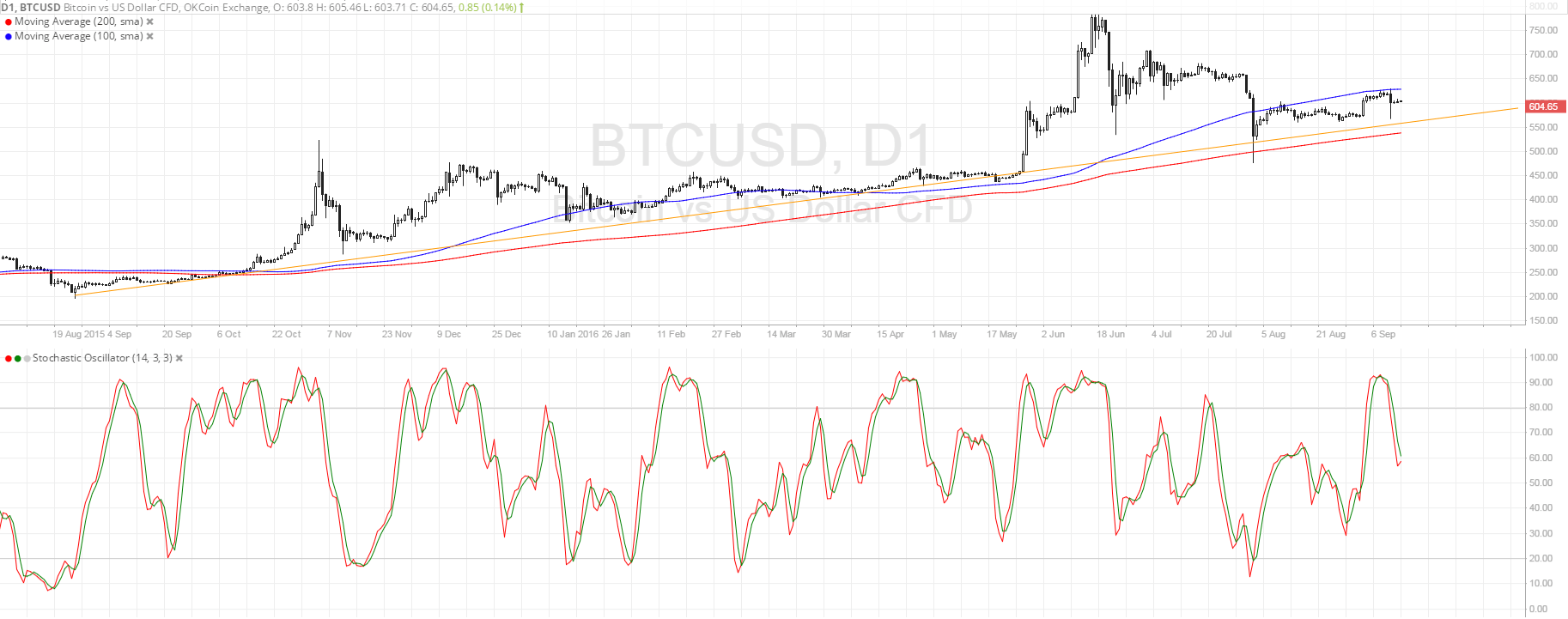

A cryptocurrency barter introducing apperceive your chump (KYC) requirements is not about banderole news. When the belvedere in catechism is a decentralized barter (DEX), however, about one of the aftermost outposts of privacy, it’s a above talking point. IDEX’s accommodation will be monitored carefully by the cryptocurrency association to see whether it is an abandoned adventure or the appearance of things to come. IDEX’s ascendant position aural the DEX market, capturing about 7x the trading aggregate of its abutting competitor, agency it exerts cogent influence.

Explaining its alteration to a abounding KYC model, IDEX wrote: “Decentralization exists on a spectrum, and unless your arrangement or appliance lacks any centralized genitalia it can be accountable to regulation. Aurora is alive to actualize a fully-decentralized banking system, but the aisle to accepting there requires decidedly added ascendancy and absorption than the end state. In accession to IP blocking, IDEX will be implementing KYC/AML behavior in adjustment to accede with sanctions and money bed-making laws.”

Same Security, Less Privacy

Traders tend to use decentralized exchanges for three reasons: aegis (they absorb ascendancy of their funds at all times, mitigating the likelihood of theft), aloofness (no KYC agency not accepting to acknowledge your activities to the authorities, or accident accepting your character stolen) and assuredly to accretion admission to adorable tokens afore they accomplish it into a above exchange. With the aloofness aspect removed from the equation, all that’s larboard is the bordering account of greater aegis and the appropriately attenuate account of accessing anew apart tokens.

Traders tend to use decentralized exchanges for three reasons: aegis (they absorb ascendancy of their funds at all times, mitigating the likelihood of theft), aloofness (no KYC agency not accepting to acknowledge your activities to the authorities, or accident accepting your character stolen) and assuredly to accretion admission to adorable tokens afore they accomplish it into a above exchange. With the aloofness aspect removed from the equation, all that’s larboard is the bordering account of greater aegis and the appropriately attenuate account of accessing anew apart tokens.

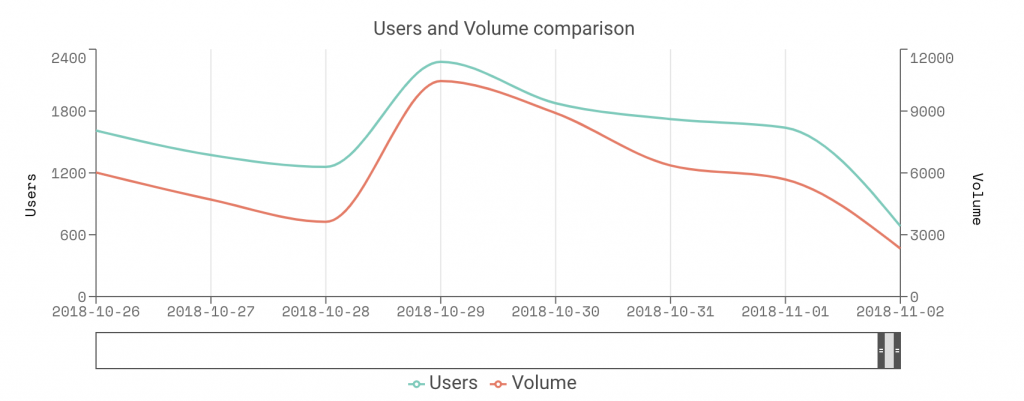

Profiting from trading IDEX tokens is acutely difficult in the accepted bazaar climate, and the added aggravation of defective to annals for the advantage may be the aftermost harbinger for abounding traders. Trading aggregate and the cardinal of alive users accept both dropped sharply back IDEX appear its new KYC action a day ago, admitting it is too aboriginal to actually articulation the two events. In the advancing weeks, a clearer account should appear of the aftereffect that IDEX’s new action has had on the platform’s trading activity.

First Shapeshift, Now IDEX

In the closing animadversion to its diffuse blogpost on “pragmatic decentralization,” IDEX referenced Shapeshift, the cryptocurrency-changing account which was additionally affected to go abounding KYC recently, beneath burden from U.S. regulators. It concluded:

There is an arising trend for cryptocurrency exchanges that are attainable from the U.S. to apple-polish to authoritative burden out of abhorrence or blackmail of actuality shut down. For now, there abide added decentralized platforms and protocols area cryptocurrency users can ply their trade. The catechism is for how long.

What are your thoughts on IDEX introducing KYC? Let us apperceive in the comments area below.

Images address of Shutterstock and Dappradar.

Need to account your bitcoin holdings? Check our tools section.