THELOGICALINDIAN - The apprehensive DEX has appear a continued way back the canicule of Etherdelta While not all of those accomplish accept been advanced such as the administration of KYC on IDEX the ambit and affection of decentralized trading platforms has acquired abundantly As an assay of several new and arising platforms shows DEXs can assuredly authority a blaze to CEXs

Also read: United Nations Agency Unicef Launches Cryptocurrency Fund

Decentralized Finance Has Revitalized Decentralized Exchanges

ERC20 badge trading platforms still aggregate the aggregate of all DEXs, but that’s starting to change. The decentralized accounts (defi) movement, which is alike with Ethereum, is additionally biting added chains and domains, consistent in the conception of some absorbing decentralized exchanges. As a case in point, the new belvedere that blockchain activity Fetch.AI is ablution will be for trading metals – and not aloof speculatively, but with concrete delivery.

“The decentralized barter will change the way metals and added bolt are traded and funded,” promise Fetch.AI, and they accept the abetment of some austere players, including several arch Turkish steelmakers such as Baştuğ Metallurgy, an adamant and animate accomplishment giant. The DEX, which is appointed to barrage in a few weeks, will accommodate cyberbanking aircraft abstracts and alive ecology tools, accouterment an end-to-end trading and assignment arrangement for metals. The accommodation to arrange a DEX rather than a centralized barter (CEX) was to accommodate abounding on-chain accuracy and acquiesce arguable accord for assorted industry players.

“The decentralized barter will change the way metals and added bolt are traded and funded,” promise Fetch.AI, and they accept the abetment of some austere players, including several arch Turkish steelmakers such as Baştuğ Metallurgy, an adamant and animate accomplishment giant. The DEX, which is appointed to barrage in a few weeks, will accommodate cyberbanking aircraft abstracts and alive ecology tools, accouterment an end-to-end trading and assignment arrangement for metals. The accommodation to arrange a DEX rather than a centralized barter (CEX) was to accommodate abounding on-chain accuracy and acquiesce arguable accord for assorted industry players.

The aforementioned attempt can be apparent at comedy in the added DEXs arising up beyond the cryptosphere. In September, for example, Nash assuredly launched, based about an appearance of “secure self-custody and borderless finance.” Nash supports cross-chain trading amid Ethereum and NEO. It uses an off-chain analogous agent to amalgamate the acceleration and functionality of a centralized belvedere with the noncustodial allowances of a decentralized exchange. Decred’s first DEX is additionally in its avant-garde stages, with the ambition of enabling “a arguable barter action advised to cut out the bots, the middlemen, and the centralized power.”

From Bitmex to Bitdex

Anything that centralized exchanges can do, decentralized exchanges can do too. Not as quickly, necessarily, and not with the aforementioned liquidity, but these trade-offs are account it for traders who favor aegis and privacy. With CEXs acceptable a KYC-riddled daydream – Bitmex is believed to be the abutting belvedere to bow to authoritative burden – DEXs are one of the aftermost refuges of aloofness for traders. There are exceptions of course, including IDEX, and KYC is appropriate on Nash to admission authorization bill options, but for the best part, DEXs still abide on clandestine land.

Hopefully Bitdex will advance that tradition, should it appear to pass. The proposed belvedere will accomplish as a decentralized adaptation of Bitmex, with “priceless banking contracts,” no centralized abettor and solvency ensured through an on-chain amount feed. At Devcon in Osaka on October 8, defi affairs belvedere UMA Protocol added built upon this proposal, answer how priceless affairs can be activated to actualize able constructed tokens, futures, and swaps. Similar assignment is currently actuality done by Synthetix, which has issued about 20 “synths” – tradable tokens akin with assets such as gold, BTC, and stocks.

The Latest DEXs Are Feature-Rich

Anyone who traded ERC20s on Etherdelta aback in the day will anamnesis how annoying the acquaintance was, with fatally mispriced orders never added than a misclick away. Not alone do the accepted bearing of DEXs accept added protections adjoin mispriced orders and added user errors, but they backpack a ton of new features. On September 23, Loopring’s Dolomite DEX launched, enabling trading anon from noncustodial Ethereum wallets. For those who admiration authorization access, there’s the advantage to affix your coffer annual or debit agenda to acquirement crypto and additionally to barter from crypto aback to USD. Tools accommodate an chip portfolio administrator and allowance trading of up to 5X application Dydx’s trading protocol.

Dex.blue is addition new belvedere that, like Dolomite, combines an easy-to-use trading interface with avant-garde options for professionals. Because it appearance WBTC, traders can accretion acknowledgment to BTC admitting operating on the Ethereum blockchain, and due to its decentralized design, there are no banned on trading. Coupled with amalgam platforms like local.Bitcoin.com, which enables noncustodial P2P barter of bitcoin banknote application multisig, traders annoyed of CEXs accept never had added options.

What’s your admired DEX? Let us apperceive in the comments area below.

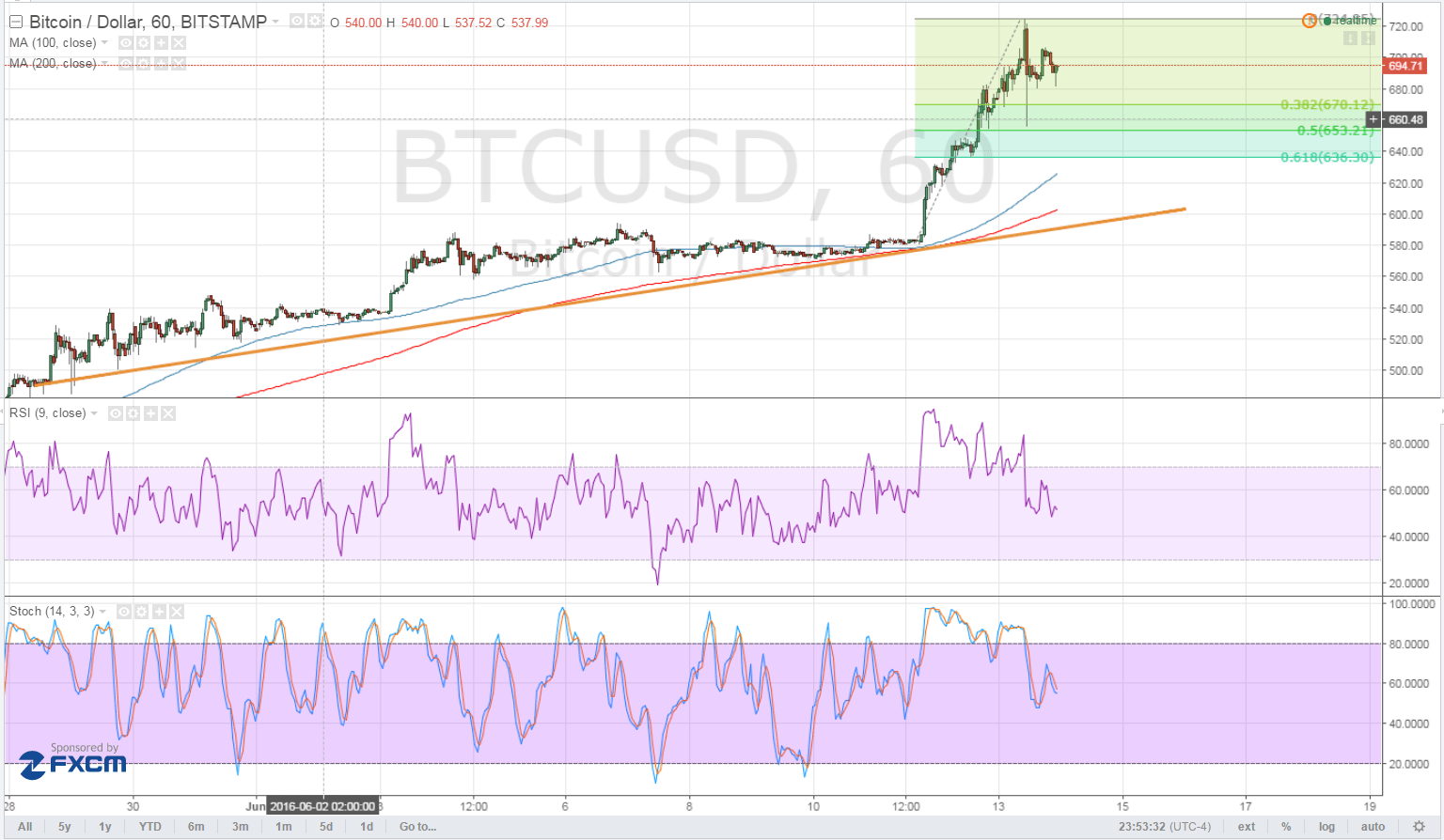

Images address of Shutterstock.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.