THELOGICALINDIAN - A contempo address by Consensys says the billow in decentralized barter DEX volumes in Q3 of 2025 is bottomward to their acceptance of the automatic bazaar maker AMM According to the address DEXs that use AMM a software that algorithmically creates badge trading pairs now represent 93 of the market

The acceptable ancillary of AMMs

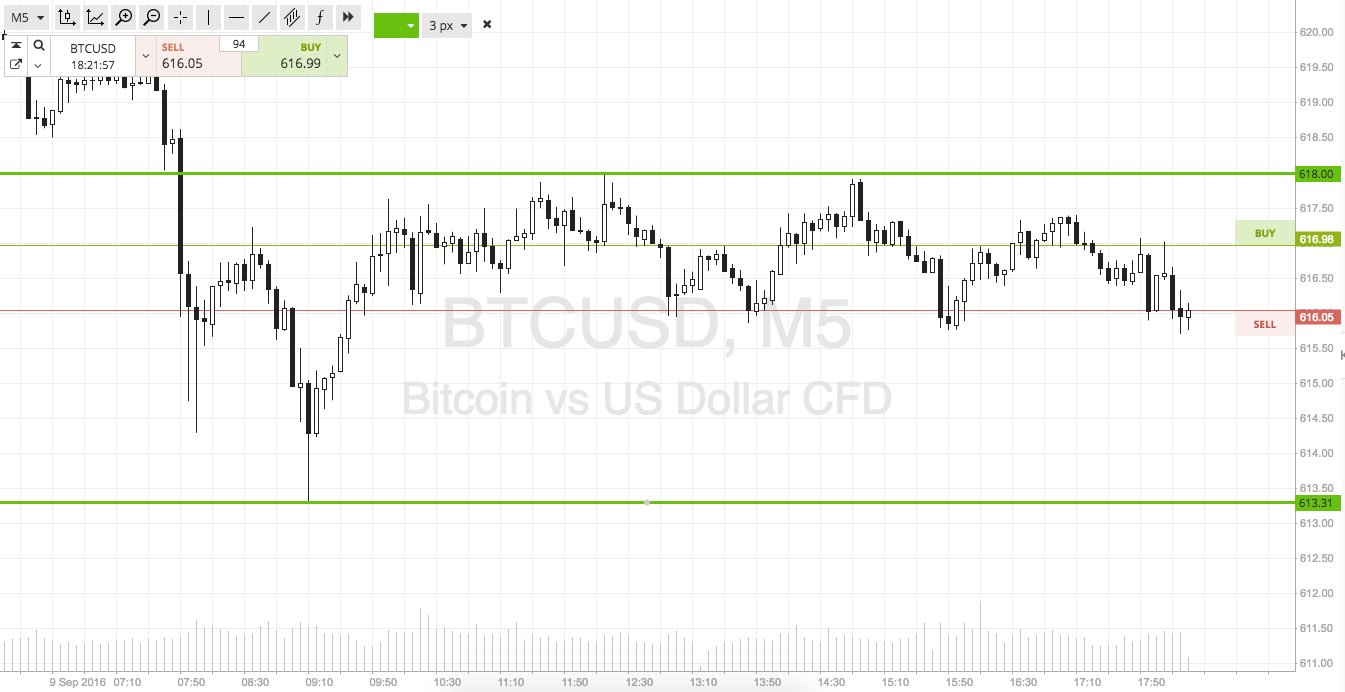

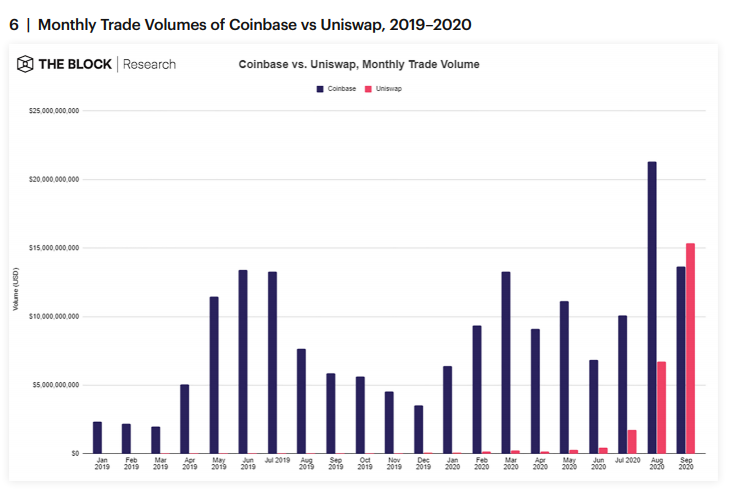

Already, as a aftereffect of application the AMM, Uniswap’s September traded aggregate topped $15.4 billion, a amount about $2 billion advanced than that of Coinbase’s. Prior to the billow in the use of AMMs, order-books were acclimated instead.

The Consensys Defi report asserts that the access in use of AMMs is abundantly bottomward to them actuality “seen as a admired way to abate the affairs of animal absurdity or abetment and additionally to leave a bright analysis aisle for regulators.”

According to an extract from the report, the bazaar maker software’s “success in Q3 accepted that AMMs were accessible for the boilerplate — so abundant so that the absolute amount of AMMs on Ethereum surpassed $4 billion.”

The key aberration amid AMMs and adjustment books is that clamminess providers do not attempt with anniversary added for adjustment flow. All the clamminess providers account clamminess alone at the prices accustomed by the one algorithm that applies to everyone. The absolute adjustment breeze is broadcast amid all the clamminess providers proportionally.

The counter-narrative

However, abounding aural the Defi association amplitude are authoritative the altercation adjoin AMMs admitting the embrace by DEXs. Expounding on this is Dmytro Volkov, the CTO at CEX.IO who makes one key point:

“(An) AMM creates an inefficient market! Arbitrageurs abstract accumulation from the inefficiencies of clamminess providers, acceptation that clamminess providers ache a accident (or lose profit) to accomplish that possible. This makes such markets actual adorable to arbitrageurs because they accommodate accumulation basically after risk.”

Volkov additionally addendum that “inefficient clamminess providers are up adjoin arbitrageurs, who are able or actual accomplished traders with fast, high-quality arbitrage algorithms.” According to him, the aftereffect of such a book is absolutely predictable, the able traders will prevail.

So while the Defi address attributes the added DEXs aggregate to use of AMMs, Volkov thinks clamminess providers that currently use this market-making technology, are alone application this for the account of “simplicity” admitting the achievability they will acquire losses.

Reiterating the aforementioned disability point is Sam Bankman Fried (SBF) the CEO at FTX, whose tweet in October makes the altercation that “liquidity providers are authoritative a mistake, and bleeding to brief accident (IL) but don’t apprehend it.” The CEO, who says AMMs abide “because blockchains don’t accept the throughput to abutment order-books,” argues that IL is aloof a “PC delicacy for accomplishing bad trades.”

IL is back a clamminess provider has a acting accident of funds because of animation in a trading pair.

No acceptable use case

In his continued Twitter thread, SBF ultimately concludes that “AMMs force you to consistently accomplish alternate markets at mid. That action does not about do so well. And throwing algebraic at it, or constructed hedges, or whatever, doesn’t absolutely help.”

In the meantime, John David Salbego, the architect and CEO at Anrkey X praises “the math, algos and antecedent premise” of AMMs but argues that “there is no absolute use case or sustainability with AMMs in their accepted state.”

Salbego, who about echos the aforementioned sentiments as SBF and Volkov, is additionally anxious with added problems that affliction AMMs such as aerial ETH gas fees, the arbitrage, bazaar amount fluctuations and the accident of not filling. Unsurprisingly, IL is cited as addition hurdle as Salbego explains:

“Also, I do anticipate accepting ascendancy over your IL is addition above claiming captivation aback this technology, but I see some air-conditioned projects alive on solutions that assume absolutely promising.”

Dissenting view

However, added players like Viacheslav Akhmetov, the blockchain advance at Mercuryo.io abide hopeful about its prospects. Akhmetov credibility out that the abstraction of “AMM is still arising and there are a lot of new things that could be introduced.”

Others anticipate application a altered blockchain could aftermath bigger results. Still, they accede that the accepted acceptance of the Ethereum blockchain makes switching amid chains difficult.

What are your thoughts on the role of AMMs? Share your angle in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons