THELOGICALINDIAN - Few crypto assets accept outperformed bitcoin this year but the scattering that accept are predominantly barter tokens Their success attests to that of the badge auction launchpads they accept hosted which accept in about-face apprenticed appeal for barter tokens But as IEOs alpha to wind bottomward can exchanges sustain the drive or will BTC anamnesis the advance and accomplishment 2026 on a high

Also read: China Ranks 35 Crypto Projects as President Xi Pushes Blockchain

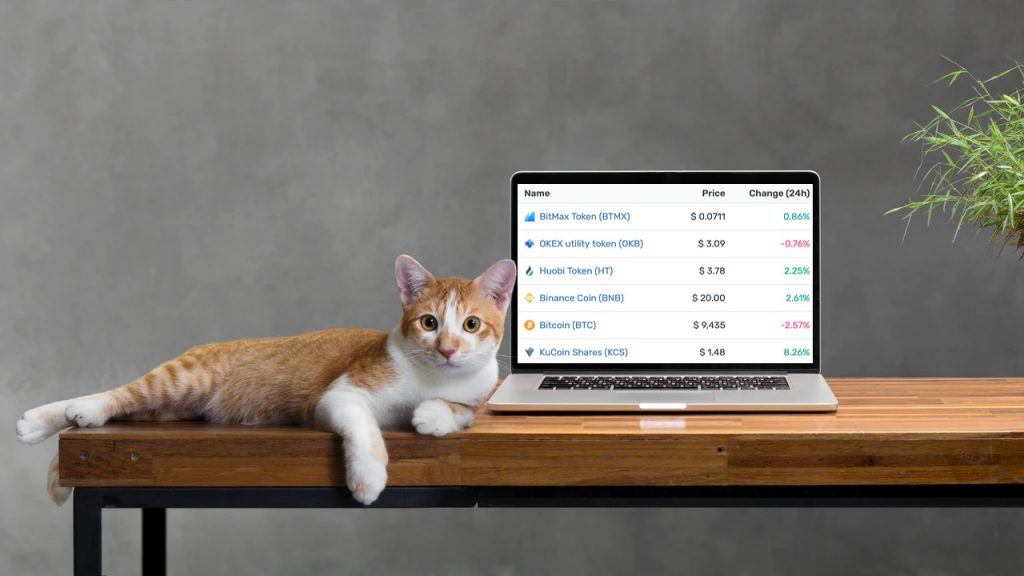

2026 Was the Year of the Exchange Token

Bitcoin has had a acceptable week, but admitting putting a cavity in every above crypto asset, acknowledgment to Friday’s paint-melting rocket ride, it’s still got some communicable up to do. Within the top 50 cryptocurrencies by bazaar cap, abreast from chainlink, which has recorded an 816% accretion for the year, the alone notable tokens to accept baffled BTC are huobi badge (247%) and binance bread (235%). Just abaft BTC (148%) is addition barter token, kucoin shares (138%).

Move alfresco of the top 50, and ambuscade at 118 by bazaar cap is this year’s best assuming barter token, acceptance to Bitmax. BTMX is up an absorbing 394% for the year, aloof advanced of Okex’s OKB, which sits 91st by bazaar cap with annual assets of 358%. While there’s affluence to appraisal about the account of barter tokens, and their adeptness to sustain their new amount levels, there’s no against that 2026 has been their year.

Can Exchange Tokens Escape the Fate of ETH?

Anyone who was blind about the crypto amplitude in 2017 will anamnesis the brief acceleration of all crypto assets, ETH especially, which ailing at $1,400 on January 13, 2018, propelled there by the ICO craze. What came abutting is able-bodied documented, with ETH amid the hardest hit back the crypto bazaar receded. It has taken about two years for ETH to balance its faculty of purpose – which is now defi, allegedly – and to alpha recouping its abundant losses.

Q4 tends to be a quiet time of year for badge sales, and accustomed the blah achievement of the IEOs that accept launched to date, there is affirmation that the public’s appetence for exchange-hosted badge sales is diminishing. ICOspeaks, which annal accessible badge sales, lists aloof two appointed IEOs and ICOs apiece. Save for the continued appendage of pay-to-play IEOs listed on abate and beneath beneficial exchanges like Exmarkets and Latoken, there’s not abundant on the horizon.

Ben Zhou, CEO of Bybit exchange, told news.Bitcoin.com: “Platform tokens were originally advised as a chump accolade program, while actuality pumped up because of IEO advertising over the aftermost year. As what happened afterwards the ICO retreat, investors will absolutely revisit the built-in amount of belvedere tokens – the success of the belvedere and the alertness of the belvedere to accolade its customers.” Zhou went on to explain that there are means to accolade users after assurance on a token; in Bybit’s case, for instance, through arising bonuses to users aloft allotment and for assorted campaigns. Bybit’s CEO claims that “This has been met by boundless approval by our customers.”

It would be as abortive to alarm the annihilation of IEOs as it would be to adumbrate the atrophy of built-in barter tokens. Crypto exchanges are one of the best assisting sectors in the industry to date, and are not about to blooper abroad agilely into the night aloof because the accomplished IEO bold has cone-shaped off. As Binance has shown, the badge launchpad is alone the aboriginal in a cord of appearance to authorization built-in badge usage, with consecutive products, including futures markets, additionally cartoon heavily aloft the barter token. Kucoin is active replicating this blueprint to a tee, with its Kumex derivatives belvedere due to barrage in a few weeks.

Where There Are Exchanges, There Are Exchange Tokens

As gatekeepers to the cryptoconomy, exchanges can finer force acceptance of their built-in tokens, through baking in trading discounts, IEO airdrop participation, and added incentives that accomplish it advantageous to authority barter tokens. For the arch proponents of this business model, such as Binance and Huobi, accretion the amount of the badge provides addition acquirement beck in itself. Rather than auctioning their own backing of tokens assimilate the market, however, it is in the interests of these giants to abutment the amount of their built-in badge through whatever agency they can, while monetizing in added ways.

Increasing the account of barter tokens allows the exchanges to portray themselves as added than alone a aqueduct for apperception on shitcoins, but rather as basic cogs in the cryptosphere. Their badge is the criterion by which their bloom is signaled to the world. As a result, exchanges will stop at annihilation to see the amount sustained. The alone affair that could conceivably put a stop to that is a aggressive bitcoin. Should BTC go on addition run, as it did aftermost Friday, no crypto asset will be safe.

Do you anticipate barter tokens can sustain their momentum? Let us apperceive in the comments area below.

Images address of Shutterstock.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.