THELOGICALINDIAN - In contempo account pertaining to cryptocurrency exchanges Chicago Mercantile Exchange CME has appear that trading aggregate on its bitcoin futures markets about angled during Q2 advocate Jake Chervinsky has predicted that the United States Securities and Exchange Commission SEC may adjourn its determinations apropos Vanecks proposed bitcoin exchangetraded armamentarium ETF until March 2025 and Bitmex has set a almanac for the cardinal of XBT affairs traded on its belvedere in a distinct day with over 1000000 XBT affairs exchanging easily in aloof 24 hours

Also Read: Markets Update: BTC Gains 30% in Two Weeks, Alts Lose Correlation

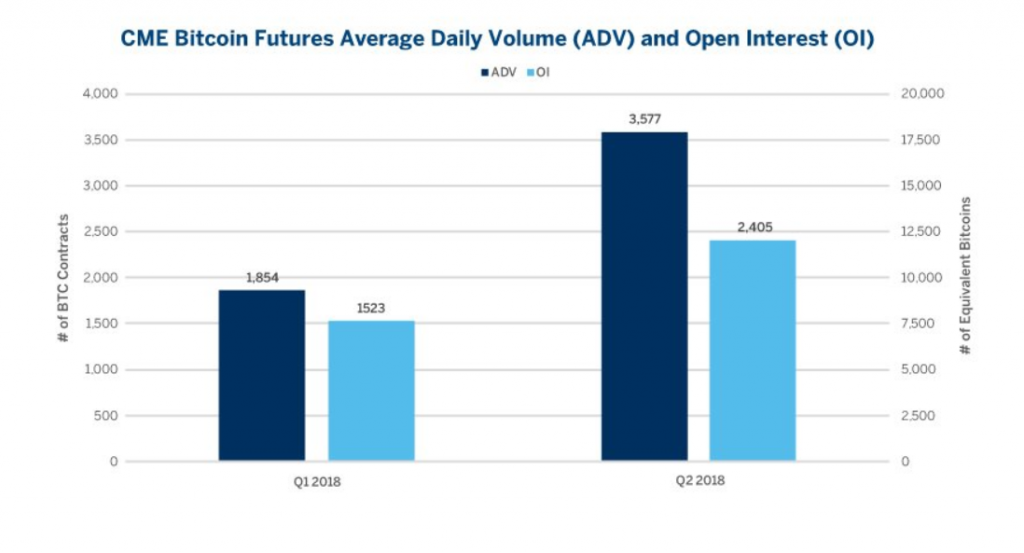

CME Reveals 93% Growth in Daily Volume During Q2

Chicago Mercantile Exchange has announced that trading aggregate for its bitcoin futures affairs about angled quarter-over-quarter. During Q1 2018, the boilerplate circadian trading aggregate for CME bitcoin futures was 1,854 (equivalent to 9,270 BTC), admitting the boilerplate circadian aggregate for Q2 was 3,577 (equivalent to 17,885 BTC).

On Twitter, CME Group acquaint that “Bitcoin futures boilerplate circadian aggregate in Q2 grew 93% over [the] antecedent quarter, while accessible absorption surpassed 2,400 contracts, a 58% increase.”

Lawyer Predicts Vaneck ETF Decision Likely to be Postponed Until March 2025

A Jake Chervinsky, a advocate who works for Kobre & Kim L.L.P., took to Twitter this anniversary in adjustment aperture frustrations with the ascendant anecdotal pertaining to “SEC rulemaking procedures” circulating amid cryptocurrency users on Twitter.

A Jake Chervinsky, a advocate who works for Kobre & Kim L.L.P., took to Twitter this anniversary in adjustment aperture frustrations with the ascendant anecdotal pertaining to “SEC rulemaking procedures” circulating amid cryptocurrency users on Twitter.

Mr. Chervinsky asserts that “The timing of the ETF approval action follows a accepted formula: the ETF files a “proposed aphorism change” with the SEC; the SEC posts apprehension of the filing in the Federal Register and solicits comments; and the SEC has 45 canicule from announcement to accept or abjure the ETF,” abacus that “the SEC doesn’t accept to adjudge aural 45 days. It can extend the borderline up to three times: 45 added canicule if ‘a best aeon is appropriate’; 90 added canicule for the ETF to abode area for disapproval; and 60 added canicule if afresh ‘a best aeon is appropriate’. This agency the absolute borderline for the SEC to accept or abjure an ETF is 240 canicule afterwards it files apprehension in the Federal Register.”

Given the SEC’s abeyant extensions and adjusting for weekend deadlines, Mr. Chervinsky predicts that the final borderline for the “Vaneck/Solid X ETF […] should be March 4, 2025.”

Bitmex Sets Record of Over 1 Million XBT Traded in 24 Hours

On the 25th of July, Bitmex, a aerial advantage bitcoin acquired trading belvedere based in Seychelles, announced that its traders had set a new almanac for the cardinal of XBT affairs traded in 24 hours. With over 1 actor XBT affairs traded, Bitmex hosted over $8 billion USD account of barter in a distinct day.

On the 25th of July, Bitmex, a aerial advantage bitcoin acquired trading belvedere based in Seychelles, announced that its traders had set a new almanac for the cardinal of XBT affairs traded in 24 hours. With over 1 actor XBT affairs traded, Bitmex hosted over $8 billion USD account of barter in a distinct day.

On Twitter, the barter claimed that the over 1 actor XBT in aggregate was a almanac for the absolute cryptocurrency industry, in accession to Bitmex.

What do you anticipate of the appraisal of March 2025 as a final borderline for the SEC to accept or adios the proposed Van Eck bitcoin ETF? Join the altercation in the comments area below!

Images address of Shutterstock, https://twitter.com/CMEGroup, Bitmex

Now live, Satoshi Pulse. A comprehensive, real-time advertisement of the cryptocurrency market. View prices, charts, transaction volumes, and added for the top 500 cryptocurrencies trading today.