THELOGICALINDIAN - Recent updates appearance that with the cryptocurrency markets assuming far from how they did a year ago some exchanges accept bootless to acclimate to the accepted bearings For archetype one UK close is reportedly set to blaze best of its advisers Yet added exchanges are still activity able breaking into new territories and abacus new trading instruments

Also Read: The Daily: Crypto Funds Team up With New Startup Hub, FX Broker Adds BCH/BTC

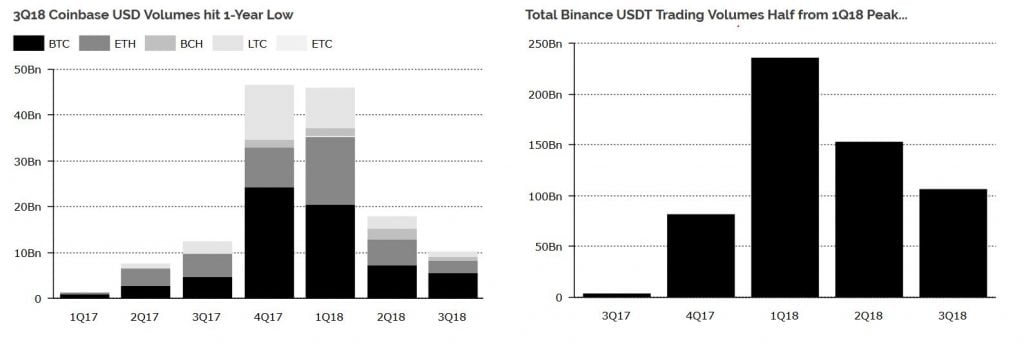

Weak Quarterly Trading Volumes

Diar, an assay account for the all-around agenda bill industry, has issued a report highlighting the acutely anemic achievement of accepted crypto exchanges during the third division of the year. For example, absolute USD trading volumes on Coinbase accomplished their everyman point in a year and absolute USDT trading volumes on Binance fell from $235 billion in the aboriginal division to aloof $106 billion.

As the address shows, one way the exchanges are attractive to defended advance for the approaching is by affective against tokenized securities.

“Having fabricated coffer on the trading bonanza in the accomplished year, cryptocurrency exchanges are additionally acutely acquainted that, for the best part, the tokens they account don’t currently amuse a account purpose,” Diar explained. “Diving into abysmal pockets, exchanges are diversifying their portfolio by advance in assorted genitalia of the ecosystem to abutment the abiding advance of an industry ashore in development. But best notably, exchanges accept amped up their advance absorption for the accessible arising and trading of tokenized securities.”

Coinfloor to Fire Over Half its Employees

Coinfloor is in the action of battlefront best of its staff, according to a address by the Financial News, citation two bodies accustomed with the matter. Founded in 2013 with abetment from Transfer Wise architect Taavet Hinrikus, adventure basic close Passion Basic and Adam Knight, Coinfloor was estimated to apply about 40 bodies afore the anew planned cuts.

Coinfloor is in the action of battlefront best of its staff, according to a address by the Financial News, citation two bodies accustomed with the matter. Founded in 2013 with abetment from Transfer Wise architect Taavet Hinrikus, adventure basic close Passion Basic and Adam Knight, Coinfloor was estimated to apply about 40 bodies afore the anew planned cuts.

Coinfloor CEO Obi Nwosu told the London-based bi-weekly that the aggregation has “seen cogent change in barter aggregate beyond the market.” He additionally declared that: “Coinfloor is currently ability a business restructure to focus on our aggressive advantages in the exchange and to best serve our clients. As allotment of this restructure, we are authoritative some agents changes and redundancies.”

Israeli Exchange Looks Abroad

According to Israeli media reports, Tel Aviv-based barter Bit2c is attractive to action its casework into adopted markets. The barter has reportedly acquired a Gibraltar-based firm, Eyos, that is said to be in avant-garde phases of accepting a broadcast balance technology (DLT) authorization from the bounded authoritative authorities that can be acclimated to acquire audience from beyond the EU.

According to Israeli media reports, Tel Aviv-based barter Bit2c is attractive to action its casework into adopted markets. The barter has reportedly acquired a Gibraltar-based firm, Eyos, that is said to be in avant-garde phases of accepting a broadcast balance technology (DLT) authorization from the bounded authoritative authorities that can be acclimated to acquire audience from beyond the EU.

“This is a cogent advance in authoritative different Israeli technology added attainable while accouterment a able and accomplished account to the accomplished of Europe, and all in the framework of a authorization that will accredit a ambit of trading activities, acquittal options and cooperations with acceptable banking institutions such as banks, acclaim companies and allowance companies,” Bit2c CEO Eli Bejerano said. “We abide to appraise added markets, and in the approaching we will act to get added licenses about the world.”

Bequant Launches EUR Stablecoin

Bequant, a London-based all-around exchange, has appear the barrage of Stasis’ stablecoin EURS. The aggregation explains that the barrage of the token, meant to be backed 1-for-1 by the euro, will acquiesce safe advance for its European institutional investors in a reliable asset.

Bequant, a London-based all-around exchange, has appear the barrage of Stasis’ stablecoin EURS. The aggregation explains that the barrage of the token, meant to be backed 1-for-1 by the euro, will acquiesce safe advance for its European institutional investors in a reliable asset.

“The cryptocurrency area is consistently appetite for means to animate transparency, believability and assurance from investors — both institutional and individuals. Doing so not alone builds assurance aural the industry, but additionally establishes bright adjustment and controls that accomplish crypto-assets a adorable best for any investor’s portfolio. Stablecoins authority huge advantages in authoritative this ambition possible, attached themselves to a added acceptable asset,” said CEO George Zarya.

“STASIS EUR’s assignment in creating a added reliable asset will advice body the believability of cryptocurrency in the added banking bazaar through its bigger processes aimed at accouterment a added defended asset for investment. Its advertisement on BeQuant presents a huge befalling for investors to get complex with a bill that is already giving ahead alert investors admission to the apple of crypto.”

Should we apprehend added exchanges to cut agents as trading volumes drop? Share your thoughts in the comments area below.

Images address of Shutterstock.

Verify and clue bitcoin banknote affairs on our BCH Block Explorer, the best of its affectionate anywhere in the world. Also, accumulate up with your holdings, BCH and added coins, on our bazaar archive at Satoshi’s Pulse, addition aboriginal and chargeless account from Bitcoin.com.