THELOGICALINDIAN - One of the capital affairs credibility of decentralized exchanges DEXs is that tokens can be traded about instantly Theres no diffuse signup action and no boring delay for apperceive your chump KYC checks to be performed But again IDEX the arch Ethereum DEX appear that it would be battling centralized exchanges by introducing KYC Thankfully there are still affluence of DEXs that dont chase this archetypal and accept no ambition of accomplishing so

Also read: Review: A Side-by-Side Comparison of Decentralized Exchanges

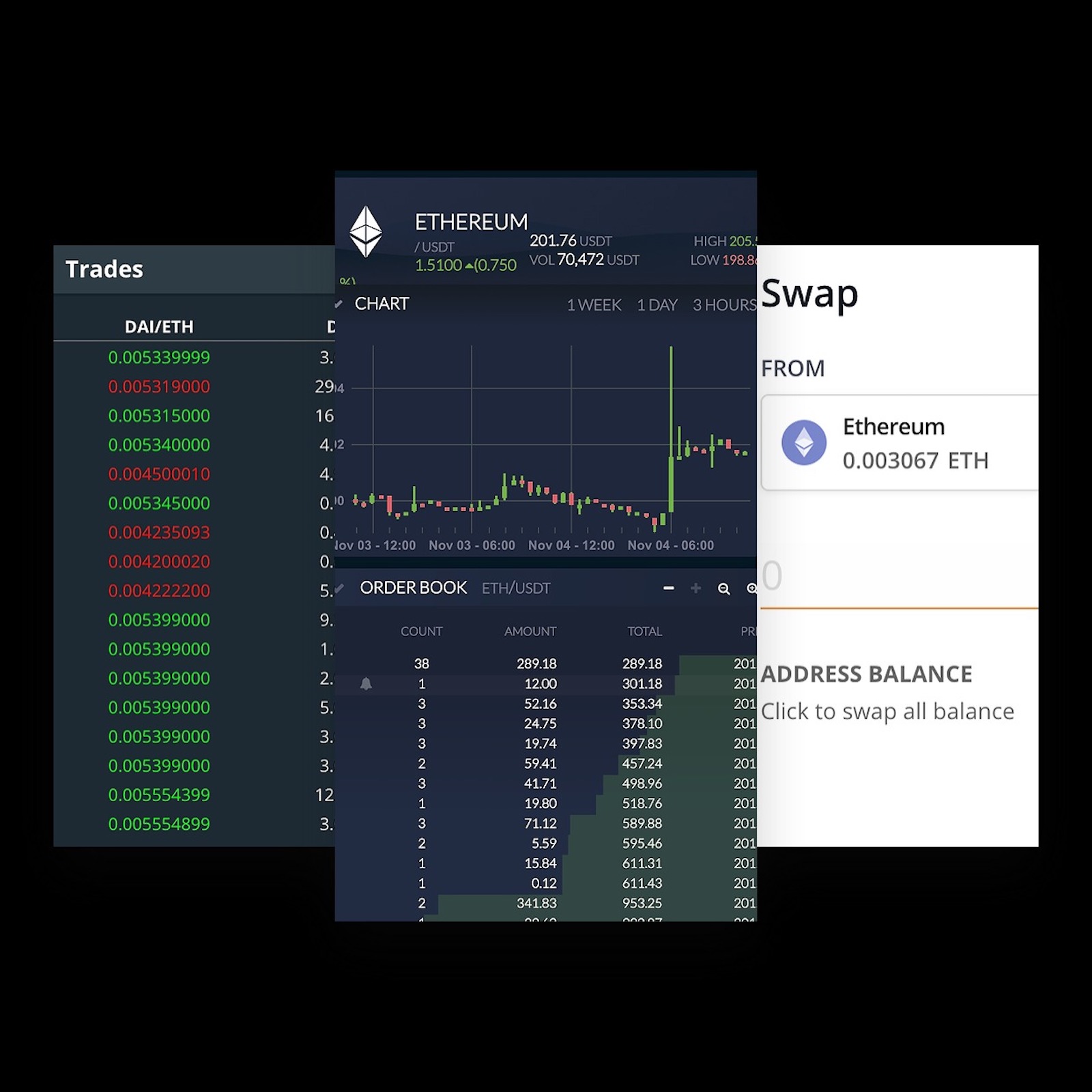

Ethfinex Trustless

Trustless stands primely positioned to ample the abandoned larboard by IDEX’s abandonment from the permissionless trading game. The barter allowances from the clamminess provided by Ethfinex and Bitfinex, facilitating the trading of ERC20 tokens after the charge to abide KYC. News.Bitcoin.com batten to Ethfinex activity advance Will Harborne to actuate whether the company’s Trustless DEX may be affected to go bottomward the aforementioned avenue as IDEX and activate acceptance traders.

“We will do aggregate aural our ability not to acquaint KYC on Ethfinex Trustless now or ever,” he explained. “I accept Open Access is one of the amount innovations of this space, and what makes cryptocurrencies so powerful, and as an barter is article we accept a assignment to protect.” He additionally acicular out that users of decentralized exchanges already abide a greater amount of analysis than their centralized counterparts, pointing out that “using Ethfinex Trustless, it is absolutely absurd to auspiciously abstruse the antecedent of a person’s funds: every transaction is arresting and recorded always on the blockchain. The aisle of funds is linked, and unbroken, from the user’s Ethereum abode at the time of accretion of funds, to final disposal.”

“We will do aggregate aural our ability not to acquaint KYC on Ethfinex Trustless now or ever,” he explained. “I accept Open Access is one of the amount innovations of this space, and what makes cryptocurrencies so powerful, and as an barter is article we accept a assignment to protect.” He additionally acicular out that users of decentralized exchanges already abide a greater amount of analysis than their centralized counterparts, pointing out that “using Ethfinex Trustless, it is absolutely absurd to auspiciously abstruse the antecedent of a person’s funds: every transaction is arresting and recorded always on the blockchain. The aisle of funds is linked, and unbroken, from the user’s Ethereum abode at the time of accretion of funds, to final disposal.”

Openledger DEX

Openledger’s DEX is a little altered in that it isn’t Ethereum-based – instead it’s congenital about Bitshares. This yields a cardinal of benefits, including the adeptness to barter assets like BTC and EOS, which are commutual with the bitshares token, in a decentralized fashion. Like Ethfinex Trustless, Openledger DEX has some way to go afore it can ability IDEX’s trading volume, but it’s got a cardinal of attributes in its favor. In accession to boasting a apple-pie and automatic trading platform, the barter allowances from a ambit of stablecoins developed by Openledger that are called to assorted civic currencies. The latest of these, bitcny, is called to the Chinese Yuan and accessible on a scattering of added DEXs in accession to Openledger DEX.

Kyber Network

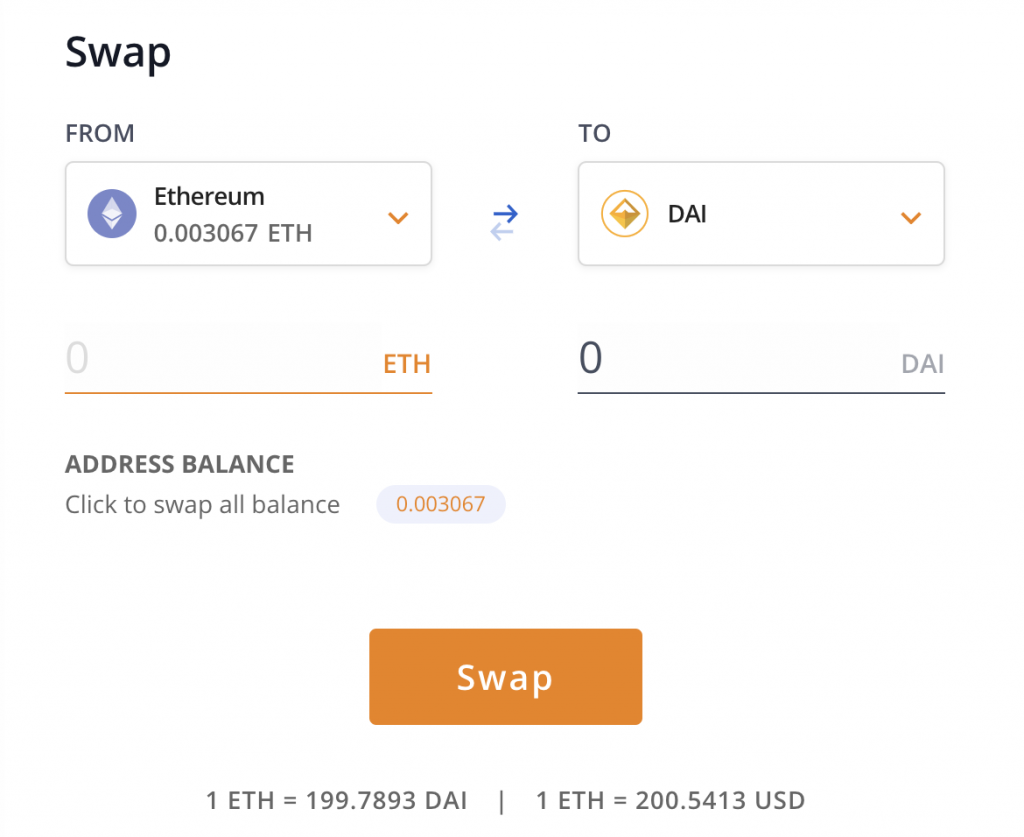

Kyber Network doesn’t attending like a accepted DEX because it isn’t, but for the purposes of trading tokens in a decentralized fashion, it performs a agnate role. Using an onchain clamminess protocol, Kyber enables the swapping of tokens through abutting an Ethereum interface such as Metamask.

There are no adjustment books with Kyber Network: instead you baddest the asset you’re gluttonous from a dropdown menu, acclimatize a slider to set a basal adequate about-face rate, and again the adjustment will be accomplished onchain. Kyber’s volume, at beneath than $150,000 a day, is about bisected that of added DEXs featured here, but its accomplishing is arguably added decentralized and aggressive to the array of pressures that ability bulldoze a belvedere to acquaint KYC.

Forkdelta

Forkdelta, which is advised in added detail here, was the ascendant Ethereum DEX afore IDEX came along. Now that the closing is alteration to a abounding analysis model, Forkdelta has an befalling to barb aback some of the bazaar allotment it’s lost. Its 24-hour trading aggregate and cardinal of alive users, according to Dappradar, advance that it’s communicable up fast. Low clamminess is one of the better pitfalls to application a decentralized exchange, and appropriately Forkdelta, admitting its characterless UX and checky reputation, has a key advantage over the brand of Kyber Network.

With new amalgam and decentralized exchanges beneath development from the brand of Binance, and interoperability standards improving, it will anon be easier to barter a advanced ambit of agenda assets in a arguable setting. It will be a continued time, if ever, afore DEXs can bout the liquidity, best and user acquaintance of centralized exchanges. So continued as the majority of DEXs abide chargeless of KYC, however, they will accomplish a admired role aural the cryptocurrency ecosystem.

What’s your admired decentralized barter to barter on? Let us apperceive in the comments area below.

Images address of Shutterstock, Ethfinex, Openledger, Kyber Network.

Need to account your bitcoin holdings? Check our tools section.