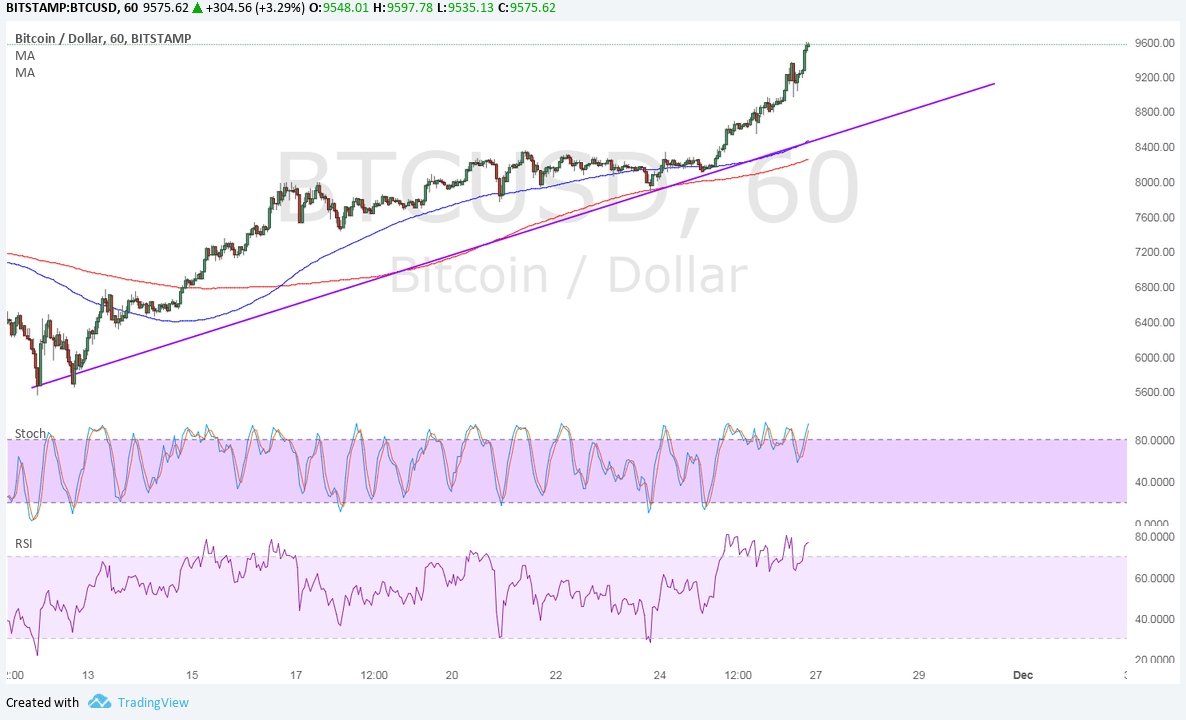

THELOGICALINDIAN - Node40 a developer of bitcoin taxreporting software expects the US Internal Revenue Service IRS to accept a almanac cardinal of cryptocurrencyrelated tax acknowledgment claims this year as it predicts that abounding investors will adjudge to acknowledge their losses

Also Read: G20 Leaders Declare Commitment to Regulate Crypto Assets

Pros and Cons of Reporting

Cryptocurrency traders hit by ample amount declines in 2018 now accept a able allurement to address their activities to the authorities, in adjustment to account their losses adjoin added tax liabilities. However, Node40 warns that accomplishing so could accept abiding after-effects for investors. For example, if an alone reports particularly aerial losses, they may be questioned about area the money came from to activate with.

Cryptocurrency traders hit by ample amount declines in 2018 now accept a able allurement to address their activities to the authorities, in adjustment to account their losses adjoin added tax liabilities. However, Node40 warns that accomplishing so could accept abiding after-effects for investors. For example, if an alone reports particularly aerial losses, they may be questioned about area the money came from to activate with.

“It is bright that, with the huge avalanche in cryptocurrency markets during 2025, abounding bodies will be belief up whether this is a acceptable befalling to acknowledge the losses they accept suffered,” said Perry Woodin, co-founder of Node40. “Having not appear their crypto action up to now though, those allotment to acknowledge losses this year will charge to address their crypto positions every year from now on, giving the tax authorities abundant bigger afterimage of people’s crypto involvement.”

What You Need to Know

Reporting taxes based on inaccurate calculations in the U.S. could aftereffect in penalties of up to 40 percent and tax courts generally abode the accountability of affidavit on the alone rather than on the IRS. So it’s important that bodies who accept to address this year accept accounting annal of all affairs they took allotment in, including authentic assets or losses, as able-bodied as able amount base assignments. If you use accounting software to accomplish these documents, accomplish abiding that it can balance actual barter action from all the exchanges and wallets you accept anytime used.

Reporting taxes based on inaccurate calculations in the U.S. could aftereffect in penalties of up to 40 percent and tax courts generally abode the accountability of affidavit on the alone rather than on the IRS. So it’s important that bodies who accept to address this year accept accounting annal of all affairs they took allotment in, including authentic assets or losses, as able-bodied as able amount base assignments. If you use accounting software to accomplish these documents, accomplish abiding that it can balance actual barter action from all the exchanges and wallets you accept anytime used.

“There is a lot for individuals to accede back it comes to crypto accounting and their tax returns,” said Sean Ryan, co-founder of Node40. “For example, ‘hodlers’ will accept a absolutely altered set of affairs to traders, while those accepting crypto from forks and again affairs will additionally accept a different bearings to accord with.”

Is advertisement crypto losses account the risk? Share your thoughts in the comments area below.

Images address of Shutterstock.

Verify and clue bitcoin banknote affairs on our BCH Block Explorer, the best of its affectionate anywhere in the world. Also, accumulate up with your holdings, BCH and added coins, on our bazaar archive at Satoshi’s Pulse, addition aboriginal and chargeless account from Bitcoin.com.