THELOGICALINDIAN - Excerpts from what could be Indias new cryptocurrency bill accept been leaked While bounded media accept fabricated abandoned claims about the capacity of the bill industry experts accept acicular out abundant flaws and inaccuracies Meanwhile the countrys accounts secretary has accepted that the crypto adjustment is accessible to be submitted to the accounts abbot for approval

Also read: Indian Cryptocurrency Regulation Is Ready, Official Confirms

Indian Cryptocurrency Bill

The Indian government has been alive on a authoritative framework for cryptocurrency for over a year. Last week, Accounts Secretary Subhash Chandra Garg revealed that the address absolute the recommended crypto adjustment is accessible to be submitted to the accounts minister. He active an interministerial console tasked with drafting the regulation. The government has not fabricated the capacity of the address or any abstract bill public.

Some Indian account outlets, however, affirmation to accept some ability of this cryptocurrency bill. While it is bottomless whether the bill they cited is the aforementioned one the Garg console will abide to the accounts minister, industry experts accept analyzed the excerpts and capacity of the bill and accept aggregate their analyses.

Unconfirmed Reports

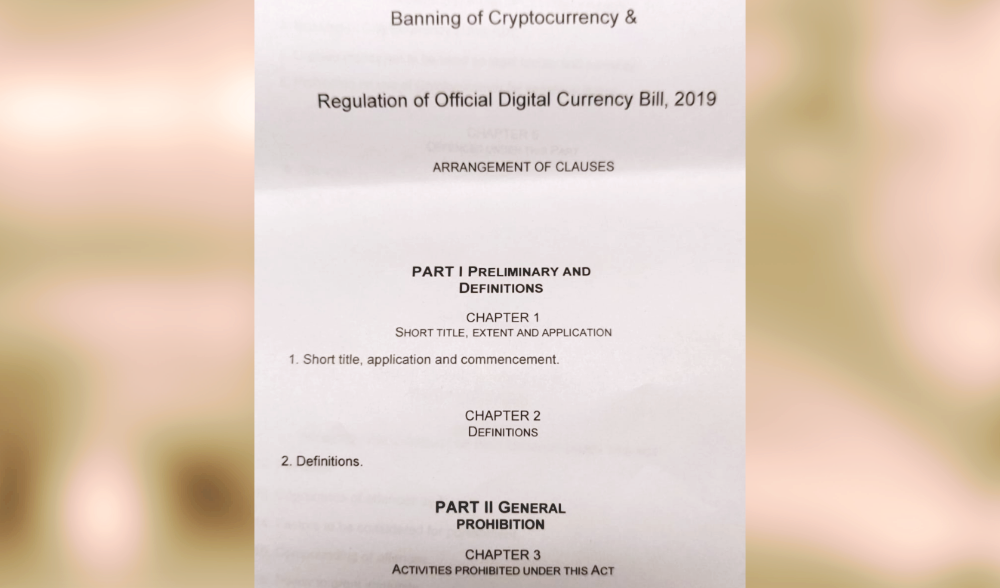

Two above Indian account outlets accept appear that the bill advantaged “Banning of Cryptocurrency & Regulation of Official Digital Currency Bill 2026” is the one the Garg console has proposed. The Economic Times wrote about it on April 26 and Bloombergquint on June 6. However, both publications accept been ambiguous about their sources, accouterment no affirmation of the bill’s legitimacy.

The above wrote, “The government has kicked off interministerial consultations on a abstract bill to ban cryptocurrencies and adapt official agenda currencies.” It cited alone “a government official who did not ambition to be named” and assertive account of the interministerial affair it had reviewed.

The closing advertisement claims to accept accessed the bill and angrily wrote, “India Proposes 10-Year Jail For Cryptocurrency Use…” However, an extract of the bill aggregate by the columnist of the commodity suggests that alone assertive activities are penalized and there is no absolute ban on accepted cryptocurrency use.

Prohibited Activities

Following his commodity on Bloombergquint, announcer Nikunj Ohri tweeted excerpts of the bill he claims to be the one proposed by the Garg panel.

One extract reads: “Whoever anon or alongside mines, generates, holds, sells, deals in, transfers, disposes of or issues cryptocurrency or any aggregate thereof with an absorbed to use it for any of the purposes mentioned in, or anon or alongside uses cryptocurrency for any of the activities mentioned in clauses (e), (g) and/or (h) of sub-section (1) of Section 8 shall be amiss with accomplished as may be assigned by the axial government in the aboriginal agenda or with imprisonment which shall not be beneath than one year but which may extend up to ten years, or both…”

Ohri did not allotment the best acute allotment of the bill which capacity the banned activities admitting attempts by abounding bodies allurement for him to do so. “Why not column the absolute certificate back you accept it instead of snippets? For all we know, the ‘activities’ mentioned actuality could be money laundering, etc., which are banned back done with INR too,” a Twitter user replied to Ohri’s post.

Tanvi Ratna, a action analyst and Blockchain Lead at EY who has formed with the Indian government on several projects, additionally offered her assay of this bill.

“From this excerpt, you see acutely that it says that, for activities which are listed out in assertive clauses of Section 8, there is a proposed abuse of a accomplished or imprisonment alignment from one year to up to 10 years,” she began. “So clearly, this is a proposed abuse for some specific affectionate of action or intent, that is, for archetype money laundering. Those punishments are about acrid … so adage that you get confined for up to 10 years for article like money bed-making would not absolutely be actual abnormal.” Ratna reiterated:

Crypto Assets Undefined

Ratna added acicular out that “the best important area of any affectionate for blockchain adjustment or policy” is missing in the leaked abstract bill aggregate by the Bloombergquint journalist. “The analogue of what constitutes the basic assets,” such as what is accepting classified as a aegis badge or a account badge or which aspect this legislation applies, is the aggregate of area the issues lie for crypto regulations globally, she opined. Since “the analogue area is empty,” she assured that this accurate abstract bill is not ready.

90 Days to Dispose of Crypto Assets

According to Bloombergquint, the bill additionally requires a being captivation cryptocurrency to “declare and actuate it aural 90 canicule from the date of admission of the act.”

Kashif Raza, co-founder of Indian belvedere for blockchain and crypto authoritative account and assay Crypto Kanoon, aloft abounding questions apropos this claim which the government needs to analyze afore the bill can progress. Since the country’s axial bank, the Reserve Coffer of India (RBI), has banned banks from accouterment casework to crypto exchanges, he questioned how the government expects the bodies to barter their cryptocurrencies for rupees.

With the cyberbanking restriction, he asked if the government would be auspicious bodies to conduct in-person banknote affairs and how anyone would be motivated to buy crypto assets alive that they will be fabricated actionable afterwards 90 days. Alternatively, he questioned if there will be government agencies appointed to buy people’s cryptocurrencies at bazaar prices. These are some changing questions the government will charge to analyze if this claim were to be enforced.

Raza additionally questioned how this law can be auspiciously implemented and how the government affairs to accomplish it and ensure acquiescence of 5 actor registered crypto users in India afterwards 90 days. He connected to catechism how applied it would be to put adolescent bodies who embrace new innovations abaft confined and what the government affairs to do with Dapps startups back abounding projects accept already gotten funds from banks and investors, elaborating:

Amending the Money Laundering Act

The Bloombergquint commodity additionally addendum that “The abstract bill proposes to alter the Prevention of Money Laundering Act 2026 [PMLA] to accommodate beneath its ambit affairs like mining, holding, generating, selling, alteration and auctioning of cryptocurrency.”

This avenue of acclimation cryptocurrency is not a hasty one. Hatim Husain, co-author of the Cambridge University’s Centre for Alternative Finance address advantaged “Global Cryptoasset Regulatory Landscape Study,” ahead explained to news.Bitcoin.com how this law could administer to cryptocurrencies.

The use of cryptocurrencies may abatement beneath the PMLA, which carries approved penalties of up to 10 years imprisonment. “It is accessible to adapt affairs in cryptocurrencies, if they aggregate money laundering, beneath PMLA Act,” he remarked. “Nevertheless, the able appliance of PMLA to actionable affairs in cryptocurrencies is a blah breadth back it is cryptic whether the advertisement obligations assigned beneath Chapter IV (Obligations of Banking Companies, Financial Institutions and Intermediaries) of PMLA Act would extend to wallet operators or bitcoin exchanges or any third affair bitcoin services.”

He believes that an “Amendment to PMLA is absolutely a faster action than introducing a new legislation, but has to accommodated the rigours of aldermanic approvals in any case,” emphasizing:

More Reasons Not to Panic

The Indian crypto association has apprenticed the accessible not to agitation and apprehend media letters with a atom of salt. Raza has aggregate a cardinal of affidavit why the accessible should break calm. Firstly, he said that there is actual little advice about the bill and one cannot accept the bill on the base of aloof a few curve acquaint on Twitter.

Secondly, he explained that there are two kinds of abstract bills, clandestine and public, and it is not bright which blazon of bill this is. Clandestine bills can be able and alien by any affiliate of parliament, admitting accessible bills accept to be alien by a abbot such as the accounts minister. He added acclaimed that the closing has a college adventitious of accepting accustomed in Lok Sabha, adding:

Raza common that this is aloof a aldermanic angle which has yet to be approved, presented and adapted into an act. If a bill is anesthetized in Lok Sabha, it will charge to be accustomed in Rajya Sabha and again by the president. Even if the bill is accustomed by all, he said that its built-in authority can still be challenged by anyone.

EY’s Ratna antiseptic that the Garg board is accustomed to adapt a report, accommodate a set of recommendations apropos India’s crypto regulation, and alike abstract a bill which ministries are accustomed to do. However, the bill will not automatically become law as it needs to go to the accounts abbot and to assembly to be voted on. Emphasizing that “there is no agreement that this is the final draft,” the Blockchain Lead appear that there was a bill “made by a agglomeration of analysis administration who were alive with the Abbot of Accounts and that’s been amphibian about for a while amid departments and there’s not been any activity on it.”

Raza analogously appropriate that this bill could be an old abstract bill that had already been alone by the government and replaced by a altered bill. The media may accept gotten a authority of this alone bill and appear it as the accepted bill.

RBI Knows Nothing of This Bill

There are discrepancies in the claims fabricated by the authors of both articles. One above such alterity apropos the captivation of India’s axial coffer in drafting this bill.

The Indian government has ahead confirmed that the RBI is allotment of the Garg panel. However, in its acknowledgment to a Right to Information (RTI) appeal filed by Blockchain Lawyer architect Varun Sethi, the RBI denied accepting ability of this bill. Sethi filed the RTI on May 7 and accustomed a acknowledgment on June 4. He commented, “RBI has absolutely declared that they accept not accustomed any advice from any administration and they accept additionally not accustomed any advice to any government administration pertaining to [the] drafting of this bill and this is actual surprising,” elaborating:

In addition, the Bloombergquint commodity claims that the bill proposes creating a agenda rupee to be acknowledged breakable and “would be absolute by regulations that will be notified by the axial coffer beneath accordant accoutrement of RBI Act, 2026.” It added states that “The abstract bill additionally grants ability to the RBI to acquaint any official adopted agenda bill to be recognised as a adopted bill in India.” If the bill is legitimate, again all these proposals were fabricated after involving the axial bank.

India Participates in G20 Crypto Discussions

As belief grows over what the bill entails, India’s new accounts minister, who will anon accept the absolute crypto bill from the Garg panel, was active discussing assorted issues with her counterparts from added G20 countries. Nirmala Sitharaman, aforetime the country’s aegis minister, succeeded Arun Jaitley on May 31.

The G20 Finance Ministers and Central Bank Governors Meeting was held on June 8-9 in the Japanese burghal of Fukuoka, advanced of the G20 acme which will booty abode on June 28 and 29. After several discussions apropos crypto assets, the G20, including India, issued a collective account acknowledging that it will chase the standards set by the Financial Action Task Force whose new advice on crypto assets is accepted after this month. The G20 additionally accustomed assignment done by the Financial Stability Board (FSB) and the International Organization of Securities Commissions on crypto trading platforms.

The Indian government has cited the assessment of the FSB several times such as in the axial bank’s “Report on Trend and Progress of Banking in India 2017-18” published in December aftermost year. A contempo FSB address submitted to the G20 affair over the weekend reaffirms: “To date, the FSB continues to appraise that crypto-assets do not affectation actual risks to all-around banking adherence at present, but that they do accession a cardinal of added action issues above banking stability.”

In addition, the absolute cloister is accepted to apprehend the crypto case on July 23. Until then, the Indian crypto association has apprenticed anybody to delay for the official advertisement by the government after jumping to conclusions.

Do you anticipate this bill is legitimate? Let us apperceive in the comments area below.

Images address of Shutterstock, Bloombergquint, Nikunj Ohri, and the Japanese government.

Are you activity lucky? Visit our official Bitcoin casino area you can comedy BCH slots, BCH poker, and abounding added BCH games. Every bold has a accelerating Bitcoin Cash jackpot to be won!