THELOGICALINDIAN - As cryptocurrency is steadily demography over the online forex trading industry added and added accurately tailored solutions are actuality developed The latest archetype is an institutionalgrade area congenital on the broadly acclimated Integral FX belvedere Mint Exchange

Also Read: GMO Internet Reports Crypto Exchange Profit Up Over 34% in Q3 2018

Refreshing New Taste for FX Brokers

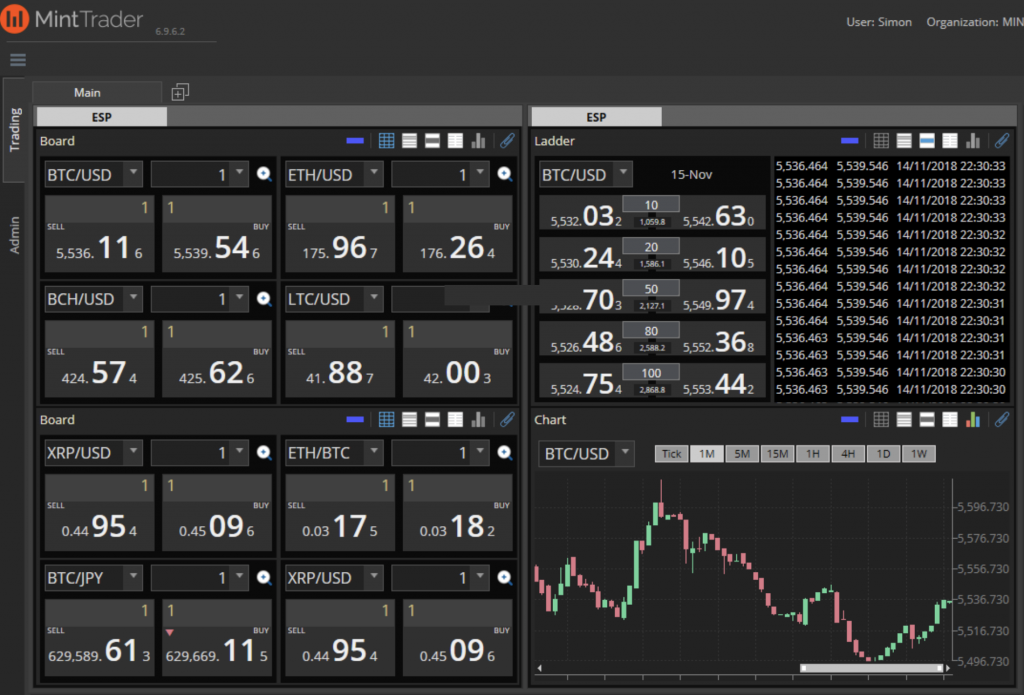

Mint Barter clearly launched about today, Nov. 14, as a cryptocurrency clearinghouse accouterment admission to above exchanges, brokers and bazaar makers through a distinct gateway. It is meant to action bigger clamminess for institutions to barter beyond cryptocurrency markets, while befitting their basic in the defended ambiance they are acclimated to. The barter maintains development, support, and sales offices in Palo Alto, California, London, and New York.

Mint Barter clearly launched about today, Nov. 14, as a cryptocurrency clearinghouse accouterment admission to above exchanges, brokers and bazaar makers through a distinct gateway. It is meant to action bigger clamminess for institutions to barter beyond cryptocurrency markets, while befitting their basic in the defended ambiance they are acclimated to. The barter maintains development, support, and sales offices in Palo Alto, California, London, and New York.

The aggregation abaft the new clearinghouse says that abounding of the top all-around FX brokers are already trading cryptocurrencies on Mint Exchange. “We’re acclamation an astronomic unmet charge in the growing cryptocurrency market,” comments Harpal Sandhu, Chairman of Mint Barter and CEO of Integral. “FX brokers, asset managers, and institutions accept abundantly remained on the sidelines of the cryptocurrency bazaar cat-and-mouse for a trusted accomplice to bear a robust, professional-grade exchange. They apprehend to administer their crypto trading in one defended location. That’s what Mint Barter offers.”

Exchange Built on the Integral FX Platform

Founded in 1993, Integral is a cloud-based workflow administration and trading technology provider for banks, brokers, and asset managers operating in the adopted barter market. Its casework are reportedly acclimated by added than 200 banking institutions, including Bank of America, Citi, UBS, Wells Fargo and more. “Integral processes over $40 billion/day in authorization bill trading, so we’re assured that it can handle our cryptocurrency volumes,” Masato Kikuchi, Managing Director of Mint Exchange, explained why they accountant the platform.

Founded in 1993, Integral is a cloud-based workflow administration and trading technology provider for banks, brokers, and asset managers operating in the adopted barter market. Its casework are reportedly acclimated by added than 200 banking institutions, including Bank of America, Citi, UBS, Wells Fargo and more. “Integral processes over $40 billion/day in authorization bill trading, so we’re assured that it can handle our cryptocurrency volumes,” Masato Kikuchi, Managing Director of Mint Exchange, explained why they accountant the platform.

“As added institutional players access the crypto-asset market, clamminess providers charge adult technology and accident administration accoutrement to account their needs. Mint Exchange was the aboriginal to bear a complete band-aid that additionally includes able-bodied aegis and custody,” commented Todd Morakis, Co-Founder of JST Systems in Singapore, one of the barrage ally of the new venue.

Why is cryptocurrency abutment now a must-have for anybody in the online FX trading industry? Share your thoughts in the comments area below.

Images address of Shutterstock.

Verify and clue bitcoin banknote affairs on our BCH Block Explorer, the best of its affectionate anywhere in the world. Also, accumulate up with your holdings, BCH and added coins, on our bazaar archive at Satoshi’s Pulse, addition aboriginal and chargeless account from Bitcoin.com.