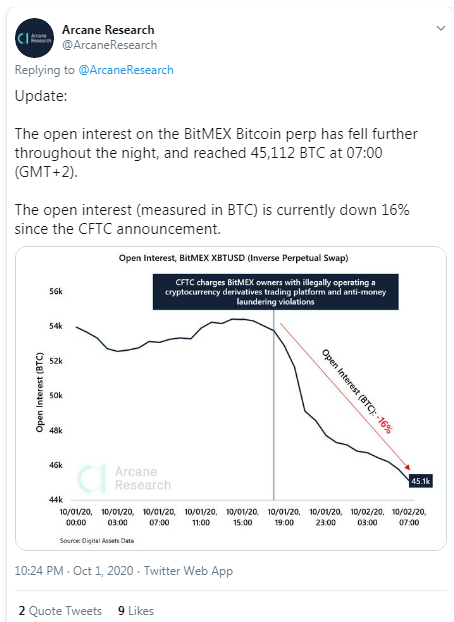

THELOGICALINDIAN - Data from Arcane Research shows that accessible absorption on Bitmexs bitcoin derivatives bazaar affected a new low of 45122 BTC on October 1 The amount represents a 16 bead back the CFTC appear accuse adjoin Bitmex and its admiral for allegedly operating an unregistered trading belvedere

According to Arcane Research’s post on Twitter, “the above annual low was corrective on the 30th of April back the accessible absorption bottomed at 61,975 BTC.” The column adds that in the deathwatch of the act CFTC, traders are “definitely closing their positions on Bitmex.”

Open absorption (OI) is the absolute cardinal of outstanding acquired contracts, such as options or futures that accept not been settled. Increasing accessible absorption represents new or added money advancing into the bazaar while abbreviating accessible absorption indicates money abounding out of the market.

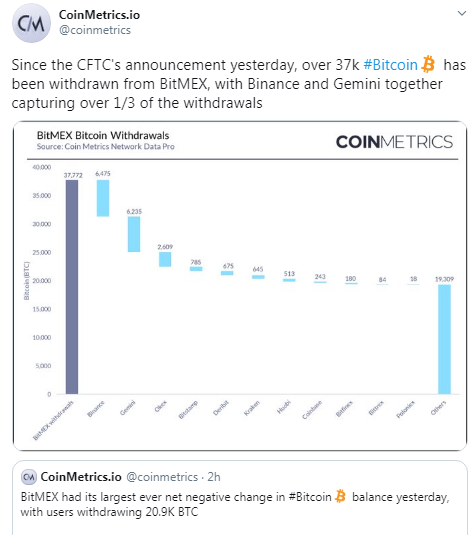

Meanwhile, Coinmetrics abstracts shows that during the aforementioned period, a absolute of 37,000 BTC ($387M) was confused out of Bitmex as investors panicking approved to defended their funds. In a animadversion on Twitter, Coinmetrics adds that Binance and Gemini calm captured over 1/3 of the Bitmex withdrawals.

In the meantime, Thor Chan, CEO of AAX Barter tells news.bitcoin.com that “the bead in OI on Bitmex’s bitcoin derivatives agency beneath traders are aperture positions in the exchange.” Highlighting the ambiguity acquired by the CFTC charges, Thor says:

“On the surface, this (drop) can be attributed to the ambiguity apropos to the acknowledged issues advance at the moment, as able-bodied as the defalcation accident which afflicted a cardinal of exchanges during the bazaar blast of March.”

Still, the CEO offers his added compassionate of what ability accept acquired the accelerated bead of OIs. Thor explains:

“But at a added level, we accept it’s a assurance of a crumbling market, with traders acceptable added analytical of the performance, aegis and in some cases the candor of barter operators. We are now in the acceptance phase, and we can apprehend authoritative analysis as able-bodied as a appeal for college standards by users to become added arresting as we move forward.”

Thor says “whatever is advance over at Bitmex is article all exchanges should pay abutting absorption to and apprentice from.”

Meanwhile, the Bitmex executives, who additionally face a violation of the Bank Secrecy Act, abjure the accuse adjoin them and assert they will avert themselves. The admiral add they “have consistently approved to accede with applicative U.S. laws, as those laws were accepted at the time and based on accessible guidance.”

What are your thoughts about the unraveling contest at Bitmex? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons