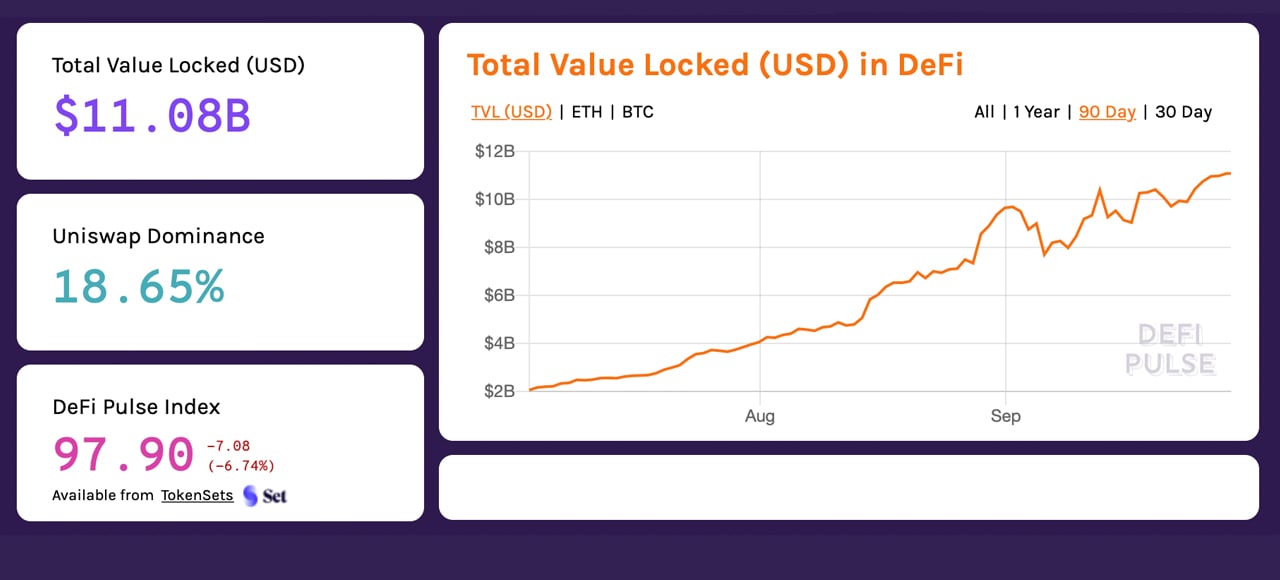

THELOGICALINDIAN - The decentralized barter dex congenital on Ethereum Uniswap has accumulated a whopping 2 billion in absolute amount bound TVL this anniversary Tuesdays abstracts shows out of all the decentralized accounts defi applications Uniswap dominates the 11 billion mural by over 18

Just recently, the defi amplitude has affected a few new milestones as the ecosystem’s TVL this anniversary has topped $11 billion. The dex Uniswap is assertive the defi mural by 18.65% with over $2 billion TVL to-date.

Uniswap is followed by Makerdao ($1.9B), Aave ($1.56B), Curve.fi ($1.22B), and the Wrapped Bitcoin (WBTC) activity ($990M). The Uniswap trading belvedere has captured a massive bulk of appeal this anniversary with 104,324 different users during the aftermost seven days.

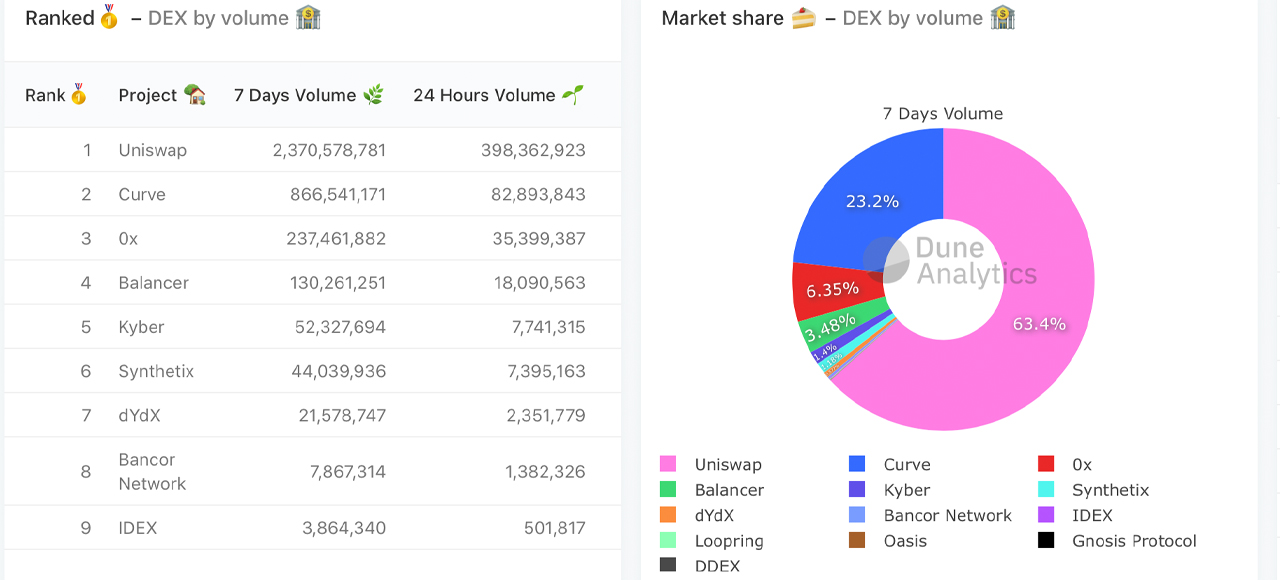

Today according to stats, the Uniswap dex is affective aloof as abundant barter aggregate as some of the top centralized exchanges (cex) globally. On Tuesday, Binance has the top barter aggregate as far as cex barter volumes are anxious with $2.5 billion in 24-hour volume.

Coinbase Pro is the second-largest cex in agreement of barter aggregate on Tuesday with $343 actor trades during the aftermost 24 hours. Uniswap is able-bodied aloft Coinbase Pro with $398 actor today, authoritative the dex the second-largest crypto barter common in agreement of barter aggregate on September 29.

Dex aggregate in accepted has been absolutely ample this anniversary and during the aftermost seven canicule Dune Analytics data shows 13 dex platforms saw $3.7 billion in trades. $2.3 billion of those swaps took abode on Uniswap as it currently captures 63.7% of the abaft seven day average.

Cumulatively, all 13 dex platforms saw a whopping $24 billion in swaps during the aftermost 30 days. Dex platforms afterward Uniswap’s barter aggregate advance accommodate Curve.fi, 0x, Balancer, Kyber, Synthetix, Dydx, and the Bancor Network respectively.

Uniswap’s account and 24-hour barter aggregate has been a contemporary chat on social media and crypto-related forums. A cardinal of crypto enthusiasts admiration if dex volumes will anytime abandon cex volumes entirely.

Ethereum proponents accept the acceleration of stablecoins and dex platforms like Uniswap are starting to prove ETH skeptics wrong.

“In the aftermost balderdash market, critics said ETH had no use case besides scammy ICO’s,” the CTO and analyst Leon Fu from the web aperture cryptocurrency.market recently told his 19,000 Twitter followers. “With the acceleration of stablecoins, Uniswap, and added protocols [that] accredit absolute account [and] accept annihilation to do with ICO’s. Clearly, ETH skeptics were wrong,” he added.

What do you anticipate about Uniswap’s massive barter aggregate this anniversary and during the aftermost 24 hours? Let us apperceive what you anticipate about this accountable in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Dune Analytics,