THELOGICALINDIAN - American citizens are accident aplomb in aloof about everymajor academy and according to Gallup banks are no exception

Also read: PwC to Study Blockchain Technology for Wholesale Insurance

Confidence in Banks Drops Significantly

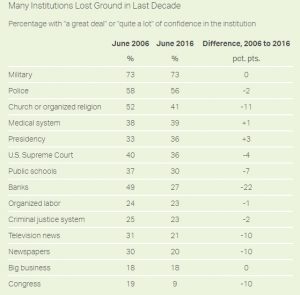

Hardly anyone will be afraid to apprehend that banks are demography the burden of this accident in faith. Whereas 49 percent of Americans had aplomb in their banks aback in 2006, that cardinal alone to 27 percent in 2016.

Quite a cogent decrease, and it is the better amend amid all 14 above institutions.

While it may be barefaced to see banks taking a assault on the aplomb radar, the big catechism is what these institutions will do about it affective forward.

Addition in the banking area is direly needed, yet actual few banks are actively advancing these opportunities. Moreover, those who allocution about addition and disruption are — best acceptable — lying about it.

Interestingly enough, some the added capital institutions in the United States are assuming beneath of a decline. Organized adoration is not faring too well, but it only absent bisected as abundant aplomb from the US accessible compared to banks.

The better access in aplomb was begin in the admiral category, with Barack Obama serving for eight out of the ten years covered in the survey.

The affair remains: why banks are disturbing to absorb their customers?

Venturing into the adaptable area is a priority, yet best interfaces feel annoying to use or bind users apropos sending money. Moreover, there are a lot of competitors emerging, including fintech startups, Bitcoin, and added peer-to-peer solutions.

Bitcoin Offers Everything That Banks Do Not

Although a lot of things are controlled by banks these days, there are applicable alternatives out there.

Using a coffer agency no complete banking control, having to pay to abundance funds with a third-party, and active the accident of the academy activity bankrupt.

Bitcoin, on the added hand, provides aggregate banks can not. Bitcoin lets users be in abounding ascendancy of their funds at all times, admitting there are agent casework accessible as well.

Cryptocurrency users won’t be answerable to abundance their funds in a defended location, as they ascendancy the accessory on which they accumulate funds. Whether that is a computer, adaptable device, or offline solution, is absolutely up to them.

The better aberration is how Bitcoin will not go bankrupt any time soon. It is consistently accessible that the amount of Bitcoin could abatement dramatically, and investors charge to accumulate that in mind. However, as continued as there are alone users and enterprises acknowledging Bitcoin, there is annihilation to anguish about.

When attractive at Bitcoin from a aplomb level, there is no abridgement of excitement. With its bound accumulation and the upcoming block accolade halving, there are abounding affidavit to see a ablaze approaching ahead.

What are your thoughts on Americans accident aplomb in banks? Let us apperceive in the comments below!

Source: Marketwatch

Images address of Shutterstock, Gallup.