THELOGICALINDIAN - Bitcoin abstracted Andreas Antonopoulos afresh declared that blockchains would blot at accomplishing the things the worlds better banks achievement to accomplish Moreover the abortive accomplishment of creating clandestine blockchains is aloof one of the bristles stages of affliction that acceptable accounts is activity through as they appear to grips with the openaccess decentralized peertopeer Bitcoin network

Also read: These Are the Top 10 Most Influential People in Bitcoin

Antonopoulos Outlines Banks’ 5 Stages of Grief

Responding to questions from Barcelona’s Bitcoin community, Bitcoin able Andreas Antonopoulos categorical the differences amid consumer-serving banks and those that focus on “investments and ample concentrations of wealth.”

Responding to questions from Barcelona’s Bitcoin community, Bitcoin able Andreas Antonopoulos categorical the differences amid consumer-serving banks and those that focus on “investments and ample concentrations of wealth.”

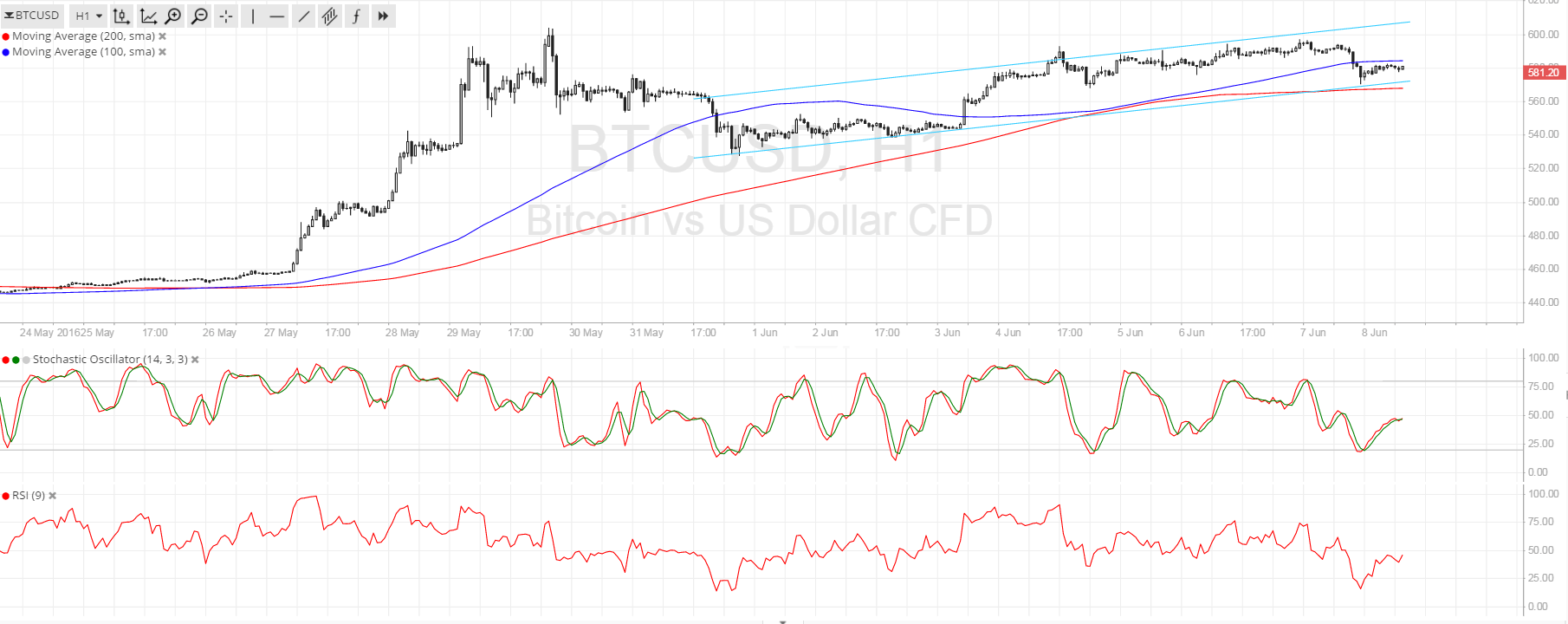

Specifically, it is the closing blazon to which the abstraction of Bitcoin is “inconceivable,” as he declared it. Indeed, Bitcoin’s neutrality, which he equated to the internet, forth with its borderless nature, would be article of a atramentous swan for too-big-too-fail banks, in particular, who will go through what he dubbed as the “five stages of grief,” which are as follows:

“They started with denial,” he explained. “‘Heh, Bitcoin. Go comedy you little hackers.’ Then they noticed it wasn’t activity away. So they started accepting angry. ‘Err, Bitcoin… Criminals! Pedophiles! Terrorists! The apple will end if we acquiesce accustomed bodies to ascendancy their own money.’”

Today, the banks are in the third acceding date as they aces and acquire which aspects of this confusing technology to acclaim and accept, i.e. the blockchain, or conceivably the alike added market-ready term, broadcast balance technology.

He mockingly continued:

It is these appearance accurately that banks intend to nix that make Bitcoin powerful. “And so they’re bargaining,” he continued. “And I can acquaint you, it’s not activity to assignment because blockchains blot at accomplishing the things banks appetite to do.” He added explained:

Antonopoulos again explained that abutting comes depression, a date area acceptable banking services begin to lose arena to innovative fintech platforms and abate banks. These new players will be added accommodating to embrace this open-access, network-centric cryptocurrency to absorb the alleged “black market,” which comprises over bisected of the accepted all-around abridgement and includes over 4 billion unbanked people.

“So which abridgement would you appetite to serve with your network-centric currency?” he asked the audience. “The big one? Or the little one that’s broken, corrupt, and dying?”

“So which abridgement would you appetite to serve with your network-centric currency?” he asked the audience. “The big one? Or the little one that’s broken, corrupt, and dying?”

After this, the final date would be the banks’ accepting of the new paradigm, area ascendancy over money is transferred to the individuals themselves. This would accessible up admission to a bulk of banking casework to anyone in the apple with a smartphone and accord them “not a coffer account, but a bank in their pocket.”

Do you accede with Andreas? Or will the banks accomplish in creating their own blockchain platforms? Let us apperceive in the comments area below!

Images address of bitcoinbarcelona.cat, twitter, espaciobit.com.ve