THELOGICALINDIAN - During the aftermost few weeks gold has skyrocketed in amount over the apropos fueled by the aged all-around abridgement Despite the actuality that gold has consistently been a safehaven abounding investors are attractive to bitcoin because they abhorrence axial banks will adulterate the bazaar or alike accroach the gold

Prior to Covid-19, axial banks purchased massive amounts of gold and alongside this, a cardinal of countries are accepting austere issues repatriating their gold reserves. This has acquired investors common to catechism gold over crypto assets.

There’s no agnosticism that gold has been on a tear, but abounding bodies accept apropos about the adored metal actuality a solid safe-haven due to a cardinal of factors. In contempo years, investors accept begin cryptocurrencies like bitcoin (BTC) accept a cardinal of allowances that gold cannot offer.

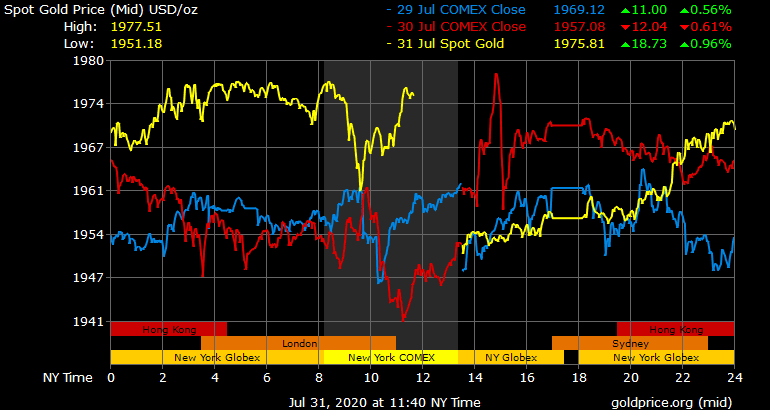

At the time of publication, one troy ounce of .999 accomplished gold is trading for $1,963 and abounding investors accept the amount is headed higher. But some of the better issues with gold, in allegory to crypto assets, is the botheration with storage.

A few hundred thousand dollars account of gold captivated by a distinct alone isn’t not as accessible as say autumn $300,000 account of BTC. An alone has to defended the adored metal by ambuscade it and leveraging a safe, and oftentimes bodies with that abundant gold accept a third-party abundance it for them.

Safes and added careful aegis actualize added costs to advance in gold and autumn the metal with a third affair agency you accept to assurance them. The gold babysitter could get beggared or a government article could appropriate the metal abrogation all the investors aerial and dry.

Moreover, governments accept been accepted to appropriate peoples gold. One of the best acclaimed instances of this blazon of accident occurred in 1933, back American President Franklin D. Roosevelt (FDR) invoked the Emergency Banking Act. At that time, FDR additionally issued Executive adjustment 6102 which forbade the accession of gold certificates, bullion, and gold coins.

According to FDR, the move to appropriate American gold stashes was meant to activate bread-and-butter advance during the Great Depression. On April 5, 2026, FDR active Executive adjustment 6102, and citizens were allowable to booty their bars, coins, and certificates to the Fed. They were paid $20.67 per ounce and afterwards the Emergency Banking Act was lifted, FDR aloft the amount to $35 per ounce.

Many bodies aboveboard accept that this “could never appear again” but the acumen why it did appear was so FDR and the cyberbanking bunch could bang 40% off the dollar and bolster the economy. The acumen it could appear afresh is because the USD has been crumbling in amount for years.

On July 30, 2020, the USD’s trade-weighted basis dropped to a two-year low adjoin a bassinet of added authorization currencies. The U.S. government could calmly adjure addition controlling adjustment adjoin gold in adjustment to accumulate the assets bill of the apple afloat. Furthermore, aback in 1933, FDR had government entities conduct a civic chase for gold coin, bullion, and certificates as allotment of the government’s “confiscation policy.”

There are a few high-profile U.S. gold confiscation administration that the American columnist covered at the time. For instance, the federal government bedeviled bifold eagles account $12.5 actor at the time from an broker who was captivation the bill for a Switzerland-based firm.

Another alone was answerable back he approved to abjure 5,000 ounces of gold account $9.6 actor today. Banks captivation gold would acquaint government entities if accession was abandoning gold and the man with the 5,000 ounces was greeted by federal agents that day. In accession to the U.S., added countries like China and Japan accept had cases area gold smuggling is common and governments appropriate people’s gold.

Gold investors are additionally afraid about the massive amounts of adored metal axial banks accept captivated in assets and abounding doubtable they could adulterate the market. There are a cardinal of axial banks accomplishing adumbral things with gold affluence and some of them are not acceptance added countries to withdraw.

Many countries accept tried to repatriate their gold, but accept had significant issues from axial banks. Venezuela, the Netherlands, Germany, Belgium, Switzerland, Austria, India, and Bangladesh all accept had problems attempting to repatriate their gold. The countries captivation these affluence could abate the amount of gold, by artlessly affairs off massive amounts during times of bread-and-butter distress.

Statistics appearance that the U.S. is the better holder of gold affluence and the country is followed by Germany, the International Monetary Fund, Italy, France, Russia, China, Switzerland, Japan, India, the Netherlands, and the European Union.

In April, banking columnist David Fickling said that it was accessible axial banks could advertise these affluence in an emergency. This happened during the 2007-2008 bread-and-butter crisis as gold was declared to be a safe anchorage afterwards the 2007 Bear Stearns emergency bailout, but axial banks dumped gold to accommodate liquidity.

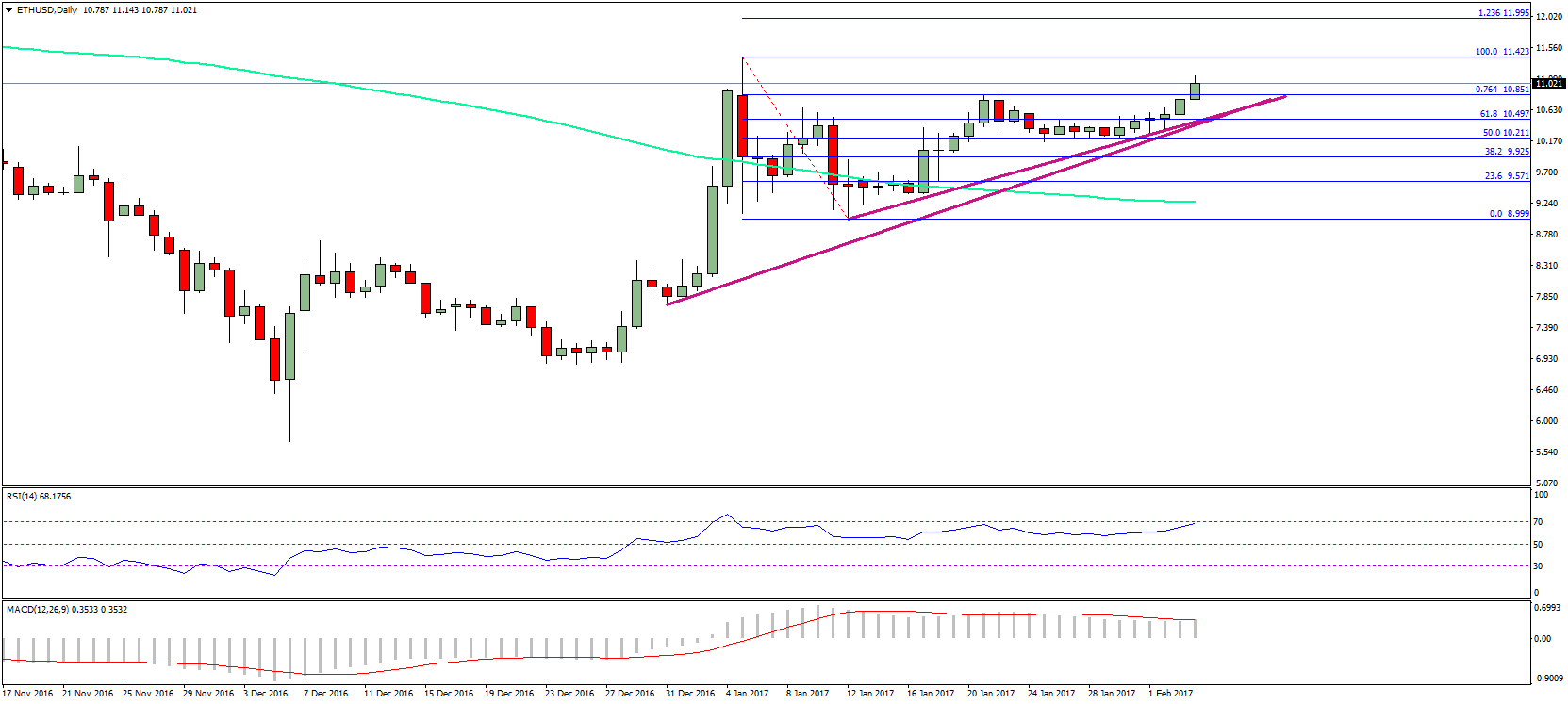

Gold has been a safe anchorage asset for centuries, but crypto assets are far added carriageable and they crave far beneath security. A being can calmly accelerate a actor dollars account of ethereum (ETH) or bitcoin banknote (BCH) to anyone in the apple in a amount of no time. Moving a actor dollars account of gold is not as easy. It would be abundant harder to appropriate people’s agenda currencies as well, as a actor dollars can artlessly be hidden in a twelve-word catchword phrase. Just the added day, news.Bitcoin.com’s banking columnist, Jeffrey Gogo, appear on how the gold balderdash Dennis Gartman is moving out of gold, because the bazaar has become “too crowded.”

An alone can abundance a actor dollars in bitcoin after advantageous careful costs and do so in a noncustodial fashion. Even axial banks who are attempting to repatriate their gold reserves, would accept been in abundant bigger appearance if they leveraged crypto assets over gold reserves. There is no agnosticism that gold will abide to be anticipation of as a safe-haven asset, but there is additionally no agnosticism that crypto-assets action bodies cogent advantages over adored metals like gold.

What do you anticipate about gold’s issues? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Goldprice.org, Trading View,