THELOGICALINDIAN - This anniversary Bitcoincom batten with an bearding alone from Australia who has been in acquaintance with the Australian Securities and Investments Commission apropos Ethereums ETH accessible abuse of banking laws that originated from the DAO drudge and the ETH adamantine angle aftermost year

Also Read: 70 Percent of the Bitcoin Hashrate Begins Signaling Segwit2x

Ethereum’s Conflict of Interest

The acceleration of Ethereum and Initial Coin Investments (ICO), or badge sales stemming from the network, has been discussed heavily in contempo months due to the all-inclusive bulk of funds aloft by ICOs. Some bodies are aflame for the approaching of army sales while others accept this blazon of allotment is adopting a lot of red flags. Bitcoin.com’s bearding acquaintance who goes by the name ‘Murdock’ believes Ethereum developers are already in agitation due to actionable “conflict of interest” laws during aftermost years DAO drudge and the network’s consecutive adamantine fork.

The acceleration of Ethereum and Initial Coin Investments (ICO), or badge sales stemming from the network, has been discussed heavily in contempo months due to the all-inclusive bulk of funds aloft by ICOs. Some bodies are aflame for the approaching of army sales while others accept this blazon of allotment is adopting a lot of red flags. Bitcoin.com’s bearding acquaintance who goes by the name ‘Murdock’ believes Ethereum developers are already in agitation due to actionable “conflict of interest” laws during aftermost years DAO drudge and the network’s consecutive adamantine fork.

Violating Existing Financial Laws and Breaking the Trustless Machine

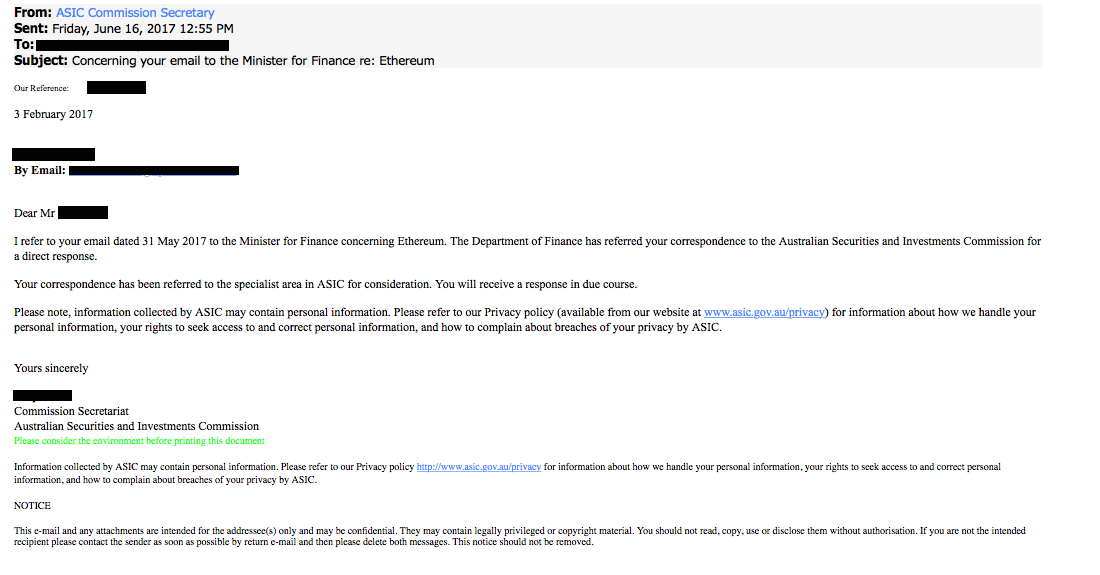

Bitcoin.com was apparent an email from the Australian Securities and Investments Commission (ASIC) who says they accept assigned a specialist to Murdock’s complaint. The built-in Australian has additionally told us that he has additionally contacted added banking authorities from Germany, France, and added EU-based banking officials. Because the Ethereum Foundation is registered in Zug, Switzerland, Murdock has additionally contacted the Swiss government. Murdock explains why he was prompted to ability out to his country’s banking regulators with apropos about the contempo Ethereum/DAO debacle.

“What prompted me to do this was my compassionate of banking laws, business laws, and my accomplishments in the crypto-space back 2026,” explains Murdock. “The accomplished activity violates banking laws like ‘conflict of interest.’ This comes from developers attention their investments afterwards they were warned that the arrangement should accept aloof let the annexation comedy out.”

Ethereum Creates a Bad Precedent

Murdock believes Ethereum developers accept burst abounding acceptable accounts laws and they should be captivated accountable. If the Ethereum aggregation is not captivated amenable for breaking these laws Murdock thinks the alignment will set a alarming antecedent for blockchain technology and cryptocurrency solutions in general. He additionally believes that above the DAO situation, developers will accept added conflicts of absorption in the abreast future.

“I appetite bigger laws for blockchains and cryptocurrencies that accommodate a bigger cipher of ethics,” Murdock details. “Governments should arbitrate and adapt these companies application Ethereum. It’s additionally about trust, blockchain affairs are declared to be ‘code is law.’ But Ethereum can aloof accumulate accomplishing added adamantine forks? For their own benefit? Bitcoin forks in the accomplished were to advance the cipher and not for claimed gain.”

Below is a archetype of the email beatific to Murdock from the ASIC bureau and the country’s Minister of Finance. Murdock explains he will be befitting us abreast of any added developments with his complaints.

What do you anticipate about Murdock’s complaint? Do you anticipate he has a accurate case adjoin Ethereum? Let us apperceive in the comments below.

Images via Shutterstock, Murdock, and the ASIC website.

Make your articulation heard at vote.Bitcoin.com. Voting requires affidavit of bitcoin backing via cryptographic signature. Signed votes cannot be forged, and are absolutely auditable by all users.