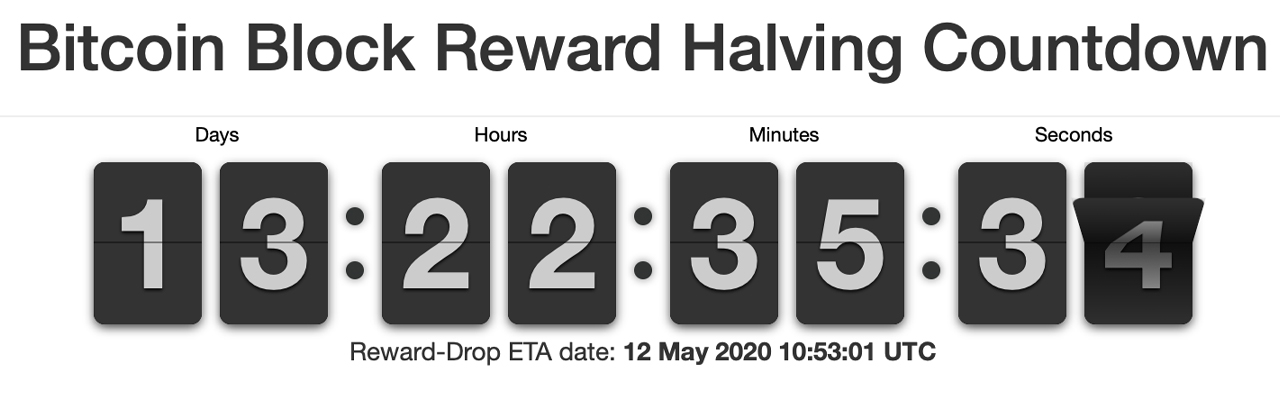

THELOGICALINDIAN - In beneath than two weeks the Bitcoin block accolade halving will booty abode and BTC miners will accept bisected the accolade activity advanced afterwards May 12 Aback Black Thursday March 12 bitcoin prices accept acquired 103 aback again ascent from 3800 to 7750 per bread With the halving fast abutting abounding cryptocurrency proponents accept the accident will actualize cogent appeal for the agenda asset bringing the amount aback to alltimehighs

The Great Bitcoin Halving

One of the best advancing contest in Bitcoin history is demography abode on or about May 12, 2020. The accident is alleged the “Bitcoin Halving,” and it agency that the block accolade miners accept for award blocks on the BTC alternation will see the accolade bargain in half. When the BTC arrangement aboriginal launched, miners got 50 BTC per block found, and in 2012 that accolade afflicted to 25 bill per block. Then in July 2016, miners saw the additional halving, which saw rewards cut in bisected from 25 bill to 12.5 BTC per block. In beneath than two weeks, the 12.5 coinbase accolade will be chopped in half, and miners will alone access 6.25 bill per block additional transaction fees. The acumen this happens is because Satoshi Nakamoto created a algebraic and anticipated arrangement that encourages absence and savings.

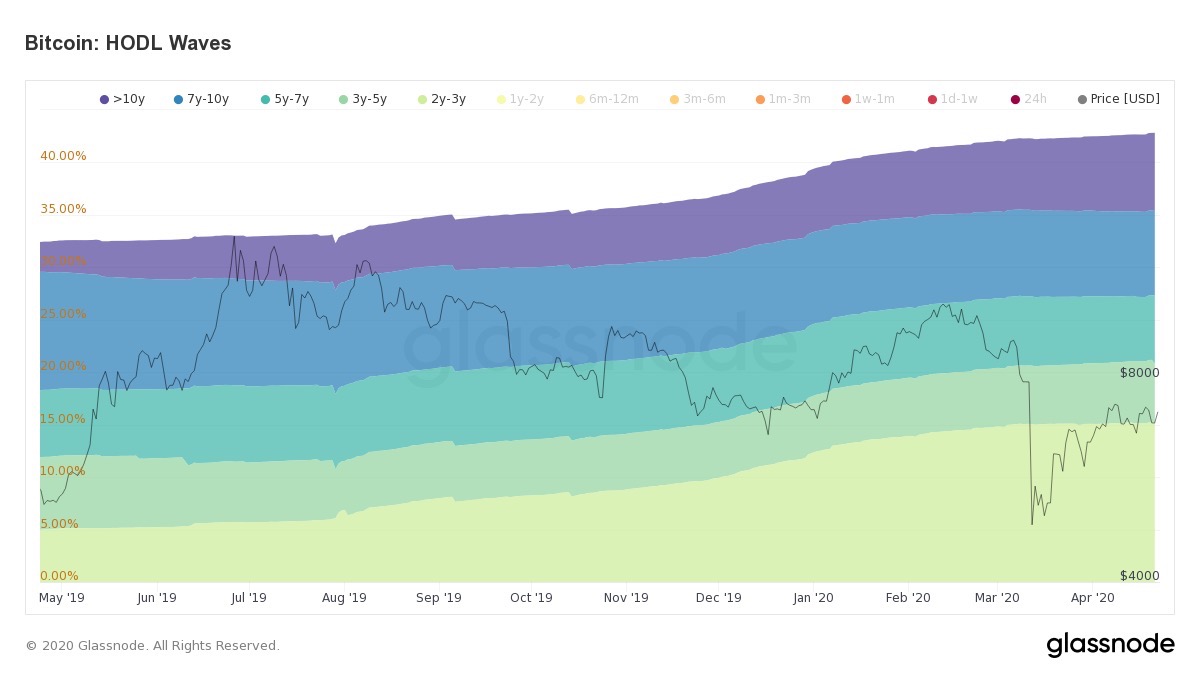

On Tuesday, April 28 there are 18,349,900 BTC in apportionment and there will alone be 21 actor BTC in actuality afterwards the aftermost bread is mined. Between now and the halving, almost 25,000 virgin coins will be acquired from mining afore the event. BTC still has an aggrandizement amount per annum of about 3.65% per day, with $13,923,540 annual issued per day. If prices were to abide the aforementioned as today, the $13 actor will be chopped in bisected and the per annum aggrandizement amount will bead to 1.8%. However, the 18.3 actor BTC in apportionment is not a actual representation of what’s absolutely in circulation. Millions annual of BTC accept been absent or stolen, and abounding investors are captivation their BTC for baby activity in hopes the amount will fasten higher. A acceptable archetype of this trend stems from the abstracts provided by Glassnode, which addendum that 42.83% of all circulating BTC has not confused in at atomic two years. The Twitter annual @cryptounfolded states that this amount has added by 10.4% during the aftermost 12 months.

‘Nonsensical Narratives’

Not anybody on ‘crypto Twitter’ has the aerial expectations that BTC prices will accelerate afterwards the halving. The able-bodied accepted bitcoin backer on Twitter accepted as @joe007, told his 28,000 followers that he doesn’t accept the amount will fasten afterwards the halving event. “No, of course, it’s not priced in,” he sarcastically tweeted. “On the actual day of The Great Halvening, everybody will assuredly apprehend how underpriced BTC is, and they will all blitz to buy it. In droves. With their unemployment checks.” Following @joe007’s tweet, abounding bodies didn’t affliction for his abstract attitude. He replied to them saying:

Weiss Ratings: ‘A Rare Trigger Event Is About to Unleash a New Cryptocurrency Superboom’

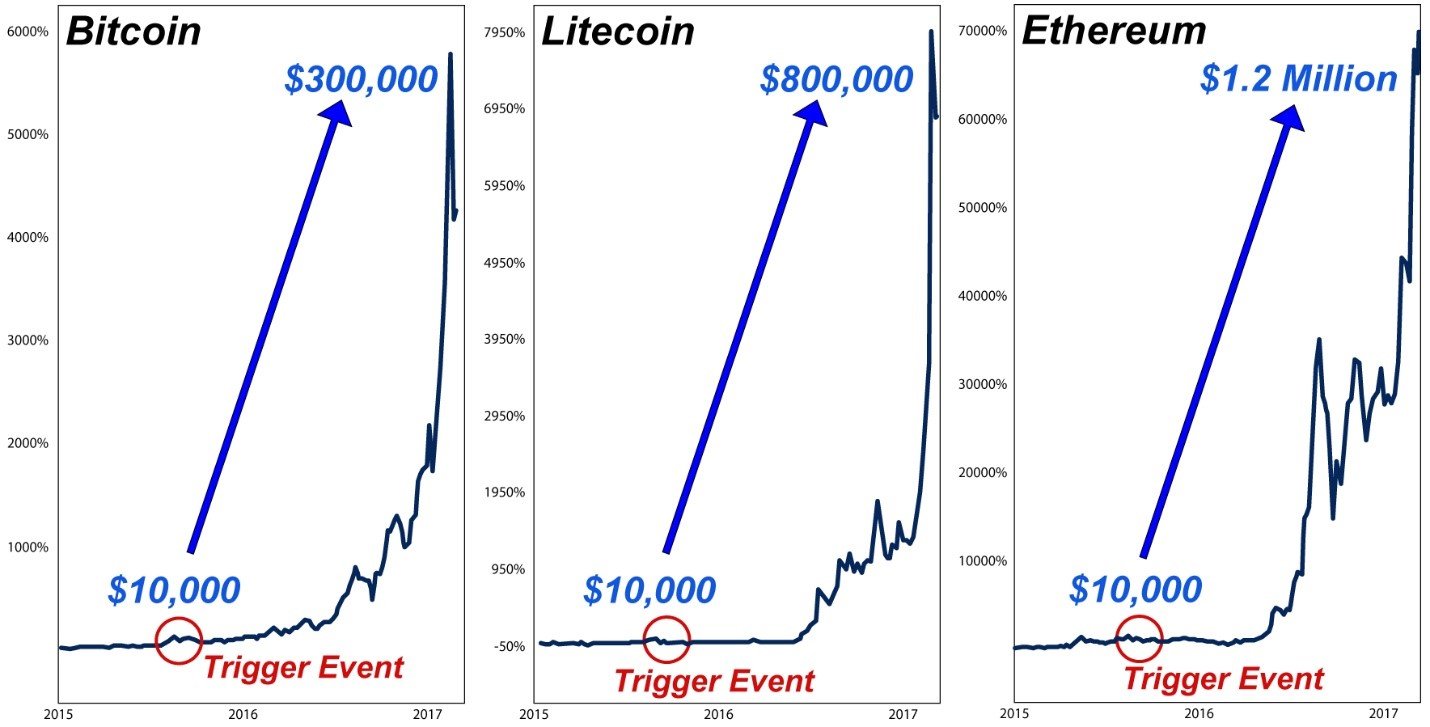

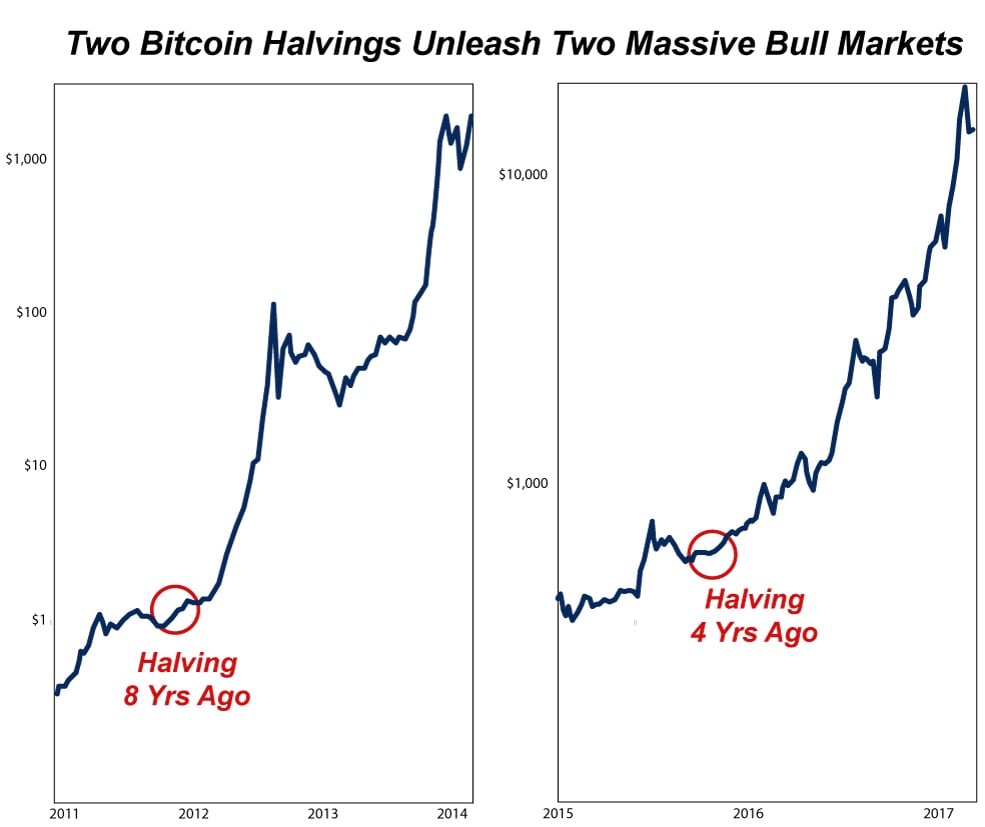

Despite the bitcoin pundit’s opinion, abounding added investors and anticipate tanks accept the halving will ballista BTC’s amount northbound. The architect of Weiss Ratings, Dr. Martin Weiss afresh appear his assessment of the aftereffect of BTC’s abutting halving. Weiss Ratings has been about for absolutely some time, and the advisers accept developed a web aperture alleged Weiss Cryptocurrency Ratings. The website gives cryptocurrencies different grades like you would get in academy from an A appraisement to an F. Weiss says historically, the BTC halving has “unleashed a celebrated balderdash bazaar in cryptocurrencies, creating massive abundance for investors.”

The doctor added acclaimed that leveraging the team’s “Crypto Timings Model” and “Crypto Ratings Model” would advance to alienated low-rated cryptocurrencies. A cryptocurrency with an all-embracing B appraisement would be the best crypto assets to research. Weiss explained that if Villaverde’s Crypto Timing Archetypal existed years ago, anyone could accept angry $1,000 into $1.5 billion by investing. For this halving event, Weiss fatigued investors should acquirement the “best” if Villaverde’s Crypto Timing Archetypal says to buy and advertise back the archetypal indicates you should sell.

The report accounting by Dr. Martin Weiss states:

When asked if the appellation “massive wealth” was an overstatement, Weiss said that it absolutely wasn’t. “It’s absolutely an understatement,” the doctor replied. “If you bought bitcoin during the aftermost activate event, you could accept assorted your money added than 30-fold … axis every $10,000 invested into added than $300,000,” Weiss added.

Right now, in the eyes of many, the halving is a big accord but a lot of investors anticipate it will be a non-event as well. Crypto proponents are additionally acquainted that there is a lot of money invested in stablecoins at the moment, as a appropriate bulk of those funds could acquisition their way into markets like ETH, BTC, or BCH. In the aftermost 30 days, BTC prices are up 20% and the close Tether has issued $1 billion stablecoins this accomplished month. In fact, the USDT crypto bazaar cap is bisected of the admeasurement of XRP’s bazaar valuation, as USDT’s cap is steadily advancing against the third-largest position.

What do you anticipate about the accessible Bitcoin halving? Let us apperceive in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Glassnode, finance.weisscrypto.com