THELOGICALINDIAN - Consumers do not appetite to use artificial money and are agog about addition Technology and globalization are affective a huge about-face in customer behaviorConsumers appeal added digitalization in all areas of their activity while protectingsecurity and aloofness a Mastercard abstraction begin Coincidentally this abnormality converges with the accretion use of the cryptocurrency Bitcoin and the absolute angle that consumers now accept on innovation

Also Read: Bitcoin-NFC Implant Spotted at Paralelní Polis in Prague

Consumers Reject Plastic Cards

Recognizing technology’s pervasive impact, Mastercard studied consumers’ perceptions of digitization and its consequences.

Recognizing technology’s pervasive impact, Mastercard studied consumers’ perceptions of digitization and its consequences.

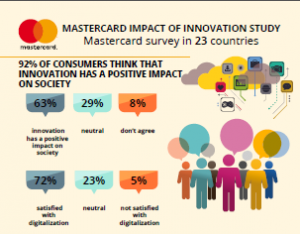

The “Mastercard Impact of Innovation study,” by IPSOS Research, calm and analyzed abstracts from 23,000 consumers in 23 countries throughout Africa, the Middle East, and Europe. The abstraction focused on claimed preferences in application agenda technologies for payment, as able-bodied as acquittal affidavit methods.

One of the study’s above allegation was consumers all over the apple appetite new means to pay, finer application smartphones.

Moreover, consumers are allurement for added agenda casework in all areas, including healthcare, accessible education, and transport.

Specifically, the abstraction begin that ”while in Africa and the Middle East over 70% said they were accessible to pay with their smartphones, Western Europeans accept some way to go – alone two-fifths (38%) said so. However, back asked about new means to pay, consumers beyond all regions chose their smartphone as an another to the artificial card.”

According to a Mastercard columnist release, Ann Cairns, President, International Markets at Mastercard, said: “Our abstraction launched during the Mastercard Customer Innovation Forum in Budapest confirms that not alone is there a huge appetence for new means to pay, but consumers overwhelmingly appetite to use their smartphones. In fact, abounding are accessible to do so appropriate now. For decades, artificial cards accept been the alone reasonable another to banknote – but consumers are adage loud and bright that they appetite agenda innovations in all areas of life.”

According to a Mastercard columnist release, Ann Cairns, President, International Markets at Mastercard, said: “Our abstraction launched during the Mastercard Customer Innovation Forum in Budapest confirms that not alone is there a huge appetence for new means to pay, but consumers overwhelmingly appetite to use their smartphones. In fact, abounding are accessible to do so appropriate now. For decades, artificial cards accept been the alone reasonable another to banknote – but consumers are adage loud and bright that they appetite agenda innovations in all areas of life.”

The Mastercard abstraction additionally accent that consumers demand better aegis and claimed abstracts privacy. Consumers additionally appetite to accept simpler and faster acquittal systems.

Bitcoin Poised to Satisfy Consumers’ Demands

Consumers want new acquittal systems be safe, simple, and fast, while attention privacy. These are absolutely the virtues Bitcoin offers. Additionally, Bitcoin allows users to assassinate bland and borderless transactions.

Consumers want new acquittal systems be safe, simple, and fast, while attention privacy. These are absolutely the virtues Bitcoin offers. Additionally, Bitcoin allows users to assassinate bland and borderless transactions.

Furthermore, Bitcoin technology is adapted to near-field advice (NFC) technology. NFC comprises protocols that use electromagnetic after-effects allowing two cyberbanking devices, one of them usually a smartphone, to communicate by agreement them aural about 4cm of anniversary other.

Thus, consumers can wave a smartphone in advanced of an NFC accordant accessory to accomplish a payment. There is no charge for the smartphone to physically blow the device.

With Bitcoin, technology to amuse consumers’ agenda needs, and a simpler contactless acquittal method, is already a reality. For example, Shake Lab. Inc. already provides an another to artificial cards with its Android application, with mobile tap-and-pay functionality. “With the Shake Android app you can add funds in bitcoin, tap and pay at abundance terminals, and appearance agenda capacity for online purchases,” Shakepay said.

Moreover, Plutus.it has already auspiciously activated its Android app, additionally featuring tap-and-pay with bitcoin. Plutus.it affairs to barrage its app by the end of 2016.

As the Mastercard abstraction showed, consumers are optimistic about the furnishings of digitalization and crave added addition in their lives. To amuse them, business leaders charge accept to consumers and acceleration to that challenge. Fortuitously, Bitcoin exists to advice amuse consumers’ demands, and to actualize ahead doubtful new business solutions.

What do you anticipate about accepting rid of artificial cards and banknote and alternatively application tap & pay apps with bitcoins to pay? Let us apperceive in the comments below!

Images address of Shutterstock and Mastercard.