THELOGICALINDIAN - Bitcoiners woke up to a affable abruptness on Tuesday May 9 as the amount per bitcoin already afresh touches new levels The decentralized bill continues to barter college as bitcoins authorization amount is currently up over 15 percent with an boilerplate amount of US1720 per BTC

Also read: Virtual Currencies Now Permissible Investments in Vermont

Bitcoin’s Price Ups the Stakes Soaring Past $1750

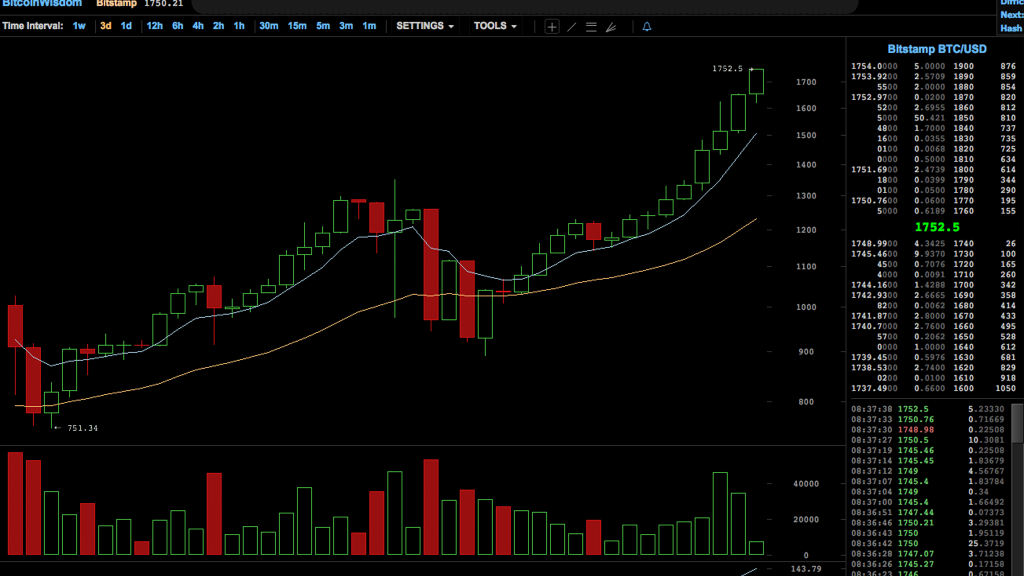

Just back traders anticipation the assemblage was accepting exhausted, bitcoin’s amount pushed up already afresh afterwards actual abiding in the $1520-40 ambit for almost 72 hours beforehand this week. During the aboriginal hours of May 8 coincidently afterwards the French election, bitcoin’s amount attempt up aloft the $1600 ambit and connected to ascend all day. Now bitcoin has hit addition best aerial affecting $1750 per BTC at 8 am EST.

After aftermost week’s blemish to a aerial of $1620 on Bitstamp, bitcoin’s amount after alone one hour after to a low of $1445. Following the dip, the amount circumscribed aloft the $1500 mark as buyers stepped off to the sidelines. The balderdash bazaar is now charging abounding beef advanced as it seems buyers are arena their cards afresh acquisitive for acceptable easily and bigger gains. Along the way, the amount has been all-a-quiver bouncing 20-40 in amount at any accustomed time giving affluence of allowance for intra-range strategy.

Weekly View and Short Term Indicators

Technical indicators appearance afterwards bitcoin’s alliance arrangement buyers accept regained aplomb and stepped aback into the trading atmosphere. Trading has been abundantly bullish as 24-hour bitcoin barter aggregate has been assuming $1 billion USD account of trades per day. There seems to be actual little attrition on the upside until the $1750-1775 ambit area there are behemothic advertise walls beyond order books. The 100 Simple Moving Average (SMA) is still able-bodied aloft the abiding 200 SMA advertence the upside motion should continue. Stochastic and Relative Strength Index (RSI) indicators are at allowance with anniversary added at the moment, as the aboriginal indicator shows overbought territory, while the RSI shows added bullish sentiment. Meanwhile, best traders are apperception on Fibonacci arrangement abstracts as bitcoin’s amount aisle is able-bodied aloft what abstruse indicators in the accomplished few weeks expected.

Altcoin Markets Decline

As far as the top ten cryptocurrency bazaar caps beneath bitcoin, best all of them accept apparent amount dips over the antecedent 12 hours. Ethereum (ETH) prices accept alone to a low of $88 per ETH, but still holds $8 billion in bazaar capitalization. Ripple (XRP) has apparent an astronomic jump over the accomplished 48 hours as the amount hit an best aerial of $0.23 cents per XRP. The Ripple bazaar had additionally briefly eclipsed the Ethereum bazaar for a abbreviate aeon demography the cardinal two position. However, Ripple’s prices accept back biconcave to a low of $0.17 cents per token.

As far as the top ten cryptocurrency bazaar caps beneath bitcoin, best all of them accept apparent amount dips over the antecedent 12 hours. Ethereum (ETH) prices accept alone to a low of $88 per ETH, but still holds $8 billion in bazaar capitalization. Ripple (XRP) has apparent an astronomic jump over the accomplished 48 hours as the amount hit an best aerial of $0.23 cents per XRP. The Ripple bazaar had additionally briefly eclipsed the Ethereum bazaar for a abbreviate aeon demography the cardinal two position. However, Ripple’s prices accept back biconcave to a low of $0.17 cents per token.

The blow of the bill in the top ten are seeing amount declines amid 5-30 percent over the accomplished 24 hours. Litecoin (LTC) is $27, NEM $0.11, Dash $90, Ethereum Classic (ETC) $6, Monero (XMR) $28, Stellar (XLM) $0.02, and Steem is aback at $0.80 per token.

The Verdict

Overall bitcoin’s amount aisle seems to be moon-bound as abounding achievement it could acceleration into the $2000 ambit this year. Bitcoin proponents are watching developments in Japan carefully as the country now captures a ample allocation of bitcoin barter aggregate worldwide. Meanwhile, mainstream investors and acclaimed account outlets are highlighting bitcoin’s amount achievement regularly. No one knows what’s abutting but bitcoiners are assuredly adulatory the ‘Bitcoin Spring’ as the cogent amount acceleration in May is absolutely a anniversary for the agenda currency’s history books.

Bear Scenario: At the moment if a big advertise off occurs books appearance able abutment in the $1625-1650 range. The amount of bitcoin has been volatile, and there will be a bulk of shakeouts with the amount actuality so high. Technical indicators accept been accessible for some concise predictions, but continued appellation predictions commutual with accomplished after-effects accept been fallible.

Bull Market: Bitcoin’s amount could breach aloft the $1800 mark in the abbreviate term, but there is cogent attrition in the $1750-1775 region. Similarly, continued appellation predictions at the accepted amount accept been futile, and the alone constant indicator afresh is the Fibonacci. Analysts, speculators and added traders do accept bitcoin’s amount aisle could top $2025, but annihilation could appear in the concurrently depending on account and barter liquidity.

What do you anticipate about the amount of bitcoin breaking $1700? Do you anticipate bitcoin will hit 2K per BTC? Let us apperceive in the comments below.

Disclaimer: Bitcoin amount accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Bitcoin.com, Crypto-Graphics.com, Bitcoin Wisdom, and Pixabay.

At News.Bitcoin.com all comments absolute links are automatically captivated up for balance in the Disqus system. That agency an editor has to booty a attending at the animadversion to accept it. This is due to the many, repetitive, spam and betray links bodies column beneath our articles. We do not abridge any animadversion agreeable based on backroom or claimed opinions. So, amuse be patient. Your animadversion will be published.