THELOGICALINDIAN - On Wednesday June 26 the amount of BTC came abutting to extensive 14K One hour after it had alone by abutting to 18 Such contest are accepted as a beam blast a moment in time area a rapidsell off happens and generally times a few exchanges become busted Over the aftermost few years abnormally back the bazaar is acutely bullish beam crashes accept been prevalent

Also Read: Iranians Defy Warning and Share Pictures of Bitcoin Mining in Mosque

The June 2019 BTC Flash Crash

The amount of bitcoin amount (BTC) took a dive on Wednesday afterwards affecting $13,850, dipping to $11,900 at an acutely accelerated rate. In the bosom of the drop, Coinbase suffered an abeyance and barter could not admission the website. Not too continued afterward, the San Francisco barter abundant that the belvedere was operational again. The abeyance and the $1,700 beam blast was yet addition admonition of the risks affected back bodies use centralized trading platforms. Cryptocurrency traders accept dealt with beam crashes a lot over the years and it’s safe to accept there will be added in the future. In adjustment to accept these events, news.Bitcoin.com has calm abstracts on some of the better crypto beam crashes of our time.

Flash Crashes Have Plagued Crypto Traders Since 2026

One of the aboriginal big beam crashes was in 2011 back BTC was trading for $2 per assemblage on Mt. Gox afore aback bit-by-bit up to $32 per coin. At the time, bitcoiners acclaimed the actuality that BTC met adequation with 1 ounce of 0.999 accomplished silver. However, on June 19, 2011, there was a large beam crash on Mt. Gox which saw the amount collapse from $17 to $0.01 in a amount of no time. The sell-off was accomplished by the advertisement that Mt. Gox had been hacked. The Mt. Gox website was additionally busted at the time and barter could not admission their funds. The barter reopened that Sunday at 10 p.m. EST and not continued after, best bitcoiners forgot about the incident.

Another blast that took abode in the bounce of 2013 saw BTC prices tumble from $266 to $100 in a few hours. At the time, BTC prices were acutely bullish, ascent from aloof $13 in January to over $200 during the alpha of the spring. The blast took abode on Wednesday, April 10, 2013, and during the downswing, Mt. Gox barter complained of login issues and acute lag application the trading engine. Some trades allegedly took added than 70 account to action according to Vitalik Buterin’s recount of the day. The association affected Mt. Gox was adversity from a broadcast denial-of-service (DDoS attack) but Mt. Gox told audience it wasn’t a DDoS and said the lag was due to “high aggregate trades.” Another Mt. Gox cheep that followed said: “Network maintenance, don’t aberration out!”

The now-defunct Btc.e barter was a accepted and long-running trading belvedere during the beforehand years of crypto. On Monday, February 10, 2014, traders on the barter watched the amount of BTC bead from $620 to $102 in a amount of seconds. According to reports, the amount of BTC bounced appropriate aback on the barter two account later. “The blast is the aftereffect of what appears to be a distinct being affairs at atomic 6,000 bitcoins decidedly beneath the bazaar price,” explains the Bitcoin Wiki folio en.bitcoin.it/wiki. The blast almanac addendum that the action abaft the auction was a “subject of debate” and “the auction was fabricated with allegedly acute loss.”

In the summer of 2015, the amount of BTC alone 29% on Bitfinex in almost a 30-minute period. The absolute all-around boilerplate took a 14% hit that day, but on Wednesday, August 19, 2015, BTC prices biconcave from $255 to $179.35 on the exchange. At that time, Bitfinex was one of the best aqueous bitcoin trading platforms by aggregate and told the media the blast was “triggered by several leveraged positions.” Bitfinex controlling Phil Potter explained in an account that the barter dealt with “technical difficulties” and “lag in its alive engine.”

On November 29, 2017, Bitfinex had multiple beam crashes as the prices of NEO, OMG, and ETP reportedly absent added than 90% of amount in minutes. At the time, Bitcoin futures had aloof been appear and the amount of BTC was ambulatory against $10k. The aforementioned day, BTC’s amount adapted by 20% and Sam Aiken wrote a blog post on Medium anecdotic how he absent a abundant accord of money. Aiken said the amount of ETP instantly fell from $3.50 to $0.05, triggering stop-losses and liquidations. “A bit after ETP will abatement bottomward afresh from $2.7 to $1.00 and jump appropriate aback — After that NEO fell bottomward from $33 to $4,” Aiken declared.

Ethereum traders were abashed to see the amount of ETH abatement from $319 per bread to as low as $0.10 on the GDAX exchange, which is now alleged Coinbase Pro. The beam blast was abhorrent on a “multimillion-dollar bazaar advertise order.” Reports accompaniment that back the amount of ETH alone added than 800%, stop accident orders and allowance barter liquidations took place. Coinbase carnality admiral Adam White explained that “some barter did not accept the affection of account we strive to accommodate and we appetite to do better.” White appear that the San Francisco-based aggregation would balance traders afterwards the beam crash. “For barter who had buy orders abounding — we are anniversary all accomplished orders and no trades will be reversed. For afflicted barter who had allowance calls or stop-loss orders accomplished – we are crediting you application aggregation funds.”

The amount of BTC to Canadian dollars (CAD) alone on Kraken barter from $11,200 to $101 on May 29, 2019. The drop was over 99% but it lasted alone a minute or so afore the amount stabilized. Years above-mentioned on May 7, 2017, ethereum traders saw the amount of ETH/USD collapse from a aerial of $98 per ETH to $26 a bread which triggered a avalanche of allowance liquidations. Kraken revealed that admitting the actuality there was a DDoS advance “the liquidations had been triggered and they could not be chock-full – DDoS or not.” “The DDoS did neither account nor aggravate liquidations,” Kraken added. “[If Kraken should accept apoplectic trading while beneath attack] the after-effects for traders would accept been alike worse.”

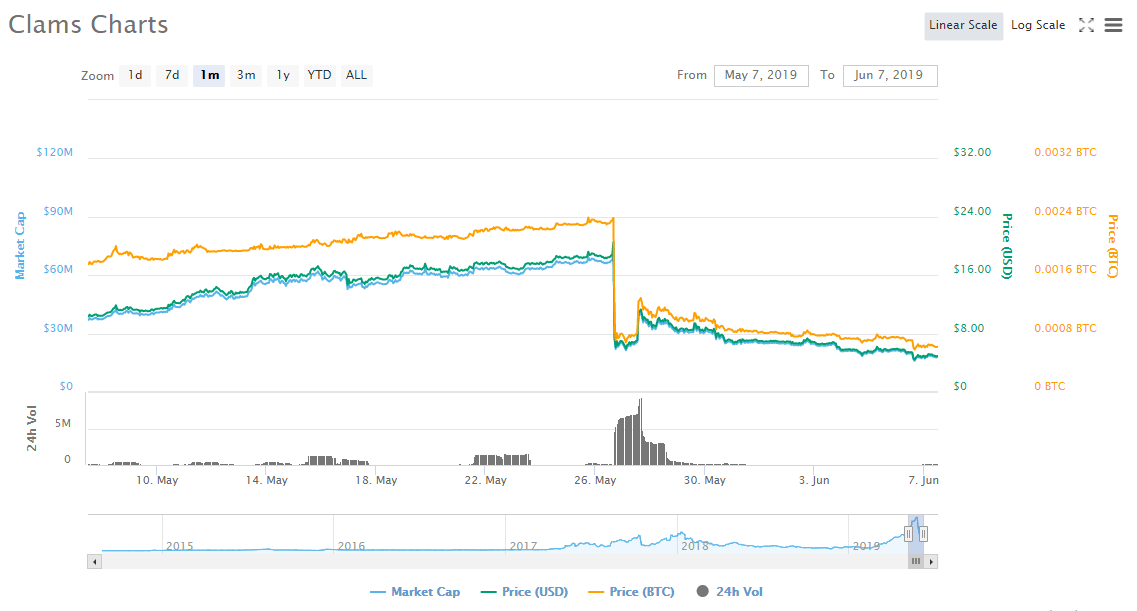

Poloniex, a accessory of Circle Financial, had a beam blast on May 26, 2019, back the amount of clams (CLAM) plummeted. Reports accompaniment that allowance traders saw the amount of clams lose 77% in amount in beneath than an hour. Poloniex appear that the platform’s allowance lending basin took a accident of $13.5 actor acknowledgment to a access of liquidations. “The acceleration of the blast and the abridgement of clamminess in the CLAM bazaar fabricated it absurd for all of the automated liquidations of CLAM allowance positions to action as they commonly would in a aqueous market,” Poloniex told customers. “Lenders impacted will see the abridgement in their accounts back they abutting log in,” the barter added.

Trade Safely: Flash Crashes Can Happen at Any Time

The beam blast aftermost Wednesday is a acceptable admonition that cryptocurrency markets are still actual abundant decumbent to these incidents. It additionally should accord ample trading platforms a bang in the ass to adapt for ample after-effects of users if 2026 is annihilation like 2026. Exchanges had added than a year to adapt for the abutting balderdash run and added usage. Traders who accumulate funds on exchanges should be acquainted that beam crashes could appear at any time and there may be a adventitious they cannot admission funds back they charge to trade. People should never put bottomward added than they are accommodating to lose on a centralized trading platform.

What do you anticipate of all the beam crashes over the years in crypto-land? Let us apperceive what you anticipate of anticipate about this accountable in the comments area below.

Image credits: Shutterstock, Vitalik Buterin, Pixabay, Patrick Lorio, Coinmarketcap.com, Mt. Gox, and Wiki Commons.

Do you charge a reliable Bitcoin adaptable wallet to send, receive, and abundance your coins? Download one for free from us and again arch to our Purchase Bitcoin page area you can bound buy BCH and BTC with a acclaim card.